Low P

Post on: 21 Апрель, 2015 No Comment

My Investment Mantras – Part 2

Today I will further share insights in to investment through part 2 of my investment mantras (https://feb10capital.wordpress.com/2014/03/16/my-investment-mantras-part-1/ ). This blog shall cover about the Income statement and P/E ratio. To make it much more understandable, wherever possible I would relate how income statement shall be related to individual person.

- Income Statement (IS):

- If you look at any financial statements, Income statement shall be the first one to be reported followed by balance sheet & then cash flows. As the name indicates income statement gives details about the income in a given period or financial year. Based on income statement one can able to identify the gross margin, operating margin, EBITDA (Earnings Before Interest, Tax, Depreciation and Amortization) and net profit margin etc. Income statement is much more similar to a salary statement of a individual person although with lot more complexity involved.

- The respective country laws & stock exchange regulators allow enough freedom for companies to report what they fit in income statements & thus all income statements doesnt look very similar. But most of the income statements would cover revenue, costs, interest/finance expenses, operating expenses (salaries, marketing etc), depreciation & amortization, income tax etc. Income statements shall also contain any one time gain or loss due to good will (gain), impairment (loss) or profit/loss due to sale of an associate or subsidiary etc. Income statement should be carefully looked to get information on profit/loss for a given period, various (gross, operating & net) profit margins and finally earnings per share (Net profit divided by total number of shares).

- However income statement doesnt guarantee that whatever profit is reported is in possession with the company. Most of the law suits against companies are related to how a particular company reported incorrect profit through accounting gimmicks even though the company didnt gain any revenue/profit. The laws regarding when a company could recognize revenue ( and profit) varies from type of product sold & is susceptible for various interpretations. As mentioned before, Income statement is like a salary statement & it only specifies how much a person earned in a particular period and salary (or income) statement is not a guarantee that particular person was paid salary for a given period. Cash flow statement (would be covered in part 3) would provide much more clarity on how much profit a company actually in possession with in a given period of time.

- Price to Earnings Ratio (P/E Ratio):

- P/E ratio is one of the widely used metric to evaluate a particular stock/company for investment. The P/E ratio indicates how much premium investors are willing to pay to buy a particular share. Usually (not always) the lower P/E indicates that company is not in favor among investors & higher P/E indicates that company shares are well sought by investors. As the name indicates, P/E ratio is calculated by dividing share price of a company with earnings per share (EPS). EPS is calculated by dividing net profit of a company with total number of outstanding shares. For example lets assume that XYZ company share price is $1 and its profit for a given FY is $10 with total outstanding shares at 100. The EPS for XYZ company for a given FY is 10 cents ($10/100) and P/E ratio for XYZ company is 10 times ($1/$.1).

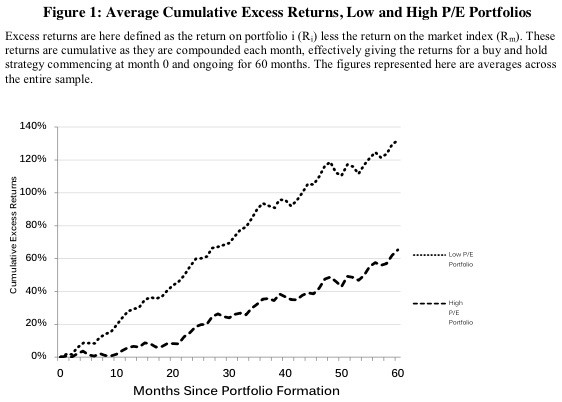

- Generally Low P/E ratio (less than 10) is very good opportunity to buy a company provided its medium to long term prospects are good. The value investors (best example is warren buffet) tend to buy shares at low P/E ratio & would wait long term to unlock the shares at much higher share value & P/E ratio (Just higher P/E ratio is not suffice). However low P/E indicates that company near term outlook is not that favorable either due to companys own challenges, industry challenges (like PC industry) or geo political reasons (war etc). As long as those challenges remain company may continue to languish at lower P/E ratio & share price would drop if earnings continue to drop (so that P/E ratio is maintained). In nut shell not all companies with low P/E ratios are good for investment & fundamental analysis should always be applied irrespective of P/E ratio. The P/E can go high in two very different & opposite ways.

- Future income growth: when investors are confident that company would able to achieve higher income in near to medium term, the investors would be willing to buy the shares at higher share price & P/E ratio. The best example is Facebook whose P/E ratio is at 82.

- Drop in income with stable share price: The other case when P/E ratio can shoot high is that the company earnings continue to drop but investors maintain confidence in the company by continuing to keep the share price stable. This kind of scenarios can be seen with companies whose barrier to entry is very high (utilities, telecom & public transportation etc) and very unlikely that those companies would lose market share in medium term (less than 5 years).

- High P/E indicates that investors are confident in growth prospects of the company & would be willing to buy shares at higher price compared to current earnings. It is also very risky to buy shares at high P/E ratio (especially > 20) as to grow the share price the company would need to consistently grow the earnings & any near term impact on earnings would cause the share price to drop. Investors should be much more cautious in buying stocks with high P/E ratio.

- Overall P/E ratio is very subjective metric & there is no steadfast rule on what ratio is best for investment purpose. The P/E ratio is much more aligned with the risk profile of a investor. A low risk profile investor would be less willing to buy the shares at very low P/E or high P/E and in same way a high risk profile investor would be comfortable with low P/E & high P/E provided there is significant potential for future returns.

In Part 3, I would discuss about Balance Sheet, Cash Flow and how would they influence my investment.

Thanks for visiting my blog. Please leave your opinion/queries as comments!!