Just How Risky Is Dividend Growth Investing

Post on: 2 Июль, 2015 No Comment

Summary

- A recent article questioned the DG community’s awareness of valuation risk.

- Consistently poorly timed investment decisions will affect your performance, no matter how you invest.

- Quantitative micro and macro risks involved with dividend growth investing.

- Some thoughts on international diversification.

- Manage risk, but don’t obsess over it.

In his recent article. Ian Bezek posited that there’s more inherent risk than meets the eye in dividend growth investing. While I believe he makes some fair points throughout the piece, I think his article would have been better titled, Why Valuation And Diversification Matter In Portfolio Management.

His critique takes the view that a large contingent of DGIers are too focused on a set of stocks with high P/E ratios that are likely destined to underperform the market. He identifies Colgate (NYSE:CL ), a stock I own, Procter & Gamble (NYSE:PG ), and General Mills (NYSE:GIS ) as some of the consumer non-durable pack that are destined for forward not-so-greatness.

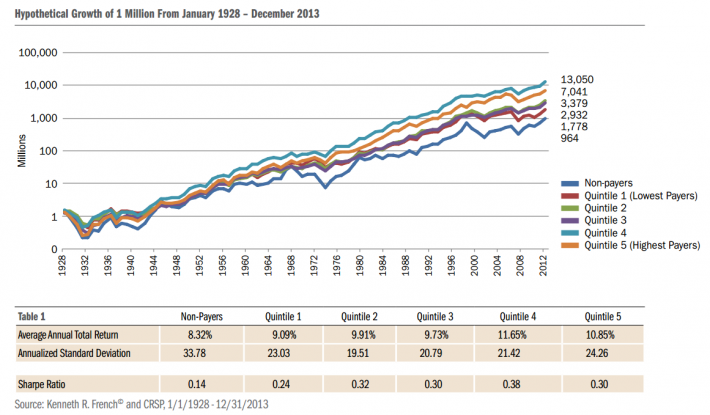

And I agree with him that those stocks are richly valued, and in my opinion not currently worthy of capital allocation. Those who read me know that I’ve been cautious on this group for some time. Yet, I’ve also pointed out reasons that investors have pushed these valuations higher and why holding them might continue to make sense. Whether you think valuations are fair today or not, moving assets into dividend payers over the past half-decade has been a wise total return decision.

Mr. Bezek seems to make the assumption, however, that Seeking Alpha DG faithful are aggressively purchasing the priciest of these stocks today. And many of them may be. However, from the extensive reading I’ve done of many DG authors and those that frequent the halls of SA, I would opine that many, perhaps most, are simply holding or perhaps reinvesting dividends — and not aggressively allocating capital. I would say it’s fairly rare nowadays that I read an article or a post that promotes table pounding buy advice or claims solid, near-term value in consumer products or garden variety large-cap dividend stocks.

It would appear to me that most proponents of Coke (NYSE:KO ), etc. are well aware of this now six-year unabated run, yet are comfortable for one reason or another holding their positions. Many investors may have owned stocks for several decades, through many market cycles and are content with the waxing and waning of price.

In reality, price is really not a risk to a dividend growth purist looking for a rising income stream once they own a stock. Valuation IS a risk when you allocate capital, which is certainly the point that Mr. Bezek is trying to make, although that’s a universal risk, not just one applicable to dividend growth stocks.

Dividend growth purists like to make the point with me that a declining stock price is actually beneficial, since you can buy more income at the lower price. However, if you’ve purchased the same asset at a higher price and with lower attached income, you’re not making the most of your income dollar. You’re suffering from opportunity cost, which I would identify as a micro-risk of dividend growth investing.

If you make too many poorly timed capital allocations to your portfolio, your overall performance, whether measured by total income received or by total return, will suffer.

On a more general level, investment in large-cap dividend growth stocks may be viewed as somewhat less risky due to the huge economic moats many of these companies possess and the low probability of complete failure. However, as we well know, given the demises or difficulties of former market leaders like Eastman Kodak, Bethlehem Steel, General Motors, and J.C. Penney, there’s no telling what may happen over the long term. So nothing should ever be taken for granted. It is one of the reasons I discourage a forever mentality by equity holders.

On a more quantitative level, dividend growth investors should be looking to take proactive steps to eliminate stocks from portfolios that are showing signs of secular business decline. While that may be certainly easier said than done, some risks to a growing income stream can be quantitatively identified and may include any of the following:

- Slowing earnings or revenue growth

- Slower dividend growth

- Serial dividend increases in excess of EPS, FCF, or other measured distribution growth resulting in a rapidly elevated or historically high payout ratio

- Credit downgrades

A dividend growth investor, somewhat by definition, may be paying more attention to the income stream than necessarily to microanalyzing the business. And that alone could represent a risk unto itself. A company that is obviously misallocating capital, including one that is misallocating the dividend, is one an investor needs to seriously contemplate commitment to.

On a more macro level, if interest rates and risk-free yield rises, I think that poses a threat to dividend stock valuations. However, I would suspect that would be a slow process, so long as we don’t see a 1994 interest rate scenario (300 basis point rise) anytime soon. A rapid rise in rates, depending on the reason for one, could be a universally negative event, again not just impacting dividend growth stocks.

Like Mr. Bezek, I have concerns over the near-term headwinds facing many multinationals, including their valuations, forex, and payout ratios. Unlike him, however, I don’t think you necessarily need overseas exposure. There may be more quantitative value today elsewhere, but sometimes you get what you pay for. Though we sometimes criticize our education system and how we are falling behind the intelligence of other corners of the world, the most innovative, and profitable, of companies on a consistent basis are born domestically. And our overall economic vibrancy, although compromised at times, and certainly not perfect, is still, in my opinion, second to none.

Wal-Mart, Microsoft, and Apple weren’t founded in Paris, Tokyo, or Shanghai; they were founded in Arkansas, Washington, and California. And though our politicians don’t always seem to get along, decorum is generally a bit more refined than what we often see abroad.

While you could buy Bancolombia (NYSE:CIB ) at a cheaper multiple than PNC Financial Services (NYSE:PNC ), I have a sneaky suspicion you’ll do better with PNC over the next decade. Further, you don’t likely have to worry about a drug cartel laundering money through your regional bank branch.

I would argue that there is always value in the domestic market, although in times such as these, it becomes incrementally more difficult to discover it, or have the gumption to buy into it.

Conclusion

There is no equity strategy that comes without risk. Unlike other assets that carry insurance or other stated guarantees, when you buy a stock without some sort of hedge, your capital or assumed cash flow stream is perpetually at risk. So while I agree with Mr. Bezek that there may be certain stocks that are priced perhaps more to perfection in the current market, I’m not sure that comes as a total shock to many, perhaps even most, dividend growth investors.

Those who assume more risk than they should usually find out when a sharp sell off or black swan economic event occurs. This usually ends up having them sell shares at the worst possible of times.

Finally, many dividend growth investors, who may now be near- or in-retirement or otherwise in the twilight of their lives, may give two diddlies about capital fluctuation or valuation so long as a durable income stream exists that enables comfort and a good night’s sleep. In the end I suppose dividend growth investing is as risky as you make it out to be.

Disclosure: The author is long CL, PNC. (More. ) The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it (other than from Seeking Alpha). The author has no business relationship with any company whose stock is mentioned in this article.