JPMorgan Sees Value in Linn Energy After Berry Merger

Post on: 16 Март, 2015 No Comment

Updated from 9:18 a.m. ET to include Leon Cooperman comment and afternoon share prices.

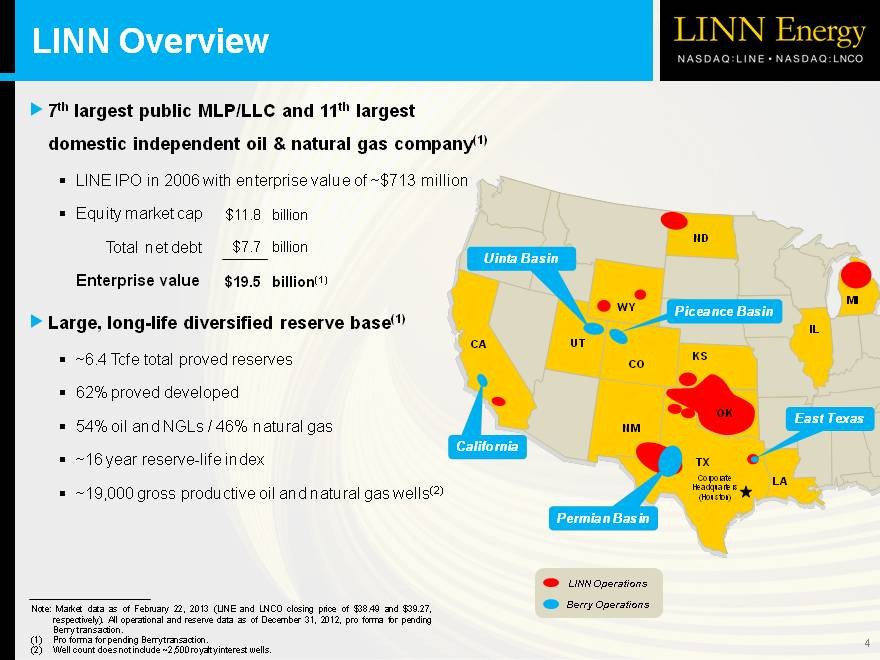

NEW YORK (TheStreet) — JPMorgan analysts see value in Linn Energy (LINE — Get Report ) now that the upstream oil and gas master limited partnership has closed an often challenged acquisition of Berry Petroleum and put some investor uncertainty to rest heading into 2014.

With the acquisition now complete, JPMorgan analysts reinitiated coverage of Linn Energy with an overweight rating and $36 price target, asserting that investors will now have the ability to refocus on the driller’s operational performance and its ability to grow earnings and cash flow through a steady diet of acquisition activity in coming years.

JPMorgan also said that while an informal Securities and Exchange Commission review of Linn Energy’s finances may remain ongoing, it will no longer challenge the Berry merger and may not remain a big issue on investor’s minds.

