Managing Early Retirement Income Needs With Your Investment Properties

Post on: 20 Июнь, 2015 No Comment

Murphy’s First Law for Real Estate: Your best tenant will get a job transfer during the worst rental market of the decade.

Murphy

I make no bones about the fact that I am a fan of investment real estate, particularly rental properties. I have nothing against flip houses; my wife and I simply don’t have the skill set to appropriately deal with them and make them profitable. I’ve arrived at my position through years of experience, and not an insignificant number of mistakes along the way .

In fact, while we have other assets to support us if necessary, our plan for ensuring we don’t get anywhere near our safe withdrawal rate in retirement is to have our living expenses (plus a buffer for budgeting errors) covered by 50% of our rental property income. We do, after all, try to live by the BiggerPockets rules when it comes to expenses and investing in real estate .

Ideally, we could simply hand the rental properties over to a multi-generational property management company, and they’d manage the properties until we rode off into the sunset.

However, at some point, we’re going to get to be too old to deal with rental properties, even in the ultra-passive mode that we’re in and we’ll want to move into safer investment instruments. This will be particularly the case as our cognitive skills decline. We’re not going to want to deal with spreadsheets, cap rates, and the like.

Plus, our property manager is about our age, and we figure she’ll want to retire in her sixties, leaving us potentially up in the air for finding property management at the quality she offers, not to mention the possibility that we won’t even be geographically co-located with our rental property portfolio by then.

To further complicate matters, while we’re in a suburb of Fort Worth, we live in a small town. The area where we have our rental properties has a total population of about 75,000. If we tried to dump a bunch of properties on the market at the same time, we’d probably flood it.

Finally, we need to consider taxes and how the taxes we have to pay will affect our decisions over time. This is particularly important because of depreciation, depreciation recapture, and the value of deferring taxes.

What the Numbers Told Me

I built up a fairly simple portfolio of properties to assess a two-person family’s investment portfolio to examine the income and tax implications of relying on rental properties for a sole source of income while paying federal income taxes out of a separate set of liquid assets.

First, let me set up some assumptions:

- Inflation rate of 3% per year

- Compound average growth rate of liquid, non-real estate investments: 6% per year

- Compound average growth rate of real estate investments: 3% per year

- Rents increase with inflation

- All improvements are expensed. None are capitalized. (Note: This is a simplifying assumption. I realize that if you put a new roof on a house, you’re going to increase your basis and start the roof on a new depreciation schedule)

- All expenses except federal income tax are 50% of rent

- Selling a house costs 8% of the total value (6% for commissions, 2% for closing costs)

- A liquid asset safe withdrawal rate for retirement is 4%

- Federal income tax is paid from liquid, non-real estate investments

Now, let’s look at how our couple got to the point where they felt like they could retire just using the income from their rental properties.

- Current age of both: 45

- They started buying one house per year in cash at age 35. The cost of the first house was $75,000 and increased by 3% each year.

- Each rental provided $1,000 a month in income when they bought their 10th house at age 44.

- The couple’s annual expenses, after federal income tax, at age 44 was $60,000.

- They have $500,000 in other liquid investments.

They now own 10 houses which provided $120,000 in rental income at age 44, giving them $60,000 to live on.

Starting at age 45, they quit their jobs and live solely on the income generated from the rental properties. If they don’t sell any of the houses along the way, then their income and expenses associated with the rental properties will continue to tick along nicely.

Interestingly enough, because depreciation remains constant, until the first house has been owned for 27.5 years, at which point it decreases, while income increases, income tax and the effective tax rate on the income increases over time (Note: I have used 2013 tax rates and standard deductions and kept the same rates through the years).

Since this couple is taking depreciation along the way, when they sell, they will have to pay depreciation recapture taxes (currently at 25%) along with long-term capital gains taxes (currently at 15%). Thus, it is possible to calculate an after-tax and selling expense value of the real estate portfolio as well as the liquid asset investment portfolio at any given point. Since the liquid asset portfolio grows at a faster rate than the real estate portfolio, it does eventually surpass the value of the real estate portfolio.

