LINN Energy Reshuffles its Portfolio with Devon Energy Deal (DVN LINE LNCO)

Post on: 16 Март, 2015 No Comment

Photo credit: Devon Energy.

LINN Energy ( NASDAQ: LINE ) and LinnCo ( NASDAQ: LNCO ) announced today that LINN Energy has finalized a deal to acquire Devon Energy ‘s ( NYSE: DVN ) noncore U.S. natural-gas assets. The $2.3 billion deal will be funded by the future sale of LINN Energy’s position in the liquids-rich Granite Wash.

Drilling down into the deal

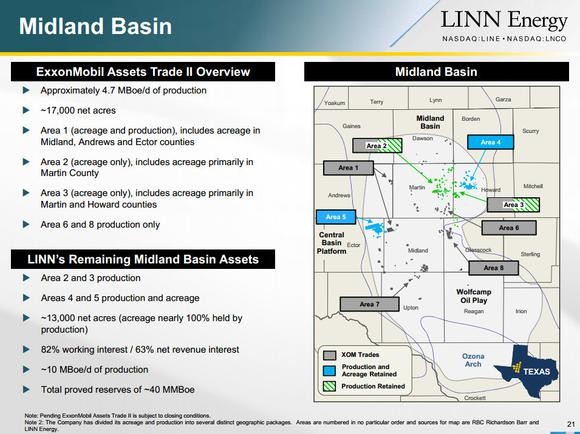

Source: LINN Energy Investor Presentation (link opens a PDF ).

LINN Energy is acquiring more than 3,800 producing oil and gas wells from Devon Energy. Those wells today produce 275 MMcfe/d, of which about 80% is natural gas. The company also sees the potential for 1,000 future drilling locations on the acquired acreage. The current decline rate of these assets is about 14%. While that rate is a little on the high side, it’s not nearly as high as the assets LINN Energy plans to sell to pay for the Devon Energy assets.

Wave goodbye to the Granite Wash

LINN Energy and LinnCo also announced plans to monetize the Granite Wash and Cleveland plays in the Texas Panhandle and Western Oklahoma. This really isn’t a surprise as LINN and LinnCo had already hinted that their position in the Mid-Continent would likely be traded next. However, instead of an outright trade with another operator, LINN Energy is first buying assets, in this case from Devon Energy, and will use the proceeds from a future sale as part of a like-kind exchange to pay for the Devon Energy deal.

Photo credit: LINN Energy.

This position produces 230 MMcfe/d of liquids-rich natural gas, which LINN Energy has grown from 65 MMcfe/d by horizontally drilling 17 different intervals since 2010. LINN Energy had used this position as the growth driver of its portfolio, but it has found the decline rate of these assets were a struggle to overcome. The company constantly needed to invest capital into the play just to maintain the production rate, which has been cutting into the its distributable cash flow. It’s a problem that investors in upsteam MLPs like LINN Energy are increasingly becoming aware of as the culprit in constrained distribution growth .

This is why we have seen LINN Energy make a strategic shift away from higher-decline horizontal properties. In fact, one of the strategic rationales behind the LinnCo-led acquisition of Berry Petroleum’s oil-rich assets last year was to free up LINN Energy from relying on the Granite Wash to supply growth. The deal allowed the company to shift its capital spending away from the Granite Wash and into the newly acquired assets’ lower-decline oil properties. That acquisition, along with the others LINN Energy has completed over the past few months, enables the company to cash in on the value it created from its position in the Granite Wash as it no long needs its high-decline headaches.

Investor takeaway