Lump Sum Investing or Dollar Cost Averaging

Post on: 4 Май, 2015 No Comment

Recently, I had an email exchange with one of our readers about how to start investing in the Roth IRA. Previously, I stated that I usually transfer $5,500 to my account, then wait for a pull back to invest. The main reason I invest $5,500 at once instead of spreading it out over the year is to avoid the transaction fees. I don’t want to pay $10 or whatever it costs to add shares to my Roth IRA every month.

Here is Howard’s question.

“I am about to put in my $5,500 in the IRA. I plan to buy a fund. But the fund has a minimum so I have no choice but to invest $3,000 at once. Beyond that, I would find it easier, this time around, to just put the whole $5,500 in at once.

But the thing is the fund is now at an all-time high. So Im confused as to whether I should invest the $3,000 now and then wait to invest the other $2,500 over time, just invest it all now and not worry that the price is high (since this isnt that relevant in the really long-term for something youre going to hold for decades and it may not go back down anyway anytime soon) or if I should actually just put it in the IRA and wait for the price to come down before investing any of it. Should I even be worrying about the price in a situation like this?

I have been told that in general, I should dollar cost average to minimize the influence of these low vs. high prices over time. So in the future, my plan was to invest a certain amount each month or something like that (although Im curious why you dont do that and seem to say you do it in a lump sum every year?) But the minimum requirement means I have no choice but to make at least one large lump sum investment.”

Lump Sum Investing or Dollar Cost Averaging?

For Howard, I don’t think it really matters all that much whether he invests $5,500 in lump sum or splits it into two installments. When you are starting out, your saving rate matters much more than your choice of investment. If Howard contributes another $5,500 next year, he will have doubled the value of his Roth IRA. At this point, it doesn’t really matter if he invests in one lump sum or dollar cost average. As long as he keeps adding $5,500 to his Roth IRA every year, it should work out well for him in 30 years.

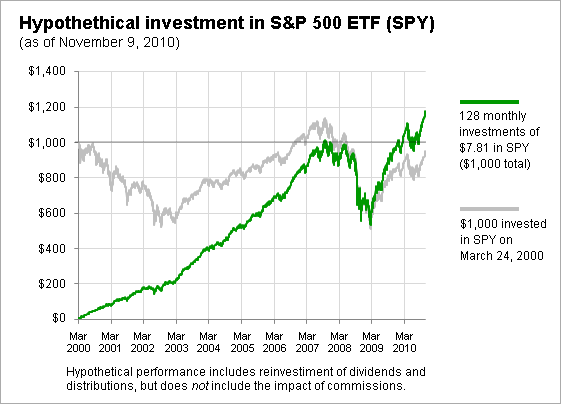

I pointed Howard to a study from Vanguard – Dollar Cost Averaging just means taking risk later. The study shows that LSI outperform DCA about 2/3 of the time. This makes sense because historically, the stock market has gone up over the long term. When you wait (DCA), you’re losing out on the gain the market is making.

The study also mentioned that if the investor is primarily concerned with minimizing downside risk and potential feelings of regret (resulting from lump-sum investing immediately before a market downturn), then DCA may be a better fit.

Lump Sum Investing is Scary

I must be getting a lot more conservative as I get older. When I was younger, I never hesitated to invest a lump sum. I know I had 30+ years to invest and the market has always done well over the long haul. However, now that I’m older, I’m much more concerned with minimizing the downside risk.

We are selling our rentals and will have a lump sum available soon (hopefully). This will be a significant percentage of our net worth and I don’t think I can stomach investing everything at once.

Situational

Am I being a hypocrite for telling Howard to invest $5,500 at once while I hesitate to do the same? It’s always clearer to analyze someone else’s situation. When you’re looking at your own problem, emotion can muddy the waters.

Anyway, Howard still has a lot of human capital left. He’ll work for many more years and keep investing in his retirement accounts. On the other hand, I don’t make much money anymore and I need to be a little more defensive. We are contemplating paying cash for a house and that is a very conservative play. I suspect we’ll end up investing part of the lump sum and then use the rest as a big down payment for a house. I’ll keep you updated.

How do you invest a lump sum?

Our friend, Nick at Pretired.org, faces a similar situation and writes an extensive article about it – What do you do when there’s nowhere to invest? Check it out.