Kingdom Trust Company

Post on: 16 Март, 2015 No Comment

What is a private company/private equity investment?

In terms of an investment option, a Private Equity IRA consists of an investment in the securities of a company whose securities are not publicly traded on a stock exchange. The purchase of the securities represents an ownership interest in the company issuing the shares. These shares are typically made available to a limited number of investors through a private offering. A huge majority of people and companies raising money are unaware that you can use an IRA to invest in private equity.

A self-directed IRA owner can choose a company he or she would like to invest in and, after agreeing to terms, direct a custodian like Kingdom Trust to send money from his or her account to complete the investment.

Why is this such a popular investment in a self-directed IRA? Opportunity and information. There is now much more of an entrepreneurial spirit than in generations past, and information about businesses, industries and product offerings is more accessible than ever:

- new businesses are created due to layoffs or downsizing;

- other businesses decide to improve their infrastructure or release new product offerings;

- still other businesses want to raise capital to expand their businesses through merger or acquisition.

The common thread is the need to raise capital for operations, equipment, land, buildings, etc. For larger companies, this might mean a full-fledged public stock offering on Wall Street. For potential private company/private equity investments, you may want to consider companies on Main Street–people you may know and already do business with.

For most privately-held companies, the need is small enough that a loan might be all that is required. Some businesses will get their loans through a bank, but what about those companies that don’t qualify for bank loans or choose not to tie themselves to bank requirements? Where do these companies find the money to get started or to expand? Or maybe a company is doing a stock offering to expand its operations. This could be a good time to get in on a growing company with limitless upside potential.

What types of private company investments can I make with a MyRA self-directed retirement account?

Private company investments may be made in a number of different types of companies. Those usually include

- C corporations

- limited liability companies

- limited partnerships

- joint ventures

Keep in mind that these investments can be made in existing companies as well as startup enterprises. Also remember that Kingdom Trust cannot promote or endorse any specific investment.

What are some benefits to investing in private companies?

One of the greatest benefits of a self-directed IRA is that you can invest in what you know or are interested in. Therefore, your Private Equity IRA can invest in a specific private company or industry you are interested in or maybe one that has a product you would like to get behind.

You can also buy, sell, and exchange private equity through your self-directed IRA without tax consequences. There are also no public disclosure laws associated with private equity.

Perhaps most important to the individual investor, your IRA could potentially make money from a private equity investment in multiple ways. This could be based upon the private companys performance, from any sale of IRA ownership or through the sale of the private company itself.

Who does due diligence on the investment?

No one can promise that a private equity investment will yield returns of Microsoft proportions, but investing in startups or expanding/growing companies can pay big dividends. However, it can also be risky, which is why you need to do your homework.

Make sure you vet the company and its principals, perform any type of competition analysis and background check, and consult with your investment, tax, and legal advisors prior to committing your retirement dollars. These investments are self-directed, and Kingdom Trust does not perform an investment review to determine suitability or soundness.

What are some limitations to what I can invest in with a Private Equity IRA?

In most cases, neither you nor any disqualified persons can be employed by the private company your IRA has invested in. Learn more about prohibited transactions to know who can and cannot be involved in the private company.

Also, your IRA cannot purchase private stock you already own, and it cannot invest in an S Corporation.

How do I get started?

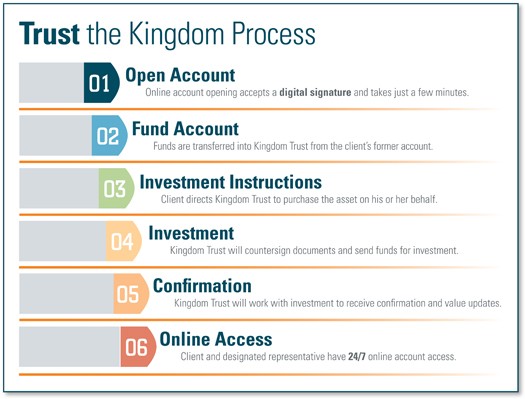

First you will need a self-directed retirement account, like the MyRA offered here at The Kingdom Trust Company. You can complete one of the forms below (depending on the type of retirement account you are interested in) or you can open a MyRA account online .

If you need assistance with getting started, give us a call at 888-753-MyRA (6972) and we will discuss the investment with you.