Know fund flow & money flow concepts investment basics

Post on: 10 Август, 2015 No Comment

The price movements of assets, whether financial assets or physical assets, are all driven by fund flow or simply cash flow. One investment basics that we should know is the underlying meaning of price, demand and supply. Fund flow / cash flow / money flow are important investment basics that we should master.

John, one of our clients, came and made a comment, You mention that fund flow is an important concept in the context of investment. I do not see the relationship between fund flow and price. What is this about?

Well, if you are unable to comprehend this cash flow fundamentals, I suggest that you should hold up your investment activities for the time being, John. Let me ask you this. What do you mean when you want to buy or demand for, say, one share of Microsoft?

Simple, this means I want to buy Microsoft at a price. now costing me about $28.

John, what do you do exactly when you buy this one share?

I write a check of $28 plus commission and duty to my broker. Someone with Microsoft stock sells me his one share.

This is perfectly correct. This means that you must have cash (or fund) to exchange for the stock. Of course you buy Microsoft at $28 because you expect that someone is willing to pay you more than $28, say $40 to exchange for your stock. Right? Now assuming that there are only 10 people each having one Microsoft share, you now join in to become one of the 10 people (seller to you is replaced by you) to own one Microsoft share each.

Maybe we can predict what will happen if there is:

- Only one person (11th buyer) with $1000 and willing to pay for one share of Microsoft at $40 — share price will rise to $40 for all the 10 shares when one person wants to sell his stock.

- Another person (12th buyer) with $1000 and willing to pay for one share of Microsoft at $15 only — either share price remain at $40 if all 10 people is not willing to sell or share price will drop to $15 if one of them is willing to sell. The latter case will likely to happen since there is only one buyer in the market.

- One big boss (13th buyer) having $10,000 cash on hand with no investment opportunity. He is having a wait and see attitude. He is looking for a chance to buy all 10 shares at a price between $15 and $40.

Please note that:

- You need to know if there is money in the hands of buyers (condition 1) and at the same time willing to buy at a higher price (condition 2) to justify your investment.

- If the 11th buyer does not buy from you. You gain $12 on paper for a while and eventually lose $13 on paper when the 12th buyer completes his transaction. The number of buyers, in this case, determine the liquidity of the Microsoft share in this case.

- Stock market is an incremental concept. The incremental (or last) transaction will determine the stock market price.

- The spike in price is because one buyer (11th buyer) willing to pay for $40. If there is no more buyer (drying up cash). The market will, at the beginning, drop in transaction (or volume) until some share-owner is willing to sell at a lower price ($15 say) in exchange for his share for money. The price will then turn South if the 12th buyer or 13th buyer find his seller below $40.

In summary, please observe the following messages:

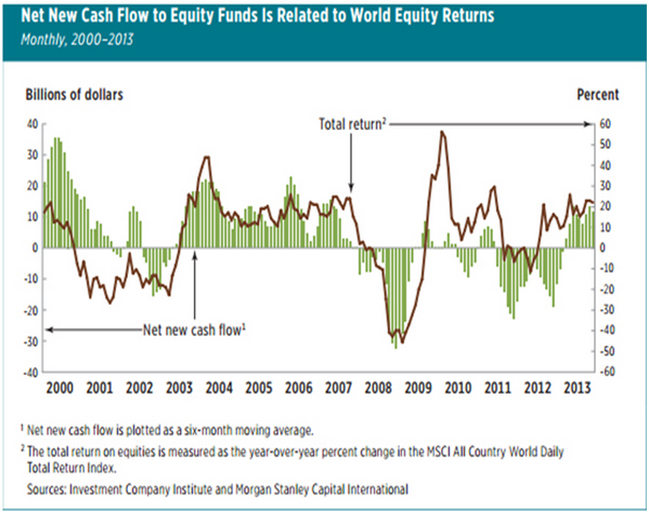

- The most important condition to buy is that you should assess whether there is more money than stock and that there is incremental cash inflow into the stock market. Whereas the condition to sell is that you should assess whether there is more stock than money and that there is incremental cash outflow from the stock market. Therefore, this boils down to the fact that all professionals are looking at money flow rather than the abstract demand and supply.

- One point to note is that the stock market will not be affected by the existence of the 13th buyer. Just like those analysts who talk about the prosperous future of Microsoft but never put in their money to buy. In worse case, they tell you after accumulating shares, and sell to you afterwards at a higher price. This is the famous “buy on rumor and sell on fact”. Talking cannot fuel the market, only cash flow can. Investment division can move the market, research division cannot.

- The 13th buyer can be said to be a ‘potential’ buyer and yet if another opportunity (say China mobile’s share) arise to compete for the $10,000, the demand is no longer there for your share. Hence the trend is where the money or cash flows.