Loanable Funds v Market what s the difference

Post on: 24 Июль, 2015 No Comment

Loanable Funds vs. Money Market: whats the difference?

Update: Once again I have updated this post with a few minor changes. Notably, I have added to graphs illustrating a separate shift in supply and demand for loanable funds. Based on discussions with readers via email, it appears that my previous graph illustrating in one diagram the shifts of both supply and demand was confusing and could be considered double counting the effect of an increase in deficit spending. Thanks again to Professor Chuck Orvis for his valuable input.

*Click on a graph to see the full-sized version

Two markets for money. right? Yes so do they show the same thing? NO! You must know the distinction between these two markets. First lets talk about the Money Market diagram.

This market refers to the Money Supply (M1 and M2 ). The Money Supply curve is vertical because it is determined by the Feds (or central banks) particular monetary policy. On the X axis is the Quantity of money supplied and demanded, and on the Y axis is the nominal interest rate . A tight monetary policy (selling of bonds by the Fed) will shift Money Supply in, raising the federal funds rate. and subsequently the interest rates commercial banks charge their best customers (prime interest rate ). On the other hand, an easy money policy (buying of bonds by the Fed) shifts Sm out, lowering the Federal Funds rate and thus the prime interest rate.

You should also know why a tight money policy is considered contractionary and why an easy money policy is considered expansionary monetary policy. Higher nominal interest rates resulting from tight money policy will discourage investment and consumption. contracting aggregate demand. On the other hand, an easy money policy will encourage more investment and consumption as nominal rates fall, expanding aggregate demand.

First watch this video lesson, which defines and introduces the money market diagram (skip ahead to 0:43 to hear the definition and explanation of the money market):

Government deficit spending and the money market: Does an increase in government spending without a corresponding increase in taxes affect the money market? You may be inclined to say yes, since the Treasury must issue new bonds to finance deficit spending. After all, when the Fed sells bonds, money is taken out of circulation and held by the Fed, thus its no longer part of the money supply.

When the Treasury issues and sells new bonds, however, the money the public uses to buy the bonds is put back into circulation as the government spending is increased. Therefore, any leftward shift of the money supply curve caused by the buying of bonds by the public is offset by the injection of cash in the economy initiated the governments fiscal stimulus package takes effect (be it a tax rebate or an increase in spending). Therefore, money supply should remain stable when the government deficit spends.

However, since the money demand curve depends on the level of transactions going on in a nations economy in a particular period of time, an increase in government spending on infrastructure. defense, corporate subsidies, tax rebates or other fiscal policy initiatives will increase the demand for money, shifting the Dm curve rightward and driving up interest rates. The higher interest rates resulting from the greater demand for money reduces the quantity of private investment; in this way the crowding-out effect can be illustrated in the money market.

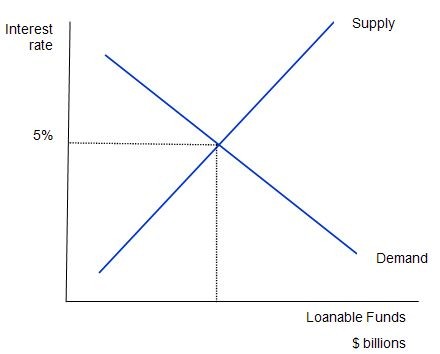

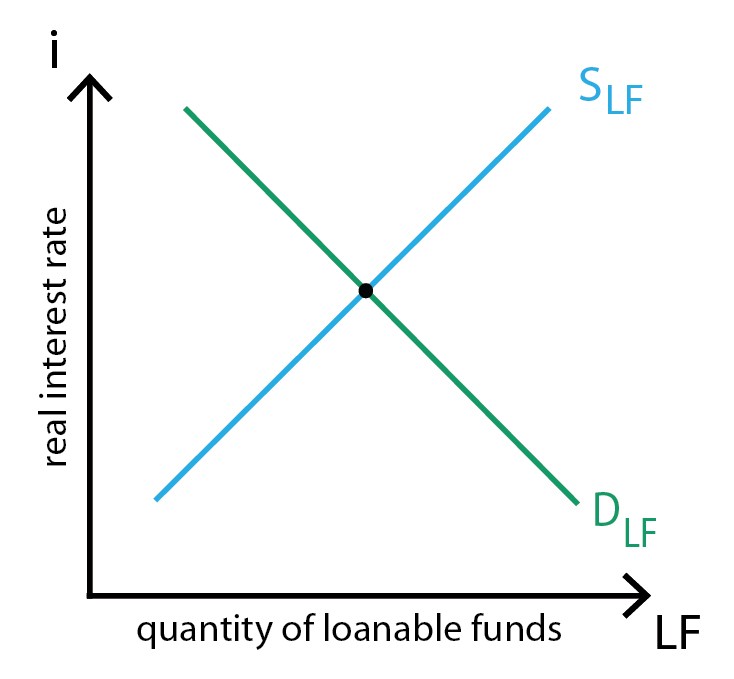

Now to the loanable funds market . Loanable funds represents the money in commercial banks and lending institutions that is available to lend out to firms and households to finance expenditures (investment or consumption). The Y-axis represents the real interest rate ; the loanable funds market therefore recognizes the relationships between real returns on savings and real price of borrowing with the publics willingness to save and borrow.

