Make The ADX Indicator Your Best Short Term Trading Indicator

Post on: 16 Март, 2015 No Comment

Good day everyone, I wanted to let all the readers of our blog be aware that the last two articles in addition to videos about putting together among the better short term trading strategies obtained wonderful reviews from our visitors, and I wanted to thank everyone to the.

This is the last the main series and I will look at the stop loss placement and profit target placement for our 20 day fade strategy that I have demonstrated throughout the last 2 days.

On Monday, I demonstrated how increasing the size of a moving average will increase your probability of trades going your way. The most effective number was near 90 days. This exercise demonstrated how increasing your moving average or your breakout length from 20 days to 90 days can increase your percentage of profitable trades from 30 % profitability to about 56 per cent profitability, this is huge.

In Tuesday, I demonstrated how you can take a method that has terrible winning ratio and reverse it to provide a very high percentage of winners when compared to losers. I took the 20 day breakouts which yielded a terrible winning ratio and reversed it. Instead of buying 20 day breakouts we might fade them and do a similar to the downside. I also provided a few filters to help increase the percentages even further. The method is termed the 20 day fade and from now on I will cover the stop loss placement plus the profit target placement for this strategy.

Some Of The Best Short term Trading Strategies Are Simple To know And Trade

I highly recommend you take notice because I find this approach to provide about 70 percent acquire to loss ratio and performs better than virtually all trading systems that sell for 1000s of dollars. Remember, there’s no correlation concerning expensive or complex trading strategies and profitability. The 20 day fade remains essentially the most profitable and one of the most effective short term trading strategies Weve ever traded, and I have traded pretty much every strategy you can imagine.

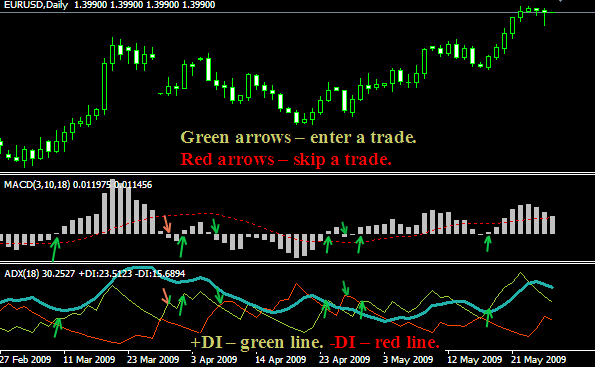

What makes The ATR Indicator Work

The ATR indicator means Average True Range, it was on the list of handful of indicators that were produced by J. Welles Wilder, and included in his 1978 book, New Concepts in Technical Trading Methods. Although the book was written and published prior to a computer age, surprisingly it has withstood the test of time and several indicators that have been featured in the book remain among the better and most popular indicators used by short term trading even today.

One very important thing to bear in mind about the ATR indicator is that it’s not utilized to determine market direction at all. The sole purpose of this indicator is to measure volatility so traders could adjust their positions, stop levels and profit targets determined by increase and decrease of volatility.

The formula for the ATR is a snap:

Wilder started with a idea called True Range (TR), that is defined as the greatest of the pursuing:

Method 1: Current High less the latest Low

Method 2: Current High less the prior Close (absolute value)

Method 3: Current Low less the prior Close (absolute value)

One of the reasons Wilder used on the list of three formulas was to ensures his calculations accounted for holes. When measuring just the difference between your high and low price, gaps are not looked at. By using the greatest number out from the three possible calculations, Wilder ensured that the calculations accounted pertaining to gaps that occur during overnight sessions.

Keep in mind, that most technical analysis charting software contains the ATR indicator build in. Therefore you won’t must calculate anything manually yourself. Nevertheless, Wilder used a 14 time period to calculate volatility; the only difference I make is start using a 10 day ATR as opposed to the 14 day. I find that this shorter time frame reflects better with short-run trading positions. The ATR can be used intra-day for day traders, just change the 10 day to 10 bars plus the indicator will calculate volatility based on the time frame you chose.

Here is an example of how the ATR looks when combined with a chart. I will use the examples from yesterday to help you to learn about the indicator and see how we use it while doing so. Before I get into this analysis, let me give you the policies for the stop loss and profit target so as to see how it looks creatively. The stop loss level is 2 * 10 day ATR plus the profit target is 4 * 10 time ATR.

In this example you will observe how I calculated the profit target with all the ATR. The method is the same to calculating your stop damage levels. You simply take the ATR your day you enter the position in addition to multiply it by 4. The best short term investing strategies have profit targets which have been at least double the length of your risk.

Don’t forget to use the original ATR level to help calculate your stop loss in addition to profit target placement. The volatility decreased and ATR went from 1. 54 to at 1.01. Use the original 1. 54 for both calculations, the only difference is earnings targets get 4 * ATR and loss levels get 2 * ATR.

In case you are taking long positions, you ought to subtract the stop loss ATR from your entry and add the ATR for the profit target. For short roles, you need to do the opposite, add the stop loss ATR to your entry and subtract the ATR from your profit target. Please review this so that you can don’t get confused when using ATR for stop loss placement and profit target placement.

This concludes our three part series within the best short term trading strategies that work in actuality. Remember, the best short term trading strategies do not need to be complicated or cost 1000s of dollars to be profitable.