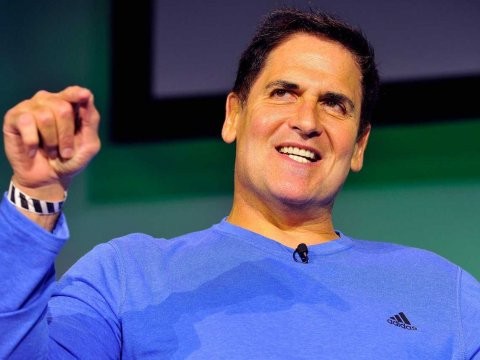

Mark Cuban interview Business Insider

Post on: 12 Август, 2015 No Comment

See Also

At our IGNITION conference last fall, Mark Cuban summed up his life in one quip: Someone has to be the world’s luckiest person!

Cuban certainly could be the world’s luckiest man, but that would discount his incredible savvy as a businessman and investor.

Cuban made his fortune when he sold Broadcast.com to Yahoo in the late ’90s. Now he owns the Dallas Mavericks. throws ragers at the Super Bowl. and angel invests in startups.

Cuban is also a judge on ABC’s Shark Tank. which just launched its second season (the next episode airs Friday, Feb 10 at 8 PM).

We did a Q&A with the billionaire over email. Here’s his advice to startups, his players, and his thoughts about Yahoo.

Business Insider. What does an entrepreneur have to do to catch your eye?

1. Know what areas I invest in. Don’t bring me anything outside of tech, media or consumer.

2. Be differentiated

3. Know your industry cold. I’m not going to do the work for you.

How many companies have you invested in; how much do you generally invest?

I don’t even know how many. 50 plus. Anywhere from $25,000 to $4 million with 90 percent being $250,000 or under.

Does a startup’s location matter to you when you invest? Is it still an advantage to have a headquarters in Silicon Valley or NYC?

To me it’s a disadvantage in either. It’s far more expensive and particularly in the Valley there is a level of arrogance that can be distracting.

Worst pitch you’ve ever heard?

Tons that started I have a great idea, can you help me? or “I don’t know where to start.” Those are an immediate no.

Best pitch you’ve ever heard?

People who can tell me why their product is unique and differentiated, by how they will compete and stay ahead and how they will give me a return on my investment from operations.

How should entrepreneurs think about their exit strategies?

They shouldn’t. They should focus on building the best possible business. If you are great, people will notice and opportunities will appear. Then you decide if it works for you or not.

You encourage people to angel invest rather than put their money in the stock market. Isn’t that insane advice for the general public?

Not if you stick to what you know and can add value to. If you can’t add value, don’t do it. What’s insane is thinking the stock market will always go up and the needs of your life, house, car and medical won’t crush your investment approach.

What do you tell your athletes to do with their money?

I tell everyone the same thing. Pay off 100 percent of your debt. Use the transactional value of cash to get an absolute return on your savings (buying something in bulk to save 40 percent on something you know you need is a guaranteed return of 40 percent. You can’t get that anywhere in market). And don’t invest in things you don’t know.

What’s the best thing about being a billionaire? The worst?

Everything. Nothing.

Do you think Yahoo made a good choice hiring a technical CEO rather than one from the media business?

Yahoo’s issue is culture. They can’t leverage all the amazing assets they have until they get a little ruthless in how they relate to their competitors. They generate huge percent of traffic for other sites and you would never know which sites because that would be impolite. They can’t be afraid of using the wrong fork.