Lost decade for stocks

Post on: 28 Март, 2015 No Comment

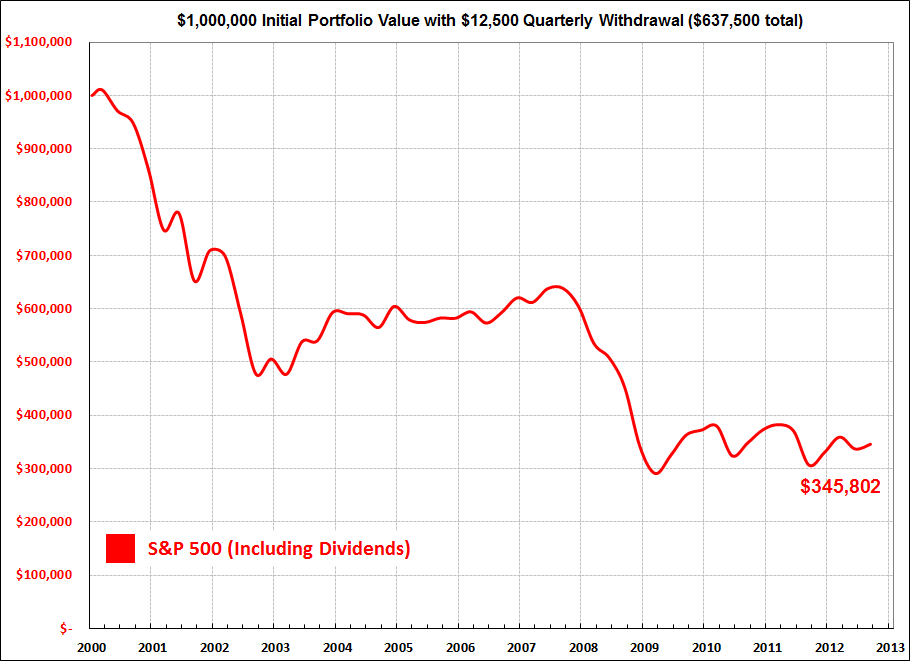

The owners of capital fared no better, with the nominal S&P500 stock price index down 20% for the decade. The dividends stockholders collected made up for some of that, but inflation took away even more.

One of the reasons stocks did so badly was that real earnings ended the decade 80% lower than they began. Even when you smooth out cyclical variations by taking a decade-long average as in the dashed blue line below, the downturn in earnings at the end of the decade is still pretty significant.

That doesnt mean you should never buy when the P/E exceeds its historical average. If you buy at those times, you may expect to earn a return below the average historical real yield of 5.5% per year, but it could be that this lower return of, say, 4% would still be better than you can get anywhere else, and good enough for your saving objectives. In 1995, Shillers long-run P/E was a bit rich by historical standards at about 20, right where it is today. If you bought at those high prices in 1995 and sold at the even higher prices in 2000, then you did very, very well. But if youre smart enough to know exactly how to pull that off, then Im smart enough to know that Im not you.

Shillers graph persuaded me to keep extra cash entirely out of stocks for most of the last 15 years. I shared with Econbrowser readers my reasons for going back into the market over November 2008 through the spring of 2009. In retrospect, that was the one brief window over the last 20 years when Shillers calculation suggests you could earn above-average historical returns from buying stocks.

Many financial analysts used to give the advice to put steady monthly amounts into stocks and hold for the long term, trusting in the long-run averages eventually to give you that 5.5% annual real return. The experience of the last decade has spooked some people out of that philosophy. I think it still makes sense provided that the long-run P/E doesnt get above 20; beyond that, you want to be aware of the risks.

Some people have the psychological reaction that when stock prices have been going down, equities are becoming a riskier investment. I take the opposite view the higher stock prices go, the scarier they look to me.

Post navigation

24 thoughts on Lost decade for stocks

Excellent call indeed in fact the linked articles were 2 of my favorite econbrowser posts so far.

If you bought at those high prices in 1995 and sold at the even higher prices in 2000, then you did very, very well. But if youre smart enough to know exactly how to pull that off, then Im smart enough to know that Im not you.

I think one would need a model/idea about trend-followers to do that or a very, very good intuition/feel for the market (in addition to the fundamentals). Preferably, one would arrange for both

The stock market has done badly because the US domestic private sector has been in deficit almost every year since 1997!

Sothe big problem is interest rates arent low enough and corporate and individual taxes are too high..right?

Some people have the psychological reaction that when stock prices have been going down, equities are becoming a riskier investment. I take the opposite view the higher stock prices go, the scarier they look to me.

Basic finance is that risk and expected return are directly related. Stock prices tend to be low at times of high risk. At that point, your expected return is highest.

Or dont you agree that risk and expected return are inexorably intertwined?

Im afraid the market just doesnt work the way Shiller thinks it does. The meaningful relationship involved isnt the one he suggests exists between inflation-adjusted stock prices and ten-year inflation-adjusted earnings per share instead, its the one between nominal stock prices and nominal dividends per share. When order exists in that relationship, you can put your investing strategy pretty much on autopilot the market even provides clear signals to let you know when that order no longer exists, frequently with early warning signals that order is breaking down.

Its untangling the relationship between expected dividends and and stock prices during periods of disorder thats the challenge!

My theory is just a return to the mean. Stocks did amazingly well in the 80s and 90s averaging a total return of twice the 1871-2008 average. This could not continue indefinitely. The 00s have brought us closer to the mean return but not quite there.

People who didnt make money this decade have a very limited view of financial instruments.

I think it still makes sense provided that the long-run P/E doesnt get above 20

If you take an equal weighting (not capitalization weighting) of random stocks (and thus accept a mostly small cap portfolio) and maintain that equal weighting with frequent rebalancing, while holding down overall trading/slippage costs, then you do a lot better. Fundamental weightings have the potential to improve things further.

The Tokyo stock exchange crossed 10,000 about 1984 on its way up to 39,000 in 1989, then the bubble burst. The Nikkei plunged into the mid-teens over the next couple of years, bounced between there and the low twenties for most of the nineties. In the noughties it began by plunging below the 1985 level, recovering to the mid teens and fainting again. It is now around 10,500, like the Dow.