Know more about The Interbank Market

Post on: 25 Август, 2015 No Comment

Posted by Alfrick on December 5, 2013

The top-level foreign exchange market where financial institutions exchange currencies is called the interbank market.

Banks, excluding minor parties and those owned by retail investors, are required to report their dealerships.

Whether these groups deal with each other directly or use electronic brokering platforms, all their transactions must be made in the higher court for security.

Three Interbank Market Constituents

With the interbank market being an important part of foreign exchange, three segments have been formed. This is a solution to investors previously addressing their concerns regarding the market to a general committee.

As there are a lot of parties with daily businesses, individual accommodations sometimes take time. With elemental sectors, they may receive the clarifications they need faster.

The forward market is a highly-organized informal place where future contracts are entered. Transactions made between two investors are standardized and have low default chances.

Also referred to as the cash market, the spot market is the one where public concerns are discussed. Most who expect instant results approach this governing body because here, commodities are exchanged for immediate deliveries.

Abbreviation of Society for Worldwide Interbank Financial Telecommunication, the SWIFT market is a network provider that permits worldwide financial institutions to exchange information. Any issue regarding the activities of two parties is discussed here.

The Open Market

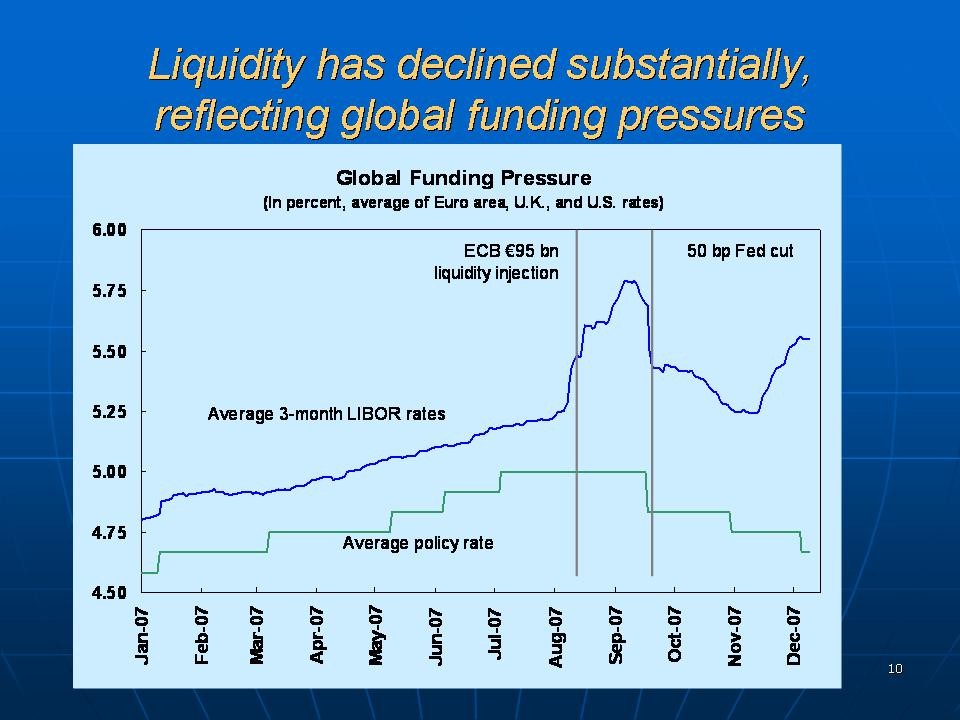

In the interbank market, operations that involve repurchase agreements where one country’s central bank either buys or sells government-owned bonds for a specified maturity are forwarded to foreign authorities. Through this, the amount of liquidity may be controlled.

It is important to manage the flow of exchanges as it is sensitive to some conditions. Especially in the absence of funding, the options investors are likely to choose are those that present fewer risks.

Overnight Trades

Overnight trades’ rates are the actual rates of transactions in the interbank market. This is in contrast to the target rate as required by the central bank. In cases of financial crises, prices are prone to massive volatility and though they create opportunities for investors, they also invite major dangers.

Based on data given by banks, the average of libor rates may be calculated. Despite a country’s central bank having control of the conditions in the interbank market, stocks with longer maturities are not easy for it to manipulate.

Because of libor values, rates only exist for up to a year. The length covers benchmarking purposes and contrary to assumptions, they are not representations of actual lending institutions. Instead, they merely indicate the difficulties that may be encountered in further pursuits.

With the interbank market being the principal venue for foreign exchange, it is recommended for investors, beginners and advanced parties alike, to consult with an established financial institution.

This allows them to track records while ensuring that every activity is processed securely.