June 2012 Stock Market Comment Looking for Undervalued Stocks!

Post on: 5 Июль, 2015 No Comment

Posted by martinwo on May 29, 2012

The old adage Sell in May and Go away was confirmed this year 2012. See last month stock market comment. Our KLCI market is down a paltry -2-3%. This correction has been very minor and remember the market cannot go higher in a straight line. The market has to correct and so it did for May 2012.

Typically, an average correction wud be -7-8%, our KLCi wud sell off to 1496-1500. Shud the KLCI market goes to this level, there will be blood in the street. As an investor, one must be ready to see this as an opportunity .

What is this investment adage all about ?

The sell in May and go away strategy simply says that investors/traders can earn better returns by investing in stocks during the best six months of a year (from November to April) and then selling the stocks in May and switch out for the worst six months (from May till October).

If you read May 2012 Stock Market Comments, theres lot of pickings for high quality dividend and companies during these down months that is why I have kept my powder dry, ready to re-load.

I believe our market is supported and there were invisible hand to prop the market above 1530 support level. Remember what was the closing level for 31 Dec 2011. Yes, it is this special number @ 1538.

We believe this level wud be tested again in the 2nd half 2012. (Pay notice when the market break below this support level. )

Having said that, we have been selectively buying high dividend quality stock companies during these period.

It is imperative that when investors/traders are buying in down market really understand what they are doing. After all, it is your money.

However if you have bought high dividend paying companies like PetGas, PetDag, Nestle, Tasco, GAB you shud do ok & well.

Do wait for accumulation phase first before thinking of accumulating at the bottom of the market. The market has not bottom yet.

To learn more about our method our next Master the Market VSA Main Course in Aug 25-27, 2012 will lead you to follow the smart money !

-

This month June Stock Market Comment, I promise to talk less (readers have complained) of Europe Debt Crisis, US Election campaign and China soft or hard landings but instead focus what my subscribers want that is the essential stock pick strategies.

Looking for Undervalued Stock in KLSE according to Canadian Warren Buffett.

Late last year, I got hold of this book from KinoKuniya KLCC (near my office) “There’s Always Something To Do The Peter Cundill Investment Approach by the legendary Canadian Warren Buffet, Peter Cundill and it was eureka experience to read such a book.

Once in a while, you do come across book like this. And you do, I wud finished reading the book within days.

Who is Peter Cundill. Hes a Value Fund manager but passed away in early 2011. Following the works of Warren Buffett and B. Graham, Cundill left his life time work of essential stock picking strategies in this great book. It is collection of his personal diaries which provides an insights view of his understanding of value investing, managing funds and this thoughts with reference to G.Soros, Templeton.

For those of us who dont like to read, here is the take-away value I got from this insightful book of value investing were :

1) Cundill willing to pay up to 60 cents for a dollar of business thats his definition margin of safety.

2) His robust stock pick strategies 6x6x6 was look for companies at PE of 6 that pay 6% dividend yield and getting the shares at 60% of the book value.

Interestingly I apply this stock pick strategies of Cundill and ran thru this filter with a wider parameter than 6x6x6 via EquitiesTracker.com and found several of our clients portfolio is in there too. (More on EquitiesTracker.com next month).

Are they undervalued now. (I broke the list into 3 parts)

Perhaps, and then maybe not. I know this list is less likely to be researched by fellow analyst/fund mgr due to its size and nature of business. We like them and the valuations for them are relatively lower as they have not matured or get into the fund mgr/analyst radar screen.

List 1 (click on image to enlarge)

List 2 (click on image to enlarge)

List 3 (click on image to enlarge)

NOTE: DO NOT TAKE THIS LIST AT PAR VALUE.

Pls do your own investigation for the above list before investing them

Cundill the Investor & His Investment Criteria

Here are some more of his investment criteria:

1. Share price must be less than book value. Preferably it will be less than net working capital less long term debt. (Net Cash holdings is preferred)

2. The PE less than 10 (For Malaysia, I preferred less than PE multiple of 19, see my book SuperCharge)

3. The company must be profitable preferably increasing earnings for past 5 years and there will have been no deficits over that period.

4. This is my favourite. The company must be paying dividends. Preferably the dividend will have been increasing and paid for some time.

5. As much as possible, avoid long term debt and bank debt.

The one thing I like about Peter Cundill is to learning the characteristics and qualities necessary to a become great investor. (i.e. patience, curiosity, discipline, contrarianism, networking skills etc).

In retrospect, he talks about finding what dont work in the stock market (e.g. investing stock when their moving averages cross-over buying or cross-down selling) & avoid them totally and to the point of determining whats work in the stock market and loading up on them.

There are other less important points such as running a mutual fund and getting the right people in your team are also in the book.

Our motto is to learn from others (both successes and failures) that have walked the path and benefit from it. It only cost me less than RM100 (price of this book) to reap the future rewards.

