Manage Portfolio Risk when doing Asset Allocation Inflation Currency Sector Market Risks

Post on: 26 Июнь, 2015 No Comment

Trek Navigation

The trek for families with positive cash flow and positive net worth. The trek focuses on saving, accumulating assets and building net worth, protecting cash flow and assets, enjoying prosperity and giving back to others.

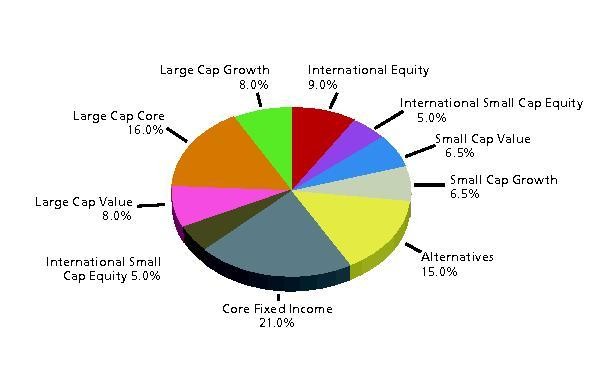

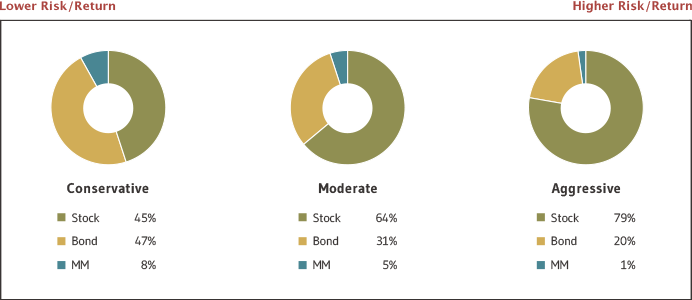

You may have found some asset classes that are well-aligned with your invest ment time horizon. However, your portfolio may be overly concentrated in some asset classes that overly-expose you to specific risks. Diversification reduces risk but doesnt eliminate it. As an investor you should be concerned that you know the risks inherent in an investment, can afford those risks and are compensated for them.

Inflation Risk

Inflation risk, also called purchasing power risk, is the chance that the cash flow s from an investment wont be worth as much in the future because of changes in purchasing power due to inflation.

Although the record inflation of the 1970s is history, inflation risk is still a common worry for income investors. Inflation causes money to lose value, and any investment that involves cash flows over time is exposed to this inflation risk. The ramifications of this can be serious: the investor earn s a lower return that he or she originally expected, in some cases causing the investor to withdraw some of a portfolios principal if he or she is dependent on it for income.

It is important to note that inflation risk isnt the risk that there will be inflation, it is the risk that inflation will be higher than expected. This is one reason investors and analysts speculate considerably about inflation rates and study indicators such as the yield curve to get a feel for where inflation rates are headed. For example, many economists believe that a steep normal yield curve means investors expect higher future inflation and a sharply inverted yield curve means investors expect lower inflation.

Manager Risk

Manager risk, or management risk, refers specifically to the risk that the company or mutual fund you have invested in will suffer as a result of ineffective, poor, or under-performing management. The company may be sound but management decisions have caused the investment to suffer.

Manager risk is mitigated through diversification.

Active Risk

Related to manager risk is active risk, which refers to the risk associated with a manager of a mutual fund trying to beat the funds benchmark. The trading activity to beat the benchmark introduces risk to the fund. As activity increases the greater the likelihood that the funds results will be divergent from the benchmark. Since risk is defined as volatility and increased trading results in increased volatility (beta) active trading generates risk.

Political risk, or country risk, refers to the effects of political instability or changes in a foreign country.