Leverage Your Returns With A Convertible Hedge

Post on: 24 Июнь, 2015 No Comment

When interest rates are low, many investors unwisely turn to higher-risk bonds, to ensure a healthy income stream. Fortunately, there’s a much safer strategy available to boost income yields: the convertible hedge.

What is a convertible hedge? Essentially, it’s a strategy that employs the purchase of a convertible bond and the short sale of the underlying common shares, to produce a higher yield on the bond itself. This article will give you a basic background in how a convertible hedge works and what issues to keep an eye on, when attempting this strategy.

Introducing the Convertible Hedge

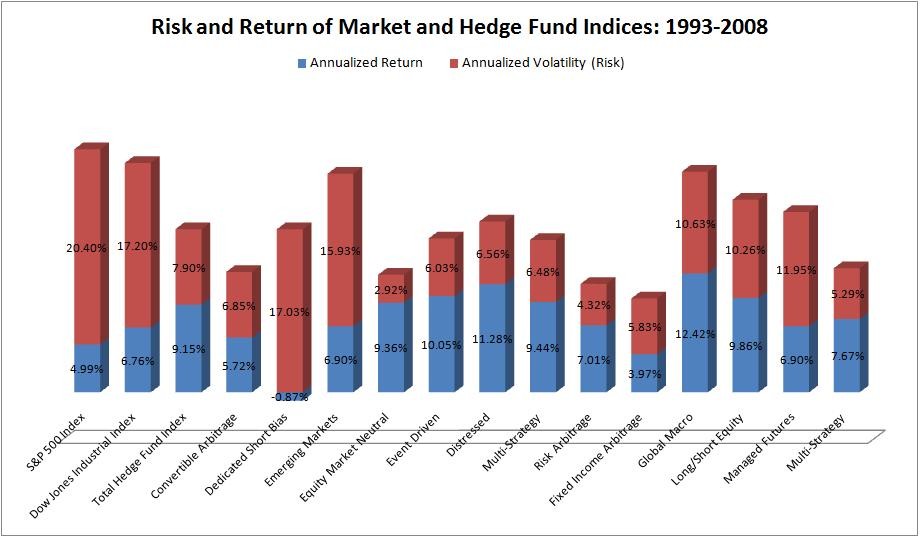

The beauty of the convertible hedge is that it is market neutral ; it pays a high yield regardless of what the rest of the market or your particular portfolio is doing. That makes it very popular among hedge fund managers and other investment professionals. (To learn more about these types of bonds, read Convertible Bonds: An Introduction .)

Let’s see how it works in theory.

- Interest rate: 6.5% per annum, paid semi-annually

- Conversion ratio: 25

- Call dates: August 10, 2028, 2029, 2030… 2038

- At the time of the bond’s issuance, ABC common stock sells for $23 per share.

The interest rate indicates the semi-annual interest earned on the bond; $65 for each $1,000 worth of bonds purchased ($32.50 each, Aug. 10 and Feb.10), just like a regular bond. The conversion ratio indicates the number of underlying shares of ABC common stock that the convertible can be exchanged for, in this case 25 shares. The call date tells the purchaser when the bond can be forcibly called in by the ABC company, for fair exchange of either cash and paid-up interest or shares. Every convertible’s call provision will be unique.

Creating the Hedge

Using the above example, imagine you create your convertible hedge by buying 10 convertible bonds ($1,000 face value each) from ABC, at a cost of $10,000. You are then entitled to exchange these bonds at any time for 250 shares of ABC common stock (25 shares for each $1,000 bond you purchase). Therefore, you can now short sell an equal number of ABC common stocks, creating, in effect, a net zero holding of shares (i.e. 250 shares in the convertible bond and 250 shares short). Your short sale would net you 250 x $23/share, or $5750. Therefore, your total cost for the bonds would be $10,000 less $5,750, or $4,250.

Now, here’s where things get exciting: if you’re earning 6.5% ($650) on $10,000 worth of bonds that you only paid $4,250 for, your real rate of return is not 6.5%, it’s 15.3%. Keep in mind, however, that any margin requirement put in force by a broker will reduce this rate of return. The difference in compounded return between these two rates is staggering: $5,822 versus $8,660, over five years. The convertible hedge more than doubles your original investment of $4,250.

Buyer Beware

Remember that the example above is a simplified version of how the convertible hedge works. In practice, there are a number of issues that have to be examined closely prior to setting up the hedge.

1. Is the bond convertible immediately? In some cases the issuer will set a date in the future, only after which can the bond be converted to common stock. Others will allow conversion only during a period of, say, three months out of every year. This will not make it impossible to create the hedge; you’ll just have to speak with your broker regarding any other potential cash or margin requirements that will be needed during the non-conversion periods. In most cases, a Treasury bill (T-bill) or other money market holding should be sufficient. (Find out what margin is, how margin calls work, the advantages of leverage and why using margin can be risky in our Margin Trading tutorial.)

2. Are there shares available to short sell? If your broker has them, what will the borrowing fee be? This can vary depending on the availability and volatility of the stock and can range from as low as 0.5% up to 50% a year!

3. Check the call features. Be sure to check any special call features in the prospectus. to ensure that investors are adequately compensated for an early return of the bond. (Learn more in Bond Call Features: Don’t Get Caught Off Guard .)

4. Be aware of dividends. Remember, all shorted stock that pays a dividend is the liability of the short seller.This must be worked into the equation of the final return or, preferably, avoided altogether (i.e. pick an issuer with non dividend -paying stock).

5. Do your due diligence. Know that companies issuing convertible debt are not always the most reliable players on the block. Check a company’s credit rating and, better still, see if there’s a bond rating on the convertible bond itself.

It may seem daunting at first, but most convertible bond prospectuses are very straightforward. With your broker’s assistance, it’s easy to get started.

The Bottom Line

Finally, there will be some paperwork required of you from your brokerage, nothing onerous, usually just a single page outlining the types of issues we’ve described above. It’s a wonder more investors don’t create hedges and more brokers don’t recommend them. The numbers alone speak to the power of the strategy. Though it does require some homework, the benefits clearly make it worthwhile. Do the homework, diversify and be prudent, and you’ll significantly enhance your returns in all market environments.