Watch this video for a clear explanation of the loanable funds market and how it can be used to illustrate the crowding-out effect (skip ahead to 3:18 for a definition and explanation of the loanable funds market):

Since an increase in the real interest rate makes households and firms want to place more money in the bank (and more money in the bank means more money to loan out), there is a direct relationship between real interest rate and Supply of Loanable Funds . On the other hand, since at lower real interest rates households and firms will be less inclined to save and more inclined to borrow and spend, the Demand for loanable funds reflects an inverse relationship. At higher interest rates, households prefer to delay their spending and put their money in savings, since the opportunity cost of spending now rises with the real interest rate.

Government deficit spending and the loanable funds market: We learned above that only the Fed can shift the money supply curve, but what factors can affect the Supply and Demand curves for loanable funds? Heres a few key points to know about the loanable funds market.

- When the government deficit spends (G>tax revenue), it must borrow from the public by issuing bonds.

- The Treasury issues new bonds, which shifts the supply of bonds out, lowering their prices and raising the interest rates on bonds.

- In response to higher interest rates on bonds, investors will transfer their money out of banks and other lending institutions and into the bond market. Banks will also lend out fewer of their excess reserves. and put some of those reserves into the bond market as well, where it is secure and now earns relatively higher interest.

- As households, firms and banks buy the newly issued Treasury securities (which represents the publics lending to the government), the supply of private funds available for lending to households and firms shifts in. With fewer funds for private lending banks must raise their interest rates, leading to a movement along the demand curve for loanable funds.

- This causes crowding out of private investment.

Another, simpler way to understand the effect of government deficit spending on real interest rates is to look at it from the demand side.

- Deficit spending by the government requires the government to borrow from the public, increasing the demand for loanable funds. In essence, the government becomes a borrower in the countrys financial sector, demanding new funds for investment, driving up real interest rates.

- Increased demand from the government pushes interest rates up, causing banks to supply a greater quanity of funds for lending. The private, however, now has fewer funds available to borrow as the government soaks up some of the funds that previously would have gone to private borrowers.

- This leads to the crowding out of private investment . in which private borrowers face higher real interest rates due to increased deficit spending by the government.

What could shift the supply of loanable funds to the right? Easy, anything that increases savings by households and firms, known as the determinants of consumption and saving. These include increases in wealth, expectations of future income and price levels, and lower taxes. If savings increases, supply of loanable funds shifts outward, increasing the reserves in banks, lowering real interest rates, encouraging firms to undertake new investments. This is why many economists say that savings is investment. What they mean is increased increased savings leads to an increase in the supply of loanable funds, which leads to lower interest rates and increased investment.

On the other hand, an increase in demand for investment funds by firms will shift demand for loanable funds out, driving up real interest rates. The determinants of investment include business taxes, technological change, expectations of future business opportunities, and so on (follow link to our wiki page on Investment).

It is important to be able to distinguish between the money market and the market for loanable funds, as both the AP and IB syllabi xpect students to understand and explain the difference between these concepts.

About the author: Jason Welker teaches International Baccalaureate and Advanced Placement Economics at Zurich International School in Switzerland. In addition to publishing various online resources for economics students and teachers, Jason developed the online version of the Economics course for the IB and is has authored two Economics textbooks: Pearson Baccalaureates Economics for the IB Diploma and REAs AP Macroeconomics Crash Course. Jason is a native of the Pacific Northwest of the United States, and is a passionate adventurer, who considers himself a skier / mountain biker who teaches Economics in his free time. He and his wife keep a ski chalet in the mountains of Northern Idaho, which now that they live in the Swiss Alps gets far too little use. Read more posts by this author

Related posts:

75 Responses to Loanable Funds vs. Money Market: whats the difference?

If the real interest rates for the US Dollar are low, there will be an increase in entrepreneurial projects, and the amount of loans given out by the American banks on a whole. This means there will be an increase in the amount of funds households and firms have.

Ceteris Paribus, on the foreign exchange market, this will mean an increase in the supply of the US Dollar, resulting in the devaluation of the US Dollar.

The real interest rates are very low in the United states, this will cause many people to borrow money for investment.Low interest rates mean a low rate of return if the money is placed in a savings account therefore firms can make more profit by investing in capital. This will increase the real wealth of investors and make them spend more money.

