Market Timing v Timing

Post on: 19 Апрель, 2015 No Comment

by KenFaulkenberry

Market Timing vs. Valuation Timing

Investors, especially value investors, are constantly being told that market timing is a bad idea. The buy and hold believers, as well as many value investing advocates, say it can’t be done. They argue that many investors crash and burn trying to time the market.

Although many of their arguments are valid, I’m going to make the case that they are doing it incorrectly. Any good financial concept can produce poor results if done improperly.

Regular readers of the AAAMP Value Blog know I put an emphasis on the fact that price matters! Investment decisions should be made with valuation the primary factor. That is a form of market timing; or if you prefer, call it valuation timing.

Market Timing vs. Valuation Timing

Momentum or growth investors may rely on market timing based on technical indicators. Many will use charts, trends, moving averages, cycle theory, etc. to time the market.

Value or contrarian investors should rely on market timing based primarily on fundamental value in relation to the current price. Instead of predicting what the market will do in the short term, a value tactical asset allocation strategy involves valuation timing based on fundamental analysis to determine the risks and opportunities for reward based on price.

Stock Market Valuation

The goal of value investing is to purchase assets that are selling below their real worth. In other words, we want a purchase price that offers a margin of safety. The reason we do this is because it lowers risk and greatly increases the chances of a profitable outcome.

When market valuations are low the value investor should take advantage of the improved probability of higher prices by increasing portfolio allocation to equities. When market valuations are high the value investor should lower risk by decreasing portfolio allocation to equities. This lowers the probability of large portfolio drawdowns.

How do you determine when the stock market valuations are low or high? Here are 3 great valuation-based metrics:

1. Shiller PE 10

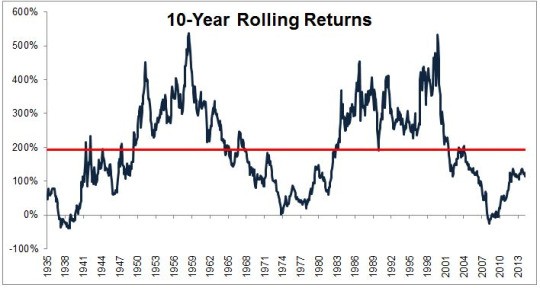

Shiller PE10 is a long term earnings based metric. It smoothes the volatility of earnings over a 10 year period and compares it to the current price. Historical data has shown a high inverse correlation between the index and returns over a 20 year period.

2. Total Market Cap Relative to Gross National Product

This ratio measures the value of the stock market compared to the economy. It makes sense that these two metrics would move together in the long run and historically they have. Long term returns have been inversely correlated with the ratio and provide a historical probability of future long term returns at the current valuation.

The long term average ratio has been approximately 70%. A higher valuation indicates a market that is historically overvalued. A lower valuation indicates a market that is historically undervalued.

3. YRI Fundamental Stock Market Indicator

This indicator uses fundamental metrics such as CRB raw industrial spot prices and unemployment claims in an index that is compared to stock prices. It has an above average record of exposing periods when equities were overvalued or undervalued.

Market / Valuation Timing Put Into Practice

The stock market has earned an average of a little less that 10% per year in the long run. But the average investors actual returns are nearly 4 percentage points lower because people tend to buy when prices are high and tend to sell when prices are low.

There is a behavior gap that affects investment returns. Instead of market timing based on valuation many let their emotions cause them to make detrimental asset allocation decisions.

Undervaluation and overvaluation are usually caused by a misjudgment of perceived risk vs. real risk. When investors get overly pessimistic they perceive the risk to be much greater than it really is. This causes prices to fall and create bargains. Conversely, when investors get overly optimistic they perceive risks to be less than reality. This causes prices to rise above the real value of the asset.

Trying to predict whether the market is going up or down in the short term is a bad form of market timing. The best idea is to improve the chances of an above average return by purchasing assets that are priced below their real or intrinsic value.

Valuation timing is a completely different, longer term way of thinking about the market. Patience is a key factor because time is what makes valuation based investing successful.

Market timing for value investors is valuation timing. Improve the probability of above average rates of return by increasing your asset allocation to investments whose valuations are bargains. Decrease the risk of portfolio drawdowns by increasing your asset allocation to cash when valuations are expensive.