Liquid alternatives v funds

Post on: 6 Июль, 2015 No Comment

Share This Story

Liquid alternatives have been the growth story for the U.S. mutual fund industry this year. Through the end of June, the alternative fund category reached $156 billion in total assets and a one-year organic AUM growth rate of 30.3%, according to Morningstar. In contrast, U.S. equity funds grew AUM by 1%; taxable bond funds declined by 0.6% over the same period.

In the first half of 2014, hedge funds also enjoyed strong growth, with AUM rising to a record $2.35 trillion at the end of the second quarter. The hedge fund industry captured $57 billion in net cash flow through the first six months of this year, according to Hedge Fund Research.

Assets are flooding into both liquid alternatives (alternative mutual funds) and hedge funds, but there is another story swirling beneath the surface. Just as ETFs have become serious competition for index mutual funds, liquid alternatives are starting to rival hedge funds.

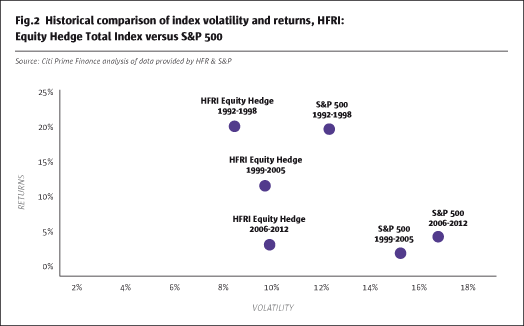

Leading hedge fund indexes have been in a performance funk since 2007, and this year is no exception. Year-to-date through August, the HFRI Fund Weighted Composite Index returned 2.43%, compared to 8.39% for the S&P 500. Over the same period, Morningstars largest alternative category, Long/Short Equity, returned 3.52%.

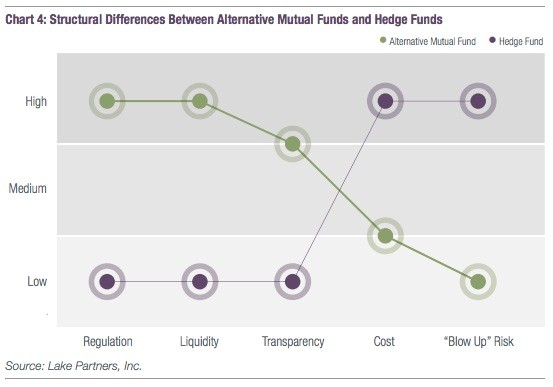

For financial advisors and their clients, liquid alternatives have several clear advantages over hedge funds: lower costs, daily valuation, liquidity, transparency and simple tax reporting. If liquid alternatives also can achieve long-term performance that is better than hedge funds, the competitive balance could tip dramatically in their favor. For reasons explained here, I believe this could happen.

Teeing up the Performance Comparison

A performance comparison between liquid alternatives and hedge funds is not simple or apples-to-apples.

The hedge fund industry has been around for decades, while relatively few liquid alternatives have track records more than 10 years long. However, individual hedge funds come and go for a variety of reasons. Individual mutual funds have more staying power, on the whole.

Hedge funds can use virtually unlimited leverage and hold a large part of their portfolios in illiquid securities those that take more than one day to liquidate in public markets. Mutual funds are limited to: 1) leverage not exceeding 33% of gross asset value; and 2) illiquid holdings not exceeding 15% of assets.

Leading hedge fund indexes, such as those published by HFR and Credit Suisse, contain an upside survivorship bias because poor-performing funds tend to drop out of the indexes over time. Studies have estimated that survivorship bias adds about 1.5% to 2% of annualized return to actual hedge fund performance. Survivorship bias is believed to be a negligible factor in alternative mutual funds.

Keeping these factors in mind, here is the 1-year, 3-year and 5-year performance for Morningstars three largest alternative categories, compared to the most comparable HFRI categories, as of the end of August.