Leveraged ETFs

Post on: 14 Апрель, 2015 No Comment

Exchange-traded funds (ETFs) have gotten increasingly popular since they were introduced in 1993. Their value is based on a portfolio of investments, often referred to as a basket. In general, the basket consists of different stocks, but may also contain hard commodities, derivatives or other investments. ETFs trade throughout the day just like a stock and their value will fluctuate throughout the trading session.

Lately specific types of ETFs – leveraged and inverse ETFs – have exploded in popularity among individual investors. Leveraged ETFs aim to provide a multiple of returns on a given index. As the name implies, “inverse” ETFs try to go up when the market drops and vice versa.

It’s an interesting concept, but one that’s prone to misconceptions – and investors can be seriously burnt as a result. If you trade leveraged or inverse ETFs, it’s important to be sure you fully understand what you’re trading.

Leveraged ETFs: typically built for day traders

Leveraged ETFs often have multiples like “2x” or “3x” or “ultra” in their names. That just means the ETF aims to deliver two or three times the return on its stated index.

In other words, a “2x Russell 2000 Index” ETF is trying to deliver twice the return of the Russell 2000 Small Cap Index. If you’re counting on a market rally, you might be attracted to these ETFs to capitalize on a market increase with limited cash down.

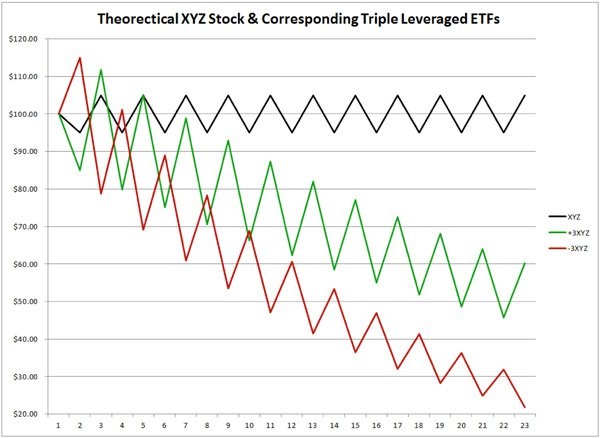

Here’s the wrinkle many investors don’t understand: Leveraged ETFs try to deliver the multiple on the index return on a daily basis. If you hold leveraged ETFs for more than one day, you may not get the multiple of the index return you’re expecting, even if your forecast is correct. In fact, you can end up with a loss – not at all what you might expect. You can blame a concept called “beta slippage” for this; it’s an effect of compounding that impacts leveraged ETFs held longer than one day.

How leveraged ETFs can spin out of control

Imagine you’re trading a 2x leveraged ETF that promises twice the return of XYZ index. You buy 1 share of the ETF for $100, and the underlying index is at 10,000.

If XYZ index shoots up 10% the next day to 11,000, your leveraged ETF would increase 20%, to $120. If, however, the index drops from 11,000 back down to 10,000 the following day, that’s a 9.09% decline. Your leveraged ETF would go down twice this amount, or 18.18%.

A decline of 18.18% from the $120 leveraged ETF price would leave you with a share worth $98.18. The index wound up right where it started — but your ETF would be down 1.82%!

Why does this happen? Most leveraged ETFs rebalance their assets daily with an eye towards delivering the multiple of the index’s returns only on that day. The holding period of your trade is not taken in to account, so your return may be quite different.

If the index keeps moving in the same direction every single day, this does result in better-than-expected returns for the longer period. But any reversals in the index’s direction render a leveraged ETF worse off than you’d expect based on its multiple. It only takes one reversal day for this effect to kick in.

As you can see, leveraged ETFs have an additional layer of complexity. If you decide to hold a leveraged ETF for longer than one day, be sure to check your holdings daily, at a bare minimum, to see that their value is in line with your expectations. If you decide to use this ETF for an intra-day trade, be sure to factor in commission costs when assessing the risks. The more frequently you trade, the more commission costs you will incur. Of course, keep in mind that any use of leverage increases your risk exposure and can lead to greater losses.

Inverse ETFs: still tricky, but upside down

Inverse or “short” ETFs have a similar compounding problem. An inverse fund tries to deliver returns that are the opposite of the index’s returns. That is, if the index goes up 1%, then the inverse ETF should go down 1%, and vice versa. “Bear market” funds in this category were attractive to lots of investors during the 2008-09 market downturn.

Take our previous example of XYZ index, but in the opposite direction. You buy 1 share of the inverse ETF for $100, and the underlying index is at 10,000.

If the index falls from 10,000 to 9,000 in one day, a decline of 10%, then an inverse ETF purchased for $100 will rise to $110 – an increase of 10%. So far, so good. If the index then climbs from 9,000 back up to 10,000 on the next day, this is an increase of 11.11%. The ETF will fall by 11.11%, from $110 down to $97.78, resulting in a loss.

Even though the index finished where it started, the inverse ETF performs worse than expected because of the daily rebalancing.

Just like “long” leveraged ETFs, inverse funds do provide better-than-expected returns if the index moves only in one direction – but even one reversal in direction will throw a wrench in the works. If you decide to hold an inverse ETF for longer than one day, make sure you monitor your holdings each day, at a minimum. If you decide to hold an inverse ETF as an intra-day position, be mindful of commission costs when evaluating these opportunities. The more frequently you trade, the more commission costs you will incur.

Inverse + leveraged ETFs = double trouble

If an ETF is both inverse and leveraged, this problem gets worse if the ETF is held longer than one day. If you’re looking for leveraged inverse exposure for longer than a day, you may be better off using other strategies to achieve this. Again, keep in mind that additional leverage will have costs and magnified risks.

Still a doubter? Check out the numbers.

The following table compares S&P 500® index returns from January through June 2009 to the returns of a 2x leveraged ETF, a -1x inverse ETF, and a -2x leveraged inverse ETF, all based on that index.

The S&P 500 was up 3.163% for that period. If you didn’t know any better, you might assume a typical 2x leveraged fund would return 6.33%, a -1x inverse fund -3.16% and a -2x leveraged inverse fund -6.33%. But that simple math ignores the compounding effect described above.

All three funds performed a lot worse than you might have expected due to the problem of compounding (fund expenses were a minor factor here, too). Amazingly, all three funds had negative returns, even though the index itself rose!

Stay alert, stay informed

For some advanced traders, there may be occasions where a leveraged or inverse ETF comes in handy for a day trade – but it’s crucial to understand that these funds aren’t designed for holding periods longer than one day. You may be unpleasantly surprised if you do hold them longer.

At least one provider of leveraged and inverse ETFs has announced plans to change its methodology so that its ETFs will rebalance monthly, rather than daily. This will likely reduce the compounding problem, but it’ll remain an issue for anyone holding the funds longer than a month. If you buy or sell at any time other than the beginning or end of a month, you also stand to be burnt by this compounding issue. Proceed with extreme caution.

In conclusion…

Leveraged and inverse ETFs have proven to be especially tricky. Hopefully now you have a better understanding of how these investments work and the pitfalls you may encounter when trading them. If you hold these investments for longer than one day, be sure to check your portfolio no less than everyday. If you decide not to hold these ETFs overnight, keep in mind that your commission costs will increase in-step with increased trading frequency. Although popular, the performance of these exchange-traded funds (ETFs) can yield unexpected results, which may be far worse than anticipated. As always it’s important to fully understand the risks and opportunities of what you are trading before committing your hard-earned capital.