-

The Best Sector that will perform in 2nd Half 2012

This is most interesting question when one ask which sector will do well, bad and so-so. It is as if someone has the crystal ball ask when will I become wealthy. Everyone has their opinion, however the results is always different. Below is the snapshot of the survey done by Edge Msia magazine and how the survey participants think about them. It is interesting to see everyone is favouring oil and gas sector.

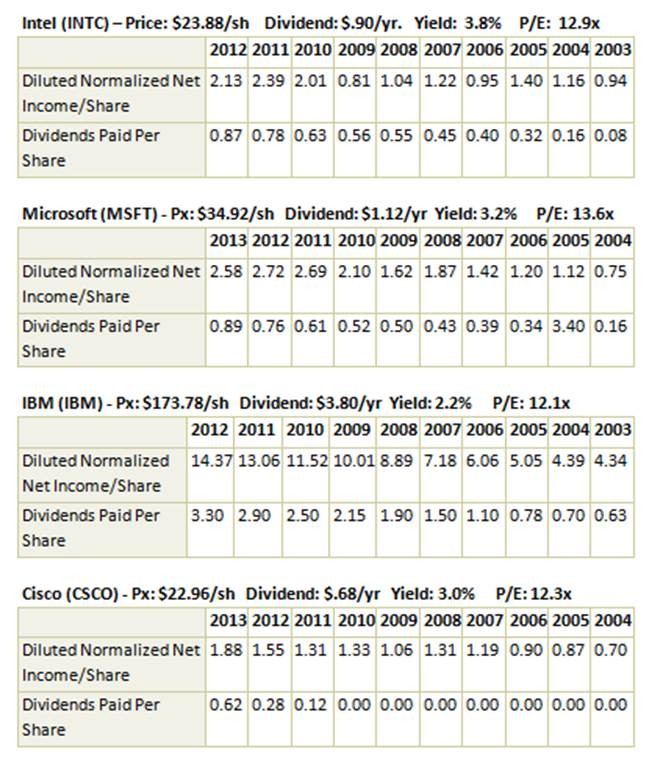

On the flip side, do you know that the best performance sector is Technology. Thats correct, according iFast (fund supermarket in Msia), it is technology up to Jan 2012.

Here is the take away for all the subscribers, dont pick what is popular. Remember the recent IPO for Facebook. I have investors and graduates who were upset when we tell them to avoid IPO for Facebook.

Now, we all know what happened to M.Zuckerberg and its Facebook shares. Read my story from www.wwealth.my

I like to bring another story from the Economist recently (see below table) about the collapse of the financial sector back in 2008/2007 and how it is looking so cheap for the banking/financial sector. Every investment house in US & Europe is prompting investors to buy the recovery stories for banking/financial.

And look what happened to the banking/financial sector over the longer span of 5 years. 2007-2011.

It is one of the worst performer sector banking in the global market.

Then Hows about the KLSE Sector

Here is the KLSE Sector Index Return, Average +% (see below). The best returned for 5 years average were plantation, financial & consumer.

We are not saying that these same sector wud be the best performing sector for 2011 or 2nd half of 2012. Dont fall into the same trap best performing sector will be the same every year. Look at the business in isolation.

Every company with its sector is different. What drives the price and valuations for these companies is what I talk about Cundill stock pick strategies mentioned earlier.

“Value investing is the discipline of buying securities at a significant discount from their current underlying values and holding them until more of their value is realized. The element of a bargain is the key to the process.” – Seth Klarman, Margin of Safety

Our clients core portfolios have exposure to these sectors. Our investment philosophy that Bill and myself to not overexpose to the cyclic sectors like banking and property has made our net return over the last 7-8 years as one of the top performing fund managers in the investment industry.

Dont buy into the hype and whats popular. Remember Facebook IPO.

Here is the Monthly Checklist for June 2012: <+>

1. For month of June 2012, I like another food and beverage manufacturer Guan Chong, a cocoa manufacturer. Yes, they have been recommended by many investment house. Click here. The PE is reasonable and the dividend yield is ok.

A comparison test amongst its peer raked GChong having the highest ROE. GChong is looking to list in SGX and this is wud impact the local price. Notice the chartwise, GChong is still in a downtrend, but we have support @ Rm2.50.

We have to be patient to accumulate this stock. look for SOS first @ Rm2.50 before accumulating.

2. For those who interested in the overseas market. Look to short EWA Australian Country Funds around USD21.00. The fundamental indicators e.g. PMI is suggesting more downside. a technical recession for the Australian economy. The housing market in Australia especially near the coastal city Sydney, Melb. & Perth will experience softer price appreciation.

Here is the housing price chart up to Jan 2012. The next release due in June 2012 may paint a worst picture.

3. The best protection in a down market and risk on & fear on, accumulate your gold at these level and continue to run your profits in gold to 1700 where resistance lies.

4. Get rid of your bad shares or non dividend shares and keep your powder dry like the title of this month looking for undervalued stocks.

HERE IS THE LATEST UPDATE FROM LAST 6 MTHS STOCK MARKET COMMENTS