Lend Your Money Turn a Profit

Post on: 5 Май, 2015 No Comment

Lend Your Money, Turn a Profit

By: BankingMyWay.com Staff

Your bank profits off money sitting in your savings account by lending it out at a higher rate than it returns to you.

So why not eliminate the middleman and lend your money to others yourself? That’s the proposition offered by financial Web sites ranging from Prosper.com and LendingClub.com to Zopa.com, which launched its U.S. site last week.

Though their models vary slightly, these social-lending sites aim to connect borrowers and lenders outside of traditional financial institutions.

The benefit? Both borrowers and lenders can get better rates than they might obtain from a bank, while the Web site makes money off of transaction fees.

Here’s how these sites generally work: A borrower posts a request for a loan, providing both the amount and the interest rate he’s seeking. Borrowers at LendingClub, for example, typically seek $5,000 to $7,000, most frequently to pay down credit-card debt.

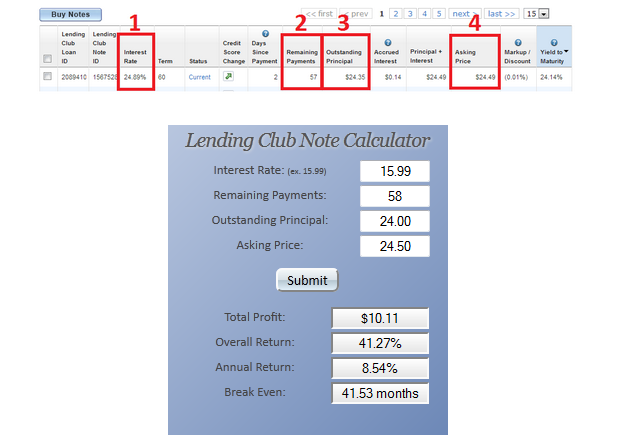

A lender, meanwhile, decides how much money she has to offer and what interest rate she will accept. The site then offers what amounts to an online marketplace, where the lender can view various loan requests and decide which to accept.

A New Asset Class?

Once loans are made, the borrowers have the cash to pay down a debt or spring for that wedding. The lender, meanwhile, has a shot at a handsome return. LendingClub, for example, boasts an average return of 12.32% since May, when it launched on Facebook. (Facebook membership is no longer required in order to participate.)

Eric DiBenedetto, a professional angel investor in the San Francisco Bay area, invested several thousand dollars with LendingClub on the day of its launch. To date, DiBenedetto has achieved returns of 12% to 14%.

Originally I did it as an experiment, he says. But it’s become a growing piece of my portfolio. It’s a great place to park some of my cash. And in this age of volatility, if I keep getting these returns I may actually move some of the money I have in equities over to these loans.

Renaud Laplanche, CEO of LendingClub, says that so-called person-to-person lending — the industry is still hunting for the right moniker — is an entirely new asset class that deserves its own place in a diversified portfolio. With this model, you get exposure to a kind of investment that you typically can’t access as an individual, says Laplanche. It also has less volatility than the stock market.

Microlending isn’t without risk to the lender. That said, each lender’s cash is typically spread out across multiple loans, to reduce the impact of any single default. Borrower profiles on LendingClub and Prosper.com include the borrower’s credit score (or a rating derived from the credit score) and debt-to-income ratio. Borrowers who don’t pay face dunning by collection agencies — and notice of nonpayment is posted to their credit report.

While the model is in its infancy, the safeguards seem to be working so far. LendingClub has originated $2.9 million in loans spread across the 425 loans since May, and late payments represent just 0.08% of the portfolio. Prosper.com says it has originated more than $100 million in loans since its 2006 launch, with a default rate of 3%.

The Philanthropic Route

But not all the social-finance sites focus so directly on the opportunity to boost returns. While that’s the model Zopa.com, a British company, uses for its U.K. and Italian sites, CEO Douglas Dolton says for the company’s U.S. launch it wanted to do something aimed at Americans’ philanthropic tendencies.

So at Zopa’s new U.S. site, a borrower receives his loan directly from one of the credit unions with which Zopa is affiliated, and investors — not lenders — buy certificates of deposit, currently yielding 5.1%, directly from the same credit unions. Like other CDs, the Zopa CDs are FDIC-insured and penalize early withdrawals.

Here’s what’s different: Every investor must contribute at least 10 basis points (a basis point is one-hundredth of a percentage point) of her return to a borrower. The funds go directly to a borrower’s loan payment, thus reducing the amount for which he is personally responsible.

The idea behind this approach is that investors will accept slightly lower returns in exchange for the knowledge that their money is helping out aspiring entrepreneurs and people who are mired in expensive credit-card debt.

We’re tapping into the desire of Americans to help people, says Dolton This is not a speculative environment; the investor gets a really spectacular return on a fully insured, very liquid CD. And without doing anything he’s helping a borrower.

Apart from conventional safeguards for lenders, both Zopa and LendingClub hope that the personal nature of these transactions will reduce lenders’ risk because borrowers tend to be more accountable to individual lenders than to faceless financial institutions.

This is like Facebook and MySpace meeting social finance, Dolton says.

For more ways to save, spend, invest and borrow. visit MainStreet.com.