# Lucas on 27 Apr 2007 at 1:00 pm

If the real interest rates in the US decrease then there will be a increase in investment in capital and entrepreneurial ventures. Therefore, the investment will increase everyone's real wealth which will increase the consumption. So because everyone has more funds there is an increase in the spendable supply of the US dollar so the value of the US dollar will decrease.

Lower real interest rates in the United States would affect Demand for the US dollar on foreign exchange markets through increases in households likeliness to borrow money, firms likeliness to invest in capital, factories, etc and thus, like Marco said, loans given by banks are increased and thus the amount of money in circulation increases, driving up the price of the US dollar. Demand for the US dollar on foreign exchange markets increases when interest rate go down due to the above, but demand for the US dollar also increase when from a low interest rate, the interest rates increase slightly, giving evidence to suggest that interest rates will increase in future; which will happen because a slight increase in interest rates prompts households to take out loans before the interest rates rise again.

When investors are deciding whether or not to make a loan in order to make an investment, there are two factors which they must take into account: the expected ate of return (expected future profit they will gain from making this investment), as well as the real interest rate. In order for the firm to invest, r (the expected rate of return) must exceed i (the real interest rate). Thus, according to this, Total Investment in a country can be depicted as a graph which plots the real interest rate against the Quantity of funds for investment. When real interest rate is highsay, 15 %very few projects have an expected rate of return this high; therefore, few firms will be willing to invest, for it would be more profitable for them to keep their money in the bank and receive the interest from this money. However, as real interest rate decreases, the quantity of funds loaned for investment increases as more projects have an expected rate of return above the real interest rate. Because of this, there is an inverse relationship between real interest rate and the quantity of funds loaned for investment.

by the way, i don't know anything on foreign exchange rates blah blah blah so i just wrote stuff on what we learned in class :).

As savings increase, there is a direct correlation between between the low interest rates and the amount of loans given out by the government. Thus, the amount of US dollars in circulation increases, devaluing the US currency in the worldwide market.

With lower interest rates, financial capital will flow out of the country. This means a lower demand for the currency and a weaker currency. The weaker currency leads to more exports and fewer imports, which increases aggregate demand.

Lower the interest rates the greater the effect on nominal GDP. Loans from banks increase so that more people will spend $$ so $ circulation increases increasing the value of the US dollar. Demand for the US dollar will increase in foreign markets this proves that interest rates will increase eventually.

# Bin Joo on 04 May 2007 at 12:35 am

Lower real interest rate in the U.S. would mean that a foreign country is less encouraged to invest in U.S. assets because of lower profit later on. Thus, the foreign country decreases its supply of currency in the market, and that foreign currency will appreciate. Because of the appreciation, U.S. currency relatively depreciates.

# Yihan on 04 May 2007 at 11:04 pm

Interesting to think about. If interest rates on loans from banks go up, domestic investment will decrease because the opportunity cost of obtaining the money is higher (it would require a higher rate of expected return for companies to be willing to invest). This would decrease AD, causing higher price levels, which causes the nation's currency to depreciate.

However, at the same time, if interest rates on bonds and returns on investments are higher, foreigners would be more willing to invest in the country because the rate of expected return is higher. This would cause the country's currency to appreciate because there is more demand for that country's currency.

# Hae Min on 07 May 2007 at 7:40 am

How HIGHER real interest rates in U.S. would affect Demand for the US dollar on foreign exchange markets, the exchange rate of the dollar compared to foreign currencies, and U.S. exports?

When the Fed increases the nominal interest rate, the real interest rate rises temporarily and investment and expenditure on consumer durable decreases. An increase in the interest rate means that the U.S. interest rate increases relative to the interest rate in other countries. Foregners are attracted to the higher interest rate they can now earn on U.S. bank deposits and bonds, which increases the demand for U.S. dollars. With more dollars demanded, the price of the dollar rises on the foreign exchange market. U.S. exports decrease sice foreigners must now pay more for goods and services of U.S.

# Jong-Bin Lim on 07 May 2007 at 3:45 pm

Assuming this IR refers to bank, lower real interest rates will discourage people invest, and investment is one of the determinant of aggregate demand. Because investment decreases, aggregate demand will also decrease.

Assuming this IR refers to interest rates on loans from banks, if it increases, people will invest less. Thus, it affects aggregate demand, and thus the dollar will depreciate.

# Angel Liu on 07 Apr 2008 at 9:23 pm

Why is the interest rate of the money market nominal and the loanable funds real? Shouldn't both be adjusted for inflation to show the actual fluctuation of interest rates.

# T. Sun on 08 Apr 2008 at 2:14 am

Why are there comments back from last year?!