Market Timing Stock Market Timing

Post on: 10 Июль, 2015 No Comment

WHY FOLLOW THE MIPS MARKET TIMING MODELS ?

- TO PROTECT YOUR NEST EGG USING A TOP RANKED MARKET TIMING SYSTEM

CNBC / Jim Cramer: Market Timing vs. Buy and Hold

- The MIPS Timing Models Tell You When to Buy and When to Sell or Short

* Do MIPS Models Really Avoid MARKET CRASHES and Make Money in Down Markets.

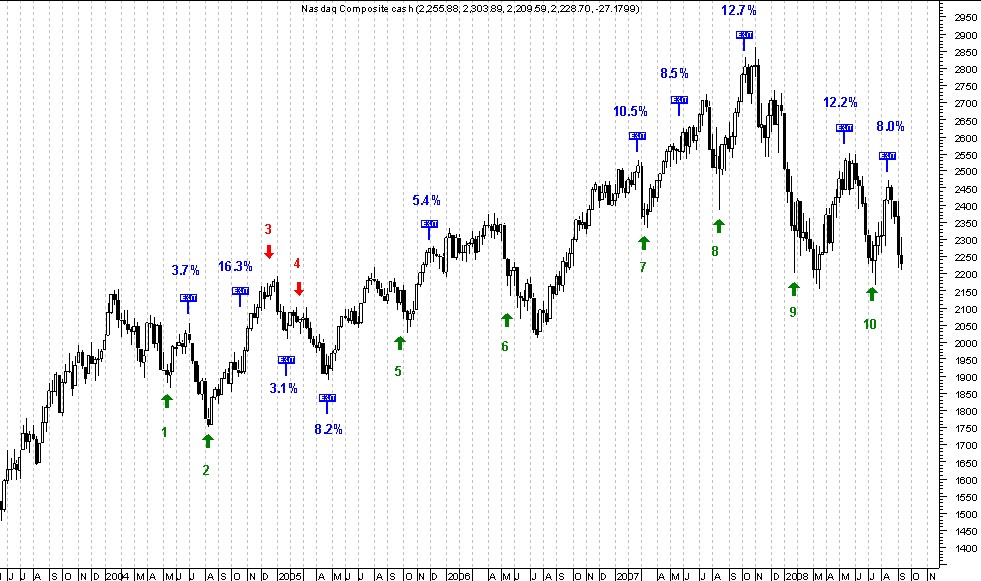

Our MIPS3/MF model went through The Crash of 2008 live (with trade signals verified by TimerTrac), and the performance of all of our MIPS3 models have been backtested in two of the last three real market crashes (1987 and 2000). In all cases, not only did the MIPS models avoid the 40-50% drops, but in each case MIPS actually made money (like the actual 90% gain from MIPS3/MF in 2008/09 shown below).

Warren Buffets Three Rules of Investing are :

1) Make Money — Almost everyone makes money in up markets, hence the expression

Dont Confuse Genius With a Bull Market.

2) Keep It — This is the tough one. Market crashes come when least expected, and

usually after months of false drops (Bear Traps). A very common stock market cycle

is 4-6 years up and 1-2 years down (the so-called 7 Year Market Cycle ). We have already

had two of these Crashes since 2000, and they WILL certainly happen again (soon?).

3) Repeat Steps 1 and 2 — Almost every investor agrees that they would be way ahead

(maybe even wealthy) if they had not gotten annihilated every time the market decided

to drop 30-50%. Dont let that happen to you, subscribe to MIPS now (you will be

thankful that you did).

MIPS3/MF in 2008

To use MIPS you only need to read this introductory section (Really!)

MIPS offers stock market timing systems that use applied mathematics, tried and proven technical indicators, and pattern recognition algorithms in its quantitative models to help you make money when the stock market is trending up (by being long) AND to protect and grow your nest egg when it is going down (by being in an all cash position or by being short like hedge funds). The fundamental concepts of MIPS (Market Inflection Points Signals) are (a) to identify Inflection Points where the market changes direction and then (b) to identify and follow the resulting trends.

en.wikipedia.org/wiki/File:Graph_of_sliding_derivative_line.gif

For students of the stock market and serious investors, this website explains: (a) why investors need a market timing system like MIPS, (b) what MIPS is, (c) how MIPS works, and (d) what kind of results the MIPS models produce. MIPS could indeed be the only trading system you will ever need to protect your investments by following the correct stock market trends.

And yes, it really is as simple to use as 1,2,3

Investors that want to get great returns (like those below) from investing in the stock market using MIPS, but do not need to fully understand the intricate details of the MIPS models, can stop reading this website now and start investing with MIPS by simply following steps 1,2,3 below.

To use the MIPS stock market timing systems. members simply:

(1) receive buy/short/cash signals from MIPS via email MIPS (

6-15 trades/year),

(2) place their trades the next day (either online trading or through their broker); and

(3) hold the resulting positions until the next trade signal email from MIPS.