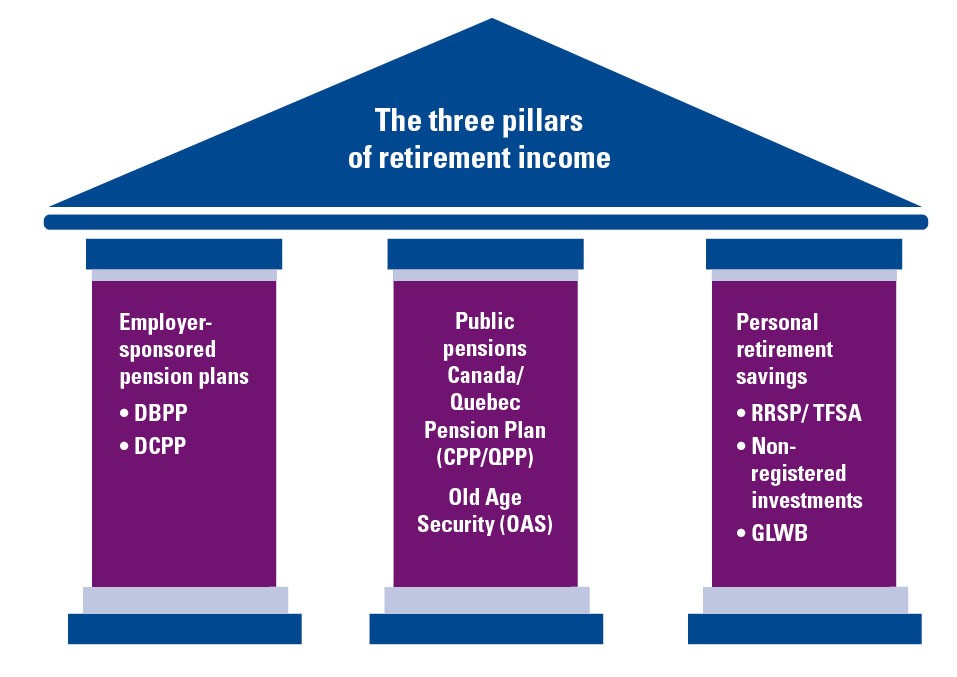

At age 45, this couple would not be wise to convert their entire real estate portfolio to liquid assets despite the greater growth rate of liquid assets because of the tax advantages of rental properties. However, as they get older and the portfolio grows, they do reach a point where they could safely convert based on the safe withdrawal rate.

Thus, starting at age 64, this couple could safely start converting their real estate portfolio to liquid assets without jeopardizing their ability to meet their income requirements.

A Brief Note About Social Security

Social Security is available to people who qualify for it (usually 40 quarters of sufficient earned income) starting at age 62. The more years you earn income, and the more income you earn, the more Social Security you’ll be eligible for, up to a certain point.

Social Security income may or may not be taxed depending on how much you earn in Social Security plus your earned income. Up to 85% of Social Security income could be taxable, depending on your AGI and non-taxable income.

As you start to look at a liquidation strategy, particularly if you’re planning on getting rid of some or all of your real estate around the time you’d start taking Social Security, you’ll want to be aware of how that affects the taxation of your Social Security. As of 2013, you could, depending on what you earn from other sources, pay a marginal tax rate of up to 46.25% on each dollar of Social Security that you take.

Wrapping It Up

In conclusion, it is possible to use rental properties as an income bridge to get to age 65 (or even beyond) until you can supplement your income with Social Security income. Using this strategy to protect the liquid asset portfolio that you hold should give that portion of your investments plenty of time to grow so that as you start to tap into the liquid assets when you get older, you will be well within safe withdrawal rate parameters.

Free eBook from BiggerPockets!

Get The Ultimate Beginnner’s Guide to Real Estate Investing for FREE — read by more than 100,000 people — AND get exclusive real estate investing tips, tricks, and techniques delievered straight to your inbox twice weekly!

- Actionable Advice for Getting Started,

- Discover the 10 Most Lucrative Real Estate Niches,

- Learn how to get started with or without money,

- Explore Real-Life Strategies for Building Wealth,

- And a LOT more

Sign up below to download the eBook for FREE today!