Long Short Hedging Strategy

Post on: 16 Март, 2015 No Comment

Long Short Hedging Strategy

The Downside Hedge Long / Short Hedging Strategy relies on our core market indicators and our Market Risk Indicator to increase the size and strength of our hedges when market conditions deteriorate. Conversely, it reduces the hedge and increases our long stock exposure when market conditions are improving.

I cant see the future, therefore I hedge.

Blair Jensen

We use a combination of technical indicators that monitor the underlying health of the market. Our indicators track the economy, market risk, value, trend of the market, and the quality and strength of rallies. When our core market indicators are gaining strength we increase our long exposure. We take profit when it appears that the health of the market is weakening. This creates a dynamic hedge that adjusts from 100% long to 50% long / 50% short depending on the character of the market.

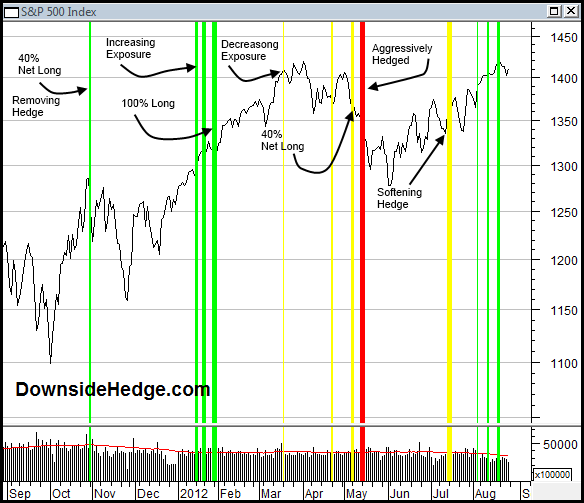

On the chart above, the green lines represent selling our hedging instruments and buying more stock. The yellow lines represent profit taking from our long positions and shorting the broad market with those profits. The red lines represent an aggressive hedge due to the increased risk of a substantial market decline.

Our Long / Short strategy is designed for investors who are comfortable shorting stocks, buying put options, and investing in mid-term or dynamic volatility instruments. It can be used by investors who believe there is danger of a substantial market decline.

Long Stock Portfolio

The Long / Short hedge has a composition of stocks that we want to own for the long term. We pick securities that we believe will out perform the market during up trends and sideways markets. These securities can be individual stocks or concentrated ETFs. We are not concerned with the performance of our stocks during down trends so we generally use high beta stocks or ETFs. We do not use defensive stocks as we believe they would be counter productive to our strategy.

We keep the number of securities in the long position of the portfolio small so that we are not diversified to such an extent that our long stocks perform similar to the broad market. For example, we would not use a broad market index fund as the long portion of the portfolio because our most common hedge is a short of the S&P 500 index. The performance of an overly diversified portfolio of long stocks would be negated by our hedges in many instances. We often use actively managed or style ETFs that out perform the market in up trends.

Hedging Instruments

We generally hedge our long portfolio by adding an offsetting short of the S&P 500 Index that varies in size depending on market conditions. When our Market Risk Indicator signals a warning we use more aggressive instruments to hedge. These instruments can include; put options that mirror our portfolio, dynamic volatility instruments like XVZ, mid-term volatility ETFs like VXZ or VIXM, or actively managed short funds like HDGE. We do not use juiced ETFs (double or triple inverse instruments) because they are designed for very short term trading and we often hedge our portfolio for weeks or months when market conditions are uncertain or dangerous. We like the dynamic volatility ETN XVZ as a hedge because it has substantial gains during a serious decline. Here are more details about XVZ and how to use volatility to hedge your portfolio .

Performance

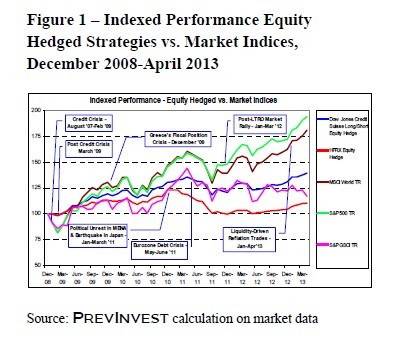

The Long / Short hedge strategy has performed significantly better than the S&P 500 without unrecoverable losses. However, it is more volatile than our Long / Cash Hedging Strategy . It is designed to limit catastrophic declines in a portfolio, but also participate in stock market rallies. The chart below compares the performance of the S&P 500 Index to our Long / Short hedging strategy. The black line represents the value of $10,000 invested in the S&P 500 Index. The green line represents the value of the same amount invested in our Long / Short hedge.

This strategy tends to out perform in strong up trends and under perform in choppy markets and small corrections. It can out perform during substantial market declines when volatility and put option premiums are rising. It has also under performed when the implied volatility of put option premiums is falling or moving sideways.

The strategy benefits by reducing risk during times when market conditions are deteriorating and increasing exposure to our long stock portfolio when market conditions are improving. It also takes advantage of profits generated in our hedging instruments during market declines. As the market declines the value of our hedge increases while the value of our long portfolio decreases. We use the imbalance generated by a market decline to take profit from the hedge and buy more of the stocks we want to own for the long term.

You can follow our Long / Short portfolio allocations in our Long Short Position posts.

Current Market Conditions

Volatility Hedged Portfolio

Long / Cash Portfolio