Make money by writing call put options

Post on: 6 Июнь, 2015 No Comment

Make money by writing call & put options

Quote:

WRITING OPTIONS

Writing out-of-money options allows you to garner small and consistent returns, during adverse market conditions. Read on to figure out what these options are and how you can make a quick buck on them

WHAT are the chances of SBI touching Rs 780 by the end of this month? Not very bright, you might say.Then, why not write an SBI Rs 780 call option and earn some low risk income? This practice is popularly known as writing out-of-money options. As a result, you can hope to make some decent income in the form of the premium received on writing the option.

Writing options

First, you must be familiar with option basics. An option can be either out-of-money, in-the-money or at-the-money. A call option is said to be in-the-money if the current market value of the underlying share is above the strike price of the option. Similarly, a put option is said to be in-the-money if the current market value of the underlying asset is below the strike price of the option. For instance, if the current price of Infosys is Rs 2,100, an Infosys 2,000 call option (strike price is Rs 2,000) and Infosys 2200 put option (strike price is Rs 2200) are in-the-money.

At-the-money simply means that the current market value of the underlying asset is the same as the strike price. For instance, if the current price of Infosys is Rs 2,100, then Infosys 2100 call and put options (strike price is Rs 2,100) are at-the-money.

A call option is said to be out-of-money if the current price of the underlying share is below the strike price of the option. A put option is said to be out-of-money if the current market value of the underlying share is above the strike price of the option. For instance, if the price of Infosys is currently Rs 2,100, then an Infosys 2,200 call option (strike price is Rs 2,200) and Infosys 2,000 put option (strike price is Rs 2,000) are outof-money.

Out of money options

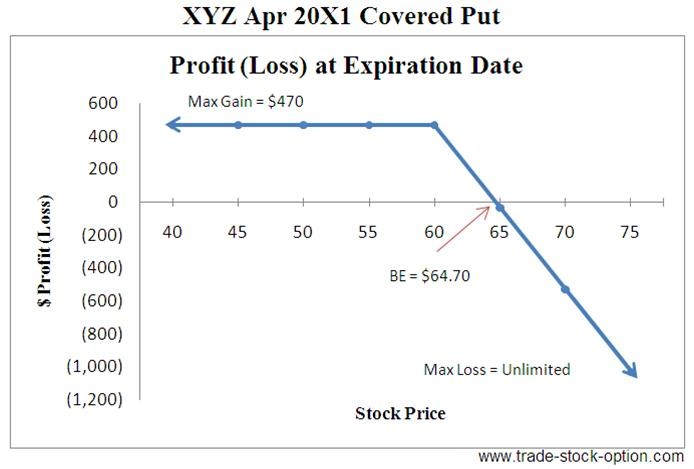

Logically, you should write a call option when you expect the underlying stock to stay at the same level or fall. Similarly, you could write a put option when you expect the price to stay at the same level or rise. As an option buyer, your risk/ loss is limited to the premium that you have paid. On the other hand, as an option seller, your risk is unlimited whereas your gains are limited to the premiums that you earn.

Hence, writing call and put options are considered to be quite risky as the losses can be unlimited, if the value of the underlying asset increases above the exercise price. For instance, if you write or sell one Infosys 1 month at-the-money call option at a strike price of Rs 2,100, when the cash price is also Rs 2,100, you would get a decent premium

of anywhere between Rs 50-70. But the risk

you would be carrying is quite high. If the

price of Infosys rises to more than Rs 2,400 on expiry, then you could stand to lose anywhere between Rs 220-250 per share (Since, the option is cash-settled, the loss will be the cash settlement amount, reduced by the premium).

However, it is always less risky to write out-of-money options, as the strike price is at a premium to the spot price. For instance, if you had written an April call option on SBI at Rs 740, on the March 29, 2005 (when the cash price was Rs 640), you would have received a premium of Rs 5.35 per share.The writer of such options gains because of the erosion of time value of options. As on April 11, 2005, the premium on the same Rs 740 call option falls to Rs 2.45, as the time to maturity narrows down. So, you could just wait till the option matures (at the end of April), hoping that it will expire as worthless. Or, if you feel that would be risky, then you could even square up your position, and earn a net of around Rs 3.

In the same manner, if you had written out a Rs 600 April put option on SBI, you would have earned a premium of Rs 7. As on April 11, 2005, the premium on this option was around Rs 3.5. Currently, there is a Rs 780 April call option on SBI, which could earn you a premium of Rs 1.95. Even though you stand to get a much lower premium than you would earn, by writing options quoting nearer the current market price, the risk is also much less, in such options.

Many a times, it gets difficult for investors to exit positions that they have built over a period of time. At such times, they could look at selling �out of the money� call options to hedge themselves and get an additional cushion on the portfolio values. Besides, a study of the options market shows that 80-90 per cent of options expire worthless. Hence, by following the strategy of writing out-of-money options, you can garner small and consistent returns, during adverse market conditions.

IN BRIEF

An option can be either out-of-money, inthe-money or at-the-money.

A call option is said to be out-of-money if the current price of the underlying share is below the strike price of the option.

It is always less risky to write out-ofmoney options as the strike price is at a premium to the spot price.

The writer of such options gains because of erosion of the time value of options.

Although the premium earned on such options is not much, the risk is also low.

A study of the options market shows that 80-90 per cent of options expire worthless.