Listings of Bullion Dealers

Post on: 26 Июнь, 2015 No Comment

Bullion Dealers are much like any other business community, in that they all deal in the same market, but that is where the similarities end.

Some only deal in bullion, and as you will find out, many also deal in numismatic coins and jewelry.

Some dealers buy and sell, while others, may call themselves dealers but are simply a place to buy bullion.

Listed below are categories of dealers separated in their own bullion business specialties.

Note: This page is as an overview of bullion dealer practices you should be aware of before you invest in bullion and the things to be aware of in the bullion market.

Things to Consider Before You Choose a Dealer

Comparison Shopping

Different Dealers don’t all have the same prices.

Comparison shopping is the best way to find the greatest investment for your dollar in any market.

Surcharges

Not every Dealer has a surcharge, which are additional fees added to the shipping cost and the cost of the bullion itself.

The dealers that do, don’t always call it a Surcharge, they tend to call them extra fees, handling fees or simply commission fees. Either way, you want to read all the fine print of every bullion dealers website before you buy.

You can often find out if there are additional fees at the bottom of a dealer’s web page. under links using the following words terms and conditions. policies. shipping charges, sale terms or just fees.

Sometimes you won’t see these fees until it’s time to commit to the purchase of your bullion and with any investment you don’t want surprises.

Shipping Fees

Every Dealer has different fees for shipping. Although, several bullion dealers have started to offer Free Shipping.

For those who do charge for shipping, some simply charge a flat fee based on the total price of your order.

While others will calculate the weight and shipping location of the customer.

This is another area where you want to know the facts before you commit to buy precious metals bullion.

Bullion Prices

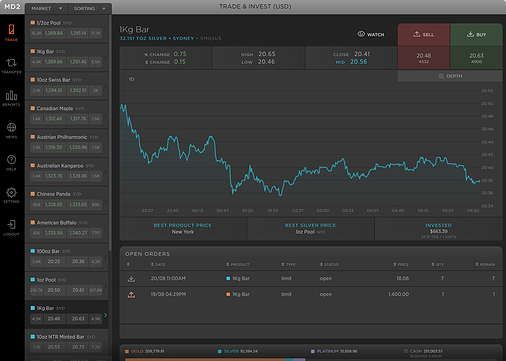

In the ever-changing prices of the bullion market, the Spot Price is the price of the precious metal, quoted for the immediate delivery for cash.

Expect to see a small charge or premium above the spot price to help dealers pay for overhead and run their businesses.

Prices of bullion for the retail investor are based upon the spot price of the precious metal, many dealers have their systems set up to reflect the spot price of the metal to change by the minute with the premium built into the ‘for sale price.’

Premiums are different for each precious metal, the lowest generally being for silver.

Premiums are lowest for junk silver bullion and for bullion rounds and bars. This is because these forms of bullion usually have no numismatic value.

Examples of bullion coins that carry higher premiums are the Silver Mexican Libertad or Australian Gold Lunar Bullion Coins, this is due to their low mintages and design. Plus these bullion coin have a larger retail draw, than bullion rounds and bars.

However, some older Bullion Bars also have high premiums, for instance, Engelhard Bullion bars and rounds.

The photo to the right is of a 5gram silver bar made by Engelhard. At the current price of silver which is $16.50 a troy ounce, the bar should only cost around $3.00.

However, this is a rare Engelhard bar, as seen by its serial number ‘08029’, which means a collector may pay up to 10 or 20 times the amount a normal raw 5gram bar would cost, for it.

The difference between a Collector and a Investor

Collecting involves Emotion, because you love what you collect and will pay almost any price for it and may never sell it.

Investing on the other hand involves having the Discipline and Knowledge of knowing when and what to buy and when to sell.

Generally for silver, premiums generally between $0.25 to $5.00 per ounce, and for gold, platinum or palladium the premium can be as low as $10 per ounce or as high as $150 per ounce above the spot price.

If prices for physical bullion are below or above these premiums its your decision as to whether or not you are getting a good deal.

Note: If the item you are looking at has a numismatic value the above figures may not apply. Collector coins have much higher premiums attached to them.

Buying Copper Bullion

copper bullion bars

Copper bullion is becoming more numerous on dealers websites. Many buyers see it as an easier way to buy bullion than to pay for some other more expensive precious metals.

What many prospective investors might be unaware of is that copper prices are based in the Avoirdupois (pronounced; a-vo-du-pwa) system of weight, and not Troy Ounces like most other precious metals.

Copper is much more abundant in the earth than other precious metals, plus the metal is seen more as an Industrial Metal than a precious metal. Currently the price of copper is selling around $3.00. This spot price reflects copper’s price per pound (lb.), not per troy ounce.

Keep Your Guard Up

I’ve used many of the bullion dealers listed below, but not all. However, you won’t see any dealers listed on this guide that does not have good business standards or participates in fraudulent business practices.

In addition, one rule of thumb that I use to be on the safe side when I buy bullion from a dealer for the first time is; to play it safe.

I keep my first purchase under $200 or place an order just above the dealer’s minimum. This will show you how much the dealer values their customers. Based upon how quickly they get the order to you and based upon them getting your order correct. In addition, to you getting quality service.

Furthermore, it gives you an idea of how long shipping may take and their shipping standards. Do they insure the shipment or do they require a signature at the time of delivery. This is in addition to any of your own personal preferences you want from a bullion dealer.

Investing Your Money

When you decide to buy, and you know who you want to buy from, you may want consider budgeting your investment dollars. You may want to split your investment money, decide at what price you want to get in. Say for instance you want to buy silver bullion.

And let’s go back in time a little and say it’s late April of 2011, when the price of silver was at $45.00. Do you want to get in at that price? or Do you want to see if the price will dip to a lower level? You hear the pundits saying the price is going higher. But this is your money, it is up to you when you want to start buying; not them.

Continuing with the scenario, you want to get in the market or your already are in the market and you want to accumulate more precious metals.

But, you look at the chart and the price has gone straight up over the last several months, the charts are lookin’ like the price should correct itself sometime in the near future.

So you only invest a half, a quarter or less of your money, or you stay out of the market completely and wait. Then you watch the markets and read the News on the homepage of the Free Bullion Investment Guide . Depending on what the silver price does, you make your decision from there and either continue to hold, sell or buy.

Many investors can get caught up in the hype when a market is going through the roof. It’s hard for any investor to decide when is the right time, or price, to buy and sell.

The lesson from the silver market of April 2011, is that if the price has moved more than 20% in a short period of time, there’s a good chance a correction is around the corner.

Ultimately, it’s your choice for when you get into any market and you have your own comfort zone.

You make the choices of how and why you are investing in the market and when is the right time to get in or out.

However, budgeting for any investment is always be a good choice to take.

As a bullion investor there are many choices offered on the web, they just seem to be scattered all over the place.

This Bullion Dealer page was created to bring reputable bullion dealers together (at one place) to help you find and make the best choice for your investment dollar.

The categories below are tailored to each Bullion Dealers own specialties.

Bullion Dealers

Junk Silver Coin Bullion Dealers — Bullion Dealers who offer 90% & 40% Junk Silver Coins. Dealers include; JM Bullion, Golden Eagle Coins, BGASC, etc.

Coin Dealers of Bullion Coins and Rounds — Dealers who offer Gov’t Bullion Coins and bullion rounds from several refineries and private mints. Dealers include; SilverGoldBull.com, ChineseCoins.com, the Perth Mint, etc.

Coin Bullion Dealers who sell graded bullion and other numismatic graded coins. (Golden Eagle Coins, Paradise Mint, Modern Coin Mart & Smyrna Coin)