Making DIY investing profitable with gains of up to 66% model portfolios annual review

Post on: 19 Апрель, 2015 No Comment

Many private investors have been forced into a do-it-yourself investment mentality since a change in the rules relating to financial advice came into force two years ago.

A year before that and in anticipation of this sea change the Money Observer Model Portfolios were set up.

Their aim is to help investors build up capital or generate income from an existing capital sum, using funds and investment trusts, although it is important to note that the nature of these investments, which are linked to the stock market, mean that nothing can be guaranteed.

Even before the Retail Distribution Review was implemented in January 2013 requiring advisers to charge fees, rather than receiving commission, the trend towards do-it-yourself investing had been accelerating.

Do it yourself

The arrival of investment platforms such as Alliance Trust Savings, Hargreaves Lansdown and our sister website Interactive Investor was making buying and selling funds and securities a relatively simple and low-cost process.

Accessing information about the investments you can use to build your own portfolios has also become much easier.

When building our 12 portfolios we took in a variety of factors. We divided them into two different levels of risk — medium and high risk. To avoid any misunderstanding we did not include low-risk options, mainly because people often interpret ‘low risk’ as ‘no risk’.

Money Observer’s Model Portfolio annual reviews

We emphasised that anyone who cannot tolerate monetary losses of any kind should steer clear of our portfolios and stick to cash.

Fortunately all of our portfolios have made money over the past three years. The best-performing portfolio was Lima — the higher risk version of our growing income portfolio — which has produced a total return of over 60 per cent.

The backmarker was Alpha — the medium risk version of our short term growth portfolio — which is up 24 per cent. All but two of the 12 portfolios outperformed the FTSE All Share index.

Over the three years to 1 January 2015 the income portfolios have on average produced better results than the growth portfolios. This is not particularly surprising bearing in mind the uncertain investment environment over the period. However, over the past year as investor confidence has increased, some of the growth portfolios have pulled ahead.

Outperformaning the FTSE All Share

The best performing portfolio overall for the year was Delta — the higher risk version of our short term growth portfolio — which returned over 10 per cent. However, the backmarker was also a growth portfolio — Echo. the higher risk version of our medium term portfolio — which returned a modest 1.76 per cent.

Despite this rather unsatisfactory result, which was mainly due to the drag on the portfolio’s performance from its holding in BlackRock World Mining trust. all of the portfolios managed to outperform the FTSE All Share Index in 2014.

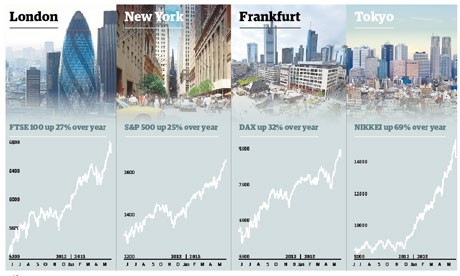

In many ways, we have been fortunate with the timing of the portfolios. In retrospect, global stock markets have been relatively kind to us — the FTSE World index is up over 50 per cent over the past three years. But it hasn’t always seemed like that with the slowdown in Chinese economic growth, the eurozone debt crisis, the Ukraine crisis and other events.

These happenings during the last three years versus the general progress in our portfolios illustrate how important it is to take a medium to long-term view when it comes to investment rather than being spooked by short-term problems.

Naturally, however, not all of the individual holdings we have chosen have met our expectations and we have had to make some switches as outlined in our portfolio reviews above.

Looking forward, the coming year could prove more challenging but hopefully the funds and trusts we have chosen will help to keep our portfolios on track and we will continue to monitor their progress every three months.