Key Principles of Budget of Effective Budgetin Important Areas in

Post on: 24 Август, 2015 No Comment

Key Principles of Budgets. 5 Characteristics of Effective Budgeting. Five Important Areas in Budgeting.

A budget is defined as the formal expression of plans, goals, and objectives of management that covers all aspects of operations for a designated time period. The budget is a tool providing targets and direction. Budgets provide control over the immediate environment, help to master the financial aspects of the job and department, and solve problems before they occur. Budgets focus on the importance of evaluating alternative actions before decisions actually are implemented.

A budget is a financial plan to control future operations and results. It is expressed in numbers, such as dollars, units, pounds, hours, manpower, and so on. It is needed to operate effectively and efficiently. Budgeting, when used effectively, is a technique resulting in systematic, productive management. Budgeting facilitates control and communication and also provides motivation to employees.

Budgeting allocates funds to achieve desired outcomes. A budget may span any period of time. It may be short term (one year or less, which is usually the case), intermediate term (two to three years), or long term (three years or more). Short-term budgets provide greater detail and specifics. Intermediate budgets examine the projects the company currently is undertaking and start the programs necessary to achieve long-term objectives. long-term plans are very broad and may be translated into short-term plans. The budget period varies according to its objectives, use, and the dependability of the data used to prepare it. The budget period is contingent on business risk, sales and operating stability, production methods, and length of the processing cycle.

There is a definite relationship between long-range planning and short-term business plans. The ability to meet near-term budget goals will move the business in the direction of accomplishing long-term objectives. Budgeting is done for the company as a whole, as well as for its component segments including divisions, departments, products, projects, services, manpower, and geographic areas.

Budgets aid decision making, measurement, and coordination of the efforts of the various groups within the entity. Budgets highlight the interaction of each business segment to the whole organization. For example, budgets are prepared for units within a department, such as product lines; for the department itself; for the division, which consists of a number of departments; and for the company.

Master (comprehensive) budgeting is a complete expression of the planning operations of the company for a specific period. It is involved with both manufacturing and nonmanufacturing activities. Budgets should set priorities within the organization. They may be in the form of a plan, project, or strategy. Budgets consider external factors, such as market trends, economic conditions, and the like. The budget should list assumptions, targeted objectives, and agenda before number crunching begins.

The first step in creating a budget is to determine the overall or strategic goals and strategies of the business, which are then translated into specific long-term goals, annual budgets, and operating plans. Corporate goals include earnings growth, cost minimization, sales, production volume, return on investment, and product or service quality. The budget requires the analysis and study of historical information, current trends, and industry norms. Budgets may be prepared of expected revenue, costs, profits, cash flow, production purchases, net worth, and so on. Budgets should be prepared for all major areas of the business.

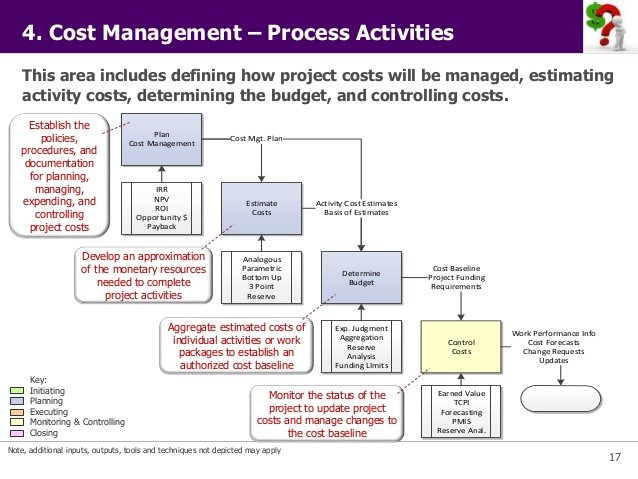

The techniques and details of preparing, reviewing, and approving budgets varies among companies. The process should be tailored to each entitys individual needs. Five important areas in budgeting are planning, coordinating, directing, analyzing, and controlling. The longer the budgeting period, the less reliable are the estimates.

Budgets link the nonfinancial plans and controls that constitute daily managerial operations with the corresponding plans and controls designed to accomplish satisfactory earnings and financial position.

Effective budgeting requires the existence of:

- Predictive ability

- Clear channels of communication, authority, and responsibility

- Accounting-generated accurate, reliable, and timely information

- Compatibility and understandability of information

- Support at all levels of the organization: upper, middle, and lower

The budget should be reviewed by a group so that there is a broad knowledge base. Budget figures should be honest to ensure trust between the parties. At the corporate level, the budget examines sales and production to estimate corporate earnings and cash flow. At the department level, the budget examines the effect of work output on costs. A departmental budget shows resources available, when and how they will be used, and expected accomplishments.

Budgets are useful tools in allocating resources (e.g. machinery, employees), making staff changes, scheduling production, and operating the business. Budgets help keep expenditures within defined limits. Consideration should be given to alternative methods of operations.

Budgets are by departments and responsibility centers. They should reflect the goals and objectives of each department through all levels of the organization. Budgeting aids all departmental areas including management, marketing, personnel, engineering, production, distribution, and facilities.

In budgeting, consideration should be given to the companys manpower and production scheduling, labor relations, pricing, resources, new product introduction and development, raw material cycles, technological trends, inventory levels, turnover rate, product or service obsolescence, reliability of input data, stability of market or industry, seasonality, financing needs, and marketing and advertising. Consideration should also be given to the economy, politics, competition, changing consumer base and taste, and market share.

Budgets should be understandable and attainable. Flexibility and innovation is needed to allow for unexpected contingencies. Flexibility is aided by variable budgets, supplemental budgets, authorized variances, and review and revision. Budgets should be computerized to aid what-if analysis. Budgeting enhances flexibility through the planning process because alternative courses of action are considered in advance rather than forcing less-informed decisions to be made on the spot. As one factor changes, other factors within the budget will also change. Internal factors are controllable by the company whereas external factors usually cannot be controlled. Internal factors include risk and product innovation.