MASTER FEEDER FUND FORMATION

Post on: 4 Июнь, 2015 No Comment

Offshore & US Domestic Master Feeder Fund (Contact us for pricing)

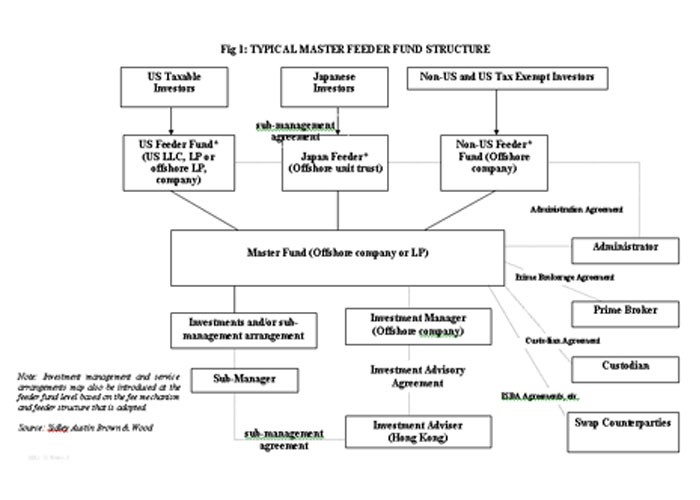

A master-feeder fund is, most commonly, a two-tiered investment structure in which investors deposit capital in a “feeder” fund, which in turn invests in a “master” fund that is managed by the same investment advisor. The master fund is the entity that invests in the market as prescribed in the partnership agreement.

The feeder fund is generally where the capital investing begins: capital (cash or securities) flows from investors into feeders, and these in turn invest all or a portion of that capital into the master fund. The master fund then uses that infusion of capital to invest in securities and thereby generate profit and loss. This profit and loss that the master fund generates is then allocated to all of the master fund’s constituent feeders. From the master fund’s perspective, each feeder can be viewed as an investor.

Master Feeder (Cayman)

- › Offshore master fund entity

- › Offshore feeder fund entity

- › Full colour offering document

Mini-Master (Cayman)

- › Master Fund Entity

- › Full colour offering document

- › Full colour offering document

When you think of a feeder fund investing in a master fund, think of it as a fund buying any other security. For example, the feeder fund (where all the limited partner/shareholder* capital resides) buys “shares” of a master fund, similarly to the way it buys shares of IBM common stock.

One significant operational difference between purchasing common stock and purchasing shares of a master fund is that when a fund buys a share of common stock, it does not “peer into” the underlying income attributes of that stock. Rather, the total return of the stock comprises only price appreciation and dividend income distributions. By contrast, when a fund buys a share of a master fund, it is buying into an investment partnership, and thus all the different income attributes (such as dividends, interest, gains, and tax adjustments) that the master fund generates are passed through to the feeder fund.

Master-Feeder Fund Structures

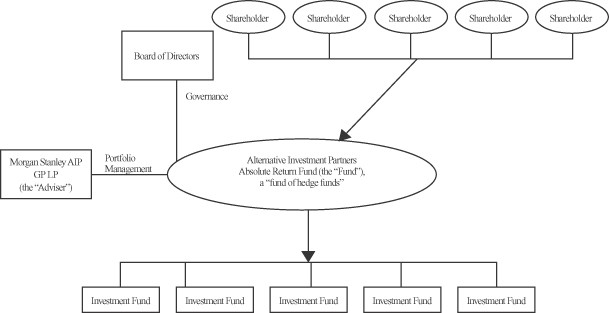

A typical master-feeder structure includes one master fund with one U.S. (“onshore”) feeder and one non-U.S. (“offshore”) feeder. The benefit of this organization is that it does not restrict the investor fund to just one type of investor (that is, tax-exempt versus U.S. taxable).

Feeder funds that invest in the same master fund can differ from one another in their investor types, investment minimums, fee structures, net asset values, and other operational features. In other words, a feeder fund is not tied to a particular master fund, but rather functions as its own legal entity, a partnership in its own right, that can invest in any number of master funds. The converse is also true: a master fund can accept investments from any number of feeders.

A master fund is typically an offshore corporation, but it can “check the box” and elect to be taxed as a partnership for U.S. tax purposes. If an onshore feeder fund invests in an offshore master fund taxed as a U.S. partnership or a limited liability company, the feeder will receive “pass-through” treatment for its share of the master fund’s profit and loss. The investment managers or general partners of offshore funds can be offshore corporations owned substantially by the fund manager or the manager’s U.S. entity.

Advantages and Disadvantages of Master-Feeder Funds

In general, depending on the objectives of the fund and its target markets, the advantages of setting up a hedge fund with a master-feeder structure can outweigh the disadvantages.

The advantages of a master-feeder structure include the following:

• A master-feeder fund reduces trading costs because it has no need to split tax lots (trading in portfolios designed to mirror each other).

• A master-feeder structure eases the administrative burden of maintaining multiple portfolios (pari passu).

• The master fund general partner’s performance fee will be able to maintain the underlying tax attributes from onshore feeders.

• The fund’s combined assets can be used to obtain greater financing benefits (for example, greater leverage or lower interest rates on borrowed securities).

Disadvantages of a master-feeder structure include the following:

• An offshore fund is generally subject to 30% withholding tax on U.S. dividends. If a fund tries to avoid such transactions, it incurs increased costs that it otherwise would not experience.

• The different investment strategies available to a master-feeder do not offer advantages to all investors at all times. For example, long-term capital gains are beneficial for U.S. limited partners, but taxes are not a concern for offshore investors. Therefore, if the master fund holds a security longer to receive favorable tax treatment, strategy conflicts may result.

• Some investment types, such as REITs and mutual funds, can be appropriate for U.S. investors, but inappropriate for offshore investors due to various regional restrictions.

• Uneven allocations of profit and loss (such as hot issue versus non-hot issue) and tax accounting can become cumbersome, negating the time and/or cost savings gained from easier trade administration.

It may appear at first glance that the advantages of a master-feeder structure are outweighed by the disadvantages, but the balance depends on the individual fund. Fund structures and strategies must be evaluated on a case-by-case basis to determine whether and when any obstacles are likely to present themselves.

Payment Policy

A retainer equal to 60% of the total fee is required up-front with the balance due upon presentation of the first draft of the fund documents. Payments can be made in U.S. Dollars. Our preferred form of payment is bank wire transfer, banking details will be provided on request. Once payment has been received in full the client questionnaire will be sent via email.Google+