Making a Monthly Personal Balance Sheet The Simple Dollar

Post on: 15 Июль, 2015 No Comment

More than a few times, Ive mentioned that I enjoy calculating my net worth on a regular basis and using that to see how my personal financial situation has improved over time. Its pretty easy to do this just create a little table with two columns, one being the date and the other being your calculated net worth. You can then use a spreadsheet to make a nice little graph of this information, allowing you to really see the benefit of all of your little moves over time.

Sounds simple, doesnt it? The problem with this picture, though, is actually getting all of that information. In order to be able to really see your progress, you need to calculate your net worth repeatedly over time. You might also want to keep track of other things over time, such as your total savings or your monthly spending over a long period.

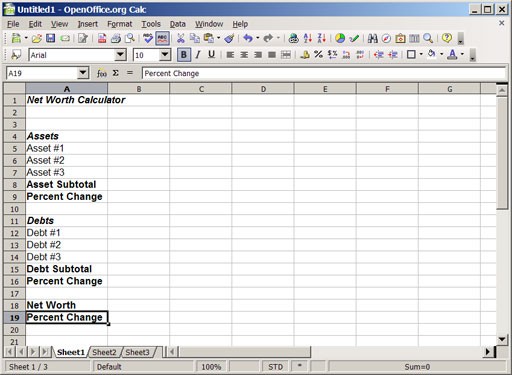

How do you come up with that data? The easy way to do it is to create a simple net worth calculator. Each week or each month or each quarter, you just drop in the balances on your accounts and it keeps track of your net worth over time for you nice and easy.

After reading Kim Sniders excellent book How to Be the Family CFO . though, Ive really come around to the idea of assembling a monthly personal balance sheet. Once a month, I sit down, figure up every number that might be a good indication of my financial state, jot down some explanations, and save that document for later. Whenever I want to look at any aspect of my personal finance growth, I just need to pull out a few of these statements.

Snider offers a great tutorial as to how she creates her own statements in her book, but Ive found that the statements that work for me are quite a bit different than her example. Heres how I assemble my own personal finance statements.

How to Assemble Personal Finance Statements

Ive started doing them on a very regular schedule. I assemble one of these on the last day of every month. For me, its very important to do these statements at the same time each month simply so that Im normalizing for all of the monthly things that happen in my life. For example, each statement includes one mortgage payment, one electric bill payment, one cycle of paying off all of our credit cards (since we use cards for our routine purchases), and so on.

My personal balance sheet contains four sections:

I include every source of income for the month, including their values. I include cash gifts on this list if my wife and I receive $50 as a gift from an older relative, we list it here to keep things straight. I try to divide up the income as clearly as possible, noting income from The Simple Dollar, income from other writing endeavors, income from consulting, my wifes income, and other sources of income on separate lines. I totaled these at the bottom. I do not include interest earned or investment growth as income here I note them below in the asset section.

This section takes by far the longest, but its well worth it. I go through our expenses and sort them into categories: food and household expenses, childrens expenses, entertainment, utilities, our mortgage, and a few other basic categories. If theres anything exceptional, I put them in as a separate line by themselves, and I often add notes off to the right to note anything unusual. As with the other section, I total these at the bottom.

I list every account and major asset that I own along with the balance of that account or the value of that item, then I total them.

Again, I list all of my debt accounts along with the amount I still owe, then I total them.

I also include a summary section . I like to look at income minus expenses (how much money I retained this month) and assets minus debts (my net worth right now).

Why not use a package like Quicken or Microsoft Money to do this? I do not like this information to be reliant on a software package that requires updating (which means buying a new copy) every few years. Keeping these records in an open document format (since I assemble these with OpenOffice) means Ill be able to access these documents forever without the need to update software unless I want to. Quicken and Money are fine packages, but they require you to get on board with updating software over the long term, and if I can do the same things myself, Id rather avoid the cost and the related technical issues.

Using Personal Statements for Long-Term Analysis

There are three big things I like to look at over time.

1. Income minus expenses over time

This is the so-called gap, the one that is the actual demonstration of how well youre truly spending less than you earn. This number should be as wide as possible. If you see it narrowing, its time to focus ideally, it should stay roughly the same or gently widen over time (as your income goes up).

2. Assets minus debts over time

This shows your net worth growth over time. If your gap is wide (from the above graph) over time, then this should be steadily going up over time sometimes sharper than others (when the stock market is going well).

3. Change in assets each month (minus income)

This shows the growth in your investments over time not including your contributions. When you see your assets increasing each month at a rate thats greater than your expenses, then youve reached a point where you can pretty much do whatever you like.

These three pictures create a great visualization of how your personal finances are improving over time and, for me, they provide motivation to keep my nose to the grindstone.

All you have to do to have this information is simply make a balance sheet each month. After a few months, you can take those numbers and create some very compelling views of your personal finance situation and you dont need Quicken or Money to do it.