Managing the Risk of Iron Condors

Post on: 13 Май, 2015 No Comment

Iron Condors: Risk Management

Despite the fact that buying iron condors is one of the most popular option strategies in use today, too many investors are unaware of how to handle the position when the market moves against the position (that means they begin to lose money and larger losses loom).

I’ve already discussed ideas for how to adjust a position that has gone awry.

The purpose of this page is to emphasize how important I believe it is to competently manage risk. It only takes one large loss to wipe out months or years of gains. It could even wipe out your entire bankroll if you take on too much risk.

When you begin buying iron condor positions (reminder: buying an IC means selling one call spread and one put spread), there’s a good chance that you will make money for several consecutive months. As great as that sounds, there’s a hidden risk when that occurs. It’s easy to believe that ‘this is easy’ and allow yourself to get too confident. That expectation of making money month after month can easily lead you to doubling the number of iron condors you buy. And if you get unlucky (yes, unlucky) and make even more money when doubling your position size, you may decide to do it again. But, why stop at doubling? You may be tempted to use every penny of your buying power. PLEASE don’t let that happen to you. Don’t get over confident.

Periodic losses are common when buying iron condors. If one on those losses occurs when you have far too much money on the line, you may freeze and find yourself unable to make an intelligent decision. If that happens to you, you could easily lose it all.

Remember:

- Iron condors earn profits most of the time

One Final point

There is one other aspect of risk that warrants discussion: Choosing your strike prices and how much cash you should collect when buying the iron condor.

There are different ways to look at opening an iron condor position. Most traders choose a method they believe gives them a good chance to earn a decent profit (a relative term that must be defined by each individual investor) with a reasonable risk.

Let’s look a few choices and perhaps you can decide which, if any, is appropriate for you.

Here are my thoughts. Remember these fit my personal comfort zone and your goal is to find positions that fit yours. Let’s assume we are talking about selling call and put spreads that are 10-points apart in an index that’s trading near $700.

The further out of the money you go when choosing options to sell, the greater the probability of a profitable trade. That’s good. But, the potential reward is small because the the price of the spread is narrow. Bottom line, you don’t collect much cash and that cash represents the most you can earn. That’s bad.

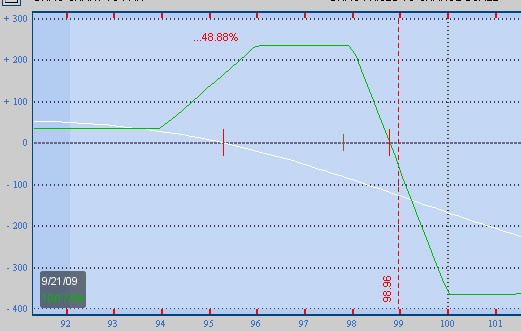

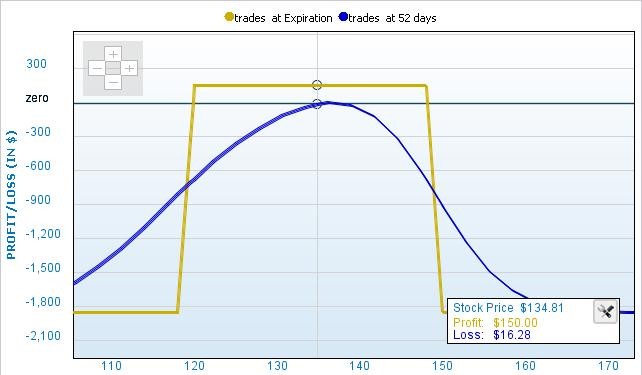

If you sell far out of the money spreads and collect $0.25 for each, your maximum profit is $50 and the most you can lose is $950. You have a very good chance of earning that $50, but it’s possible to lose 19 x as much. That’s not going to happen often, but even once every two years would consume your profits (don’t ignore commissions). This is not a good risk/reward ratio. I don’t recommend this style, but it’s your decision.

If you sell spreads that are much closer to the money and collect $700 total, then you have a very small chance of earning the maximum because those options have a fairly good chance to be in the money when expiration arrives. That’s the bad news. But the good news is that your maximum loss is ‘only’ $300 and you may earn a profit as high as $700. It’s a low probability (or profiting) position, but the risk/reward ratio is excellent. I don’t recommend this style either.

I recommend choosing strike prices between those extremes. You want to sell options that are far enough out of the money that you are comfortable with the risk that they may soon move into the money. You also want to collect enough cash when opening the position that there is enough reward to justify that risk. I have no rigid rules for you. You truly must find your own comfort zone. If you don’t know where that is, no problem. Paper trade for awhile and think about the positions you ‘own.’ Do they make you nervous, or are you okay with the potential risk and reward? You’ll discover what works for you and it won’t take too many sample trades for you to figure it out.

For more details on iron condors, plus other option strategies, read The Rookie’s Guide to Options .