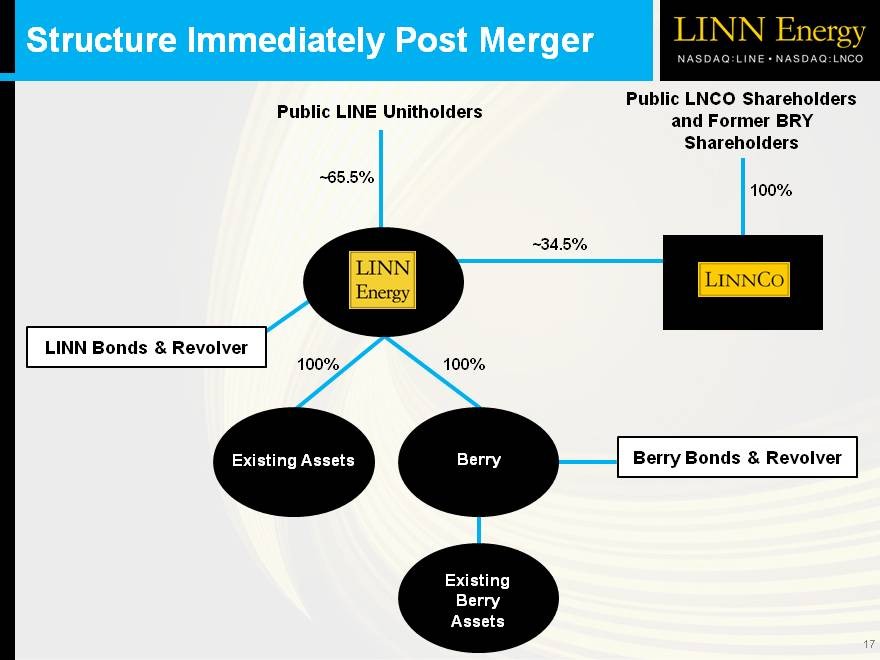

We believe investors can now refocus on operations, as the closure of the Berry merger eliminates a major overhang that created volatility and uncertainty in the LP units, JPMorgan analysts said on Monday. They highlighted Linn Energy’s structure, which uses LinnCo (LNCO — Get Report ) as a vehicle to make acquisitions on a tax-free basis, as a strategic advantage. Meanwhile, after the Berry merger, Linn Energy will have achieved a scale far beyond its upstream MLP competitors, potentially giving the company the ability to make acquisitions that provide consistent earnings and cash flow growth.

Competition to acquire quality assets in the E&P space has become fierce, in our view, and we consider Linn Energy’s larger relative size as a strategic advantage, JPMorgan said.

In mid-December, Linn Energy completed its acquisition of Berry Petroleum. The deal’s closure came after a series of amended proxy statements on the merger, the SEC’s requirement that the company retire some non-GAAP financial metrics it had disclosed to investors and an amended stock offer for Berry Petroleum.

Linn Energy, through its acquisition unit LinnCo, was forced to offer 1.68 shares for each Berry Petroleum share, in a $4.9 billion transaction when including debt. The Houston-based driller previously offered Berry Petroleum investors 1.25 shares of LinnCo for each of their shares, however, uncertainty over the firm’s accounting practices and a battered share price caused the company to raise the stock merger ratio. Linn Energy also said that Berry’s improving performance compelled a higher stock exchange ratio.

JPMorgan now forecasts that in the wake of the merger, Linn Energy will be able to increase its cash distributions to shareholders by 5% year-over-year through 2015, driven by oil and gas production the company has acquired. The analysts also project that Linn Energy will continue to make acquisitions in the range of $1 billion a year starting in 2015. Through acquisitions, Linn Energy is expected to create a base of reserves split evenly between oil and natural gas, JPMorgan said.

For now, Linn Energy’s monthly distributions to shareholders remain at $2.90 a share on an annualized basis.

Linn Energy’s accounting practices and the non-GAAP metrics that drive its dividend came under scrutiny in 2013, as the firm worked to complete its acquisition of Berry Petroleum.

Both Barron’s and independent research firm Hedgeye Risk Management argued Linn’s use non-GAAP accounting figures overstated the cash flow it could pay out to shareholders and under-reported the expenses tied to its hedging practices and drilling capital expenditure. Hedgeye also calculated that Linn Energy’s cost of replacing its oil and gas production was about $25 per barrel of oil equivalent (BoE), while the company’s financial results and analyst calculations generally indicated replacement costs of about $15 per BoE.

As part of a series of amended proxy filings with the SEC on its Berry Merger, Linn Energy said in September it re-defined some non-GAAP financial metrics such as maintenance capital expenditure and distributable cash flow (DCF). However, those changing definitions didn’t impacted Linn Energy’s underlying financial picture.

Instead of maintenance capital expenditure Linn Energy now uses the term discretionary reductions for a portion of oil and natural gas development costs. This metric includes estimated drilling and development costs to convert the company’s energy reserves to producing status. The metric, however, doesn’t include the historical cost of the company’s acquired oil and gas properties.

Those accounting changes and their minimal impact to Linn’s reported financial results proved helpful in the company’s attempt to close its Berry acquisition. However, in the wake of the deal’s closure, Hedgeye analyst Kevin Kaiser maintained that Linn Energy would struggle to generate the oil and gas production and cash flows to maintain or grow its high dividend yield.

Large investors like Leon Cooperman of hedge fund Omega Advisors contested assertions that Linn Energy was being overly aggressive or misleading in its accounting disclosures.

We were supportive. We own it and continue to own, Cooperman said in am e-mail to TheStreet on Monday, Securities and Exchange Commission filings show that Omega Advisors continues to be among Linn Energy’s largest shareholders with a holding of nearly three million shares with $93 million at current prices. Filings as of the third quarter show Omega pared its holding from over six million shares at the start of 2013.