Journal of Asset Management Asset liability management modelling with risk control by stochastic

Post on: 10 Май, 2015 No Comment

Journal of Asset Management (2010) 11, 73–93. doi:10.1057/jam.2010.8

Asset liability management modelling with risk control by stochastic dominance

Xi Yang 1. Jacek Gondzio 2 and Andreas Grothey 3

Correspondence: Xi Yang, School of Mathematics and Maxwell Institute for Mathematical Sciences, University of Edinburgh, James Clerk Maxwell Building, King’s Buildings, Mayfield Road, Edinburgh EH9 3JZ, UK

1 has recently been awarded a PhD in Optimization at the University of Edinburgh. She received her BSc in Computational Maths in China, and subsequently graduated with MSc in Financial Maths with distinction in Edinburgh, UK. Her main research interests are risk measures and management, stochastic dominance and stochastic programming.

2 is a professor of Optimization at the School of Mathematics at the University of Edinburgh. His research interests include the theory, implementation and applications of optimization techniques, and in particular the development of theory and practical algorithms based on interior point methods for optimization. The algorithms and software he developed (HOPDM and OOPS) have been used to solve some huge scale optimization problems including those arising in financial applications. He published more than 50 papers in top optimization journals.

3 is Lecturer for Operations Research in the School of Mathematics at the University of Edinburgh since 2005. He holds an MSc in Numerical Analysis from the University of Dundee and a PhD in Optimization from the University of Edinburgh. His main research interests are Interior Point Methods and Stochastic Programming.

Received 5 March 2010; Revised 5 March 2010.

Abstract

An Asset Liability Management model with a novel strategy for controlling the risk of underfunding is presented in this article. The basic model involves multi-period decisions (portfolio rebalancing) and deals with the usual uncertainty of investment returns and future liabilities. Therefore, it is well suited to a stochastic programming approach. A stochastic dominance concept is applied to control the risk of underfunding through modelling a chance constraint. A small numerical example and an out-of-sample backtest are provided to demonstrate the advantages of this new model, which includes stochastic dominance constraints, over the basic model and a passive investment strategy. Adding stochastic dominance constraints comes with a price. This complicates the structure of the underlying stochastic program. Indeed, the new constraints create a link between variables associated with different scenarios of the same time stage. This destroys the usual tree structure of the constraint matrix in the stochastic program and prevents the application of standard stochastic programming approaches, such as (nested) Benders decomposition and progressive hedging. Instead, we apply a structure-exploiting interior point method to this problem. The specialized interior point solver, object-oriented parallel solver, can deal efficiently with such problems and outperforms the industrial strength commercial solver CPLEX on our test problem set. Computational results on medium-scale problems with sizes reaching about one million variables demonstrate the efficiency of the specialized solution technique. The solution time for these non-trivial asset liability models appears to grow sublinearly with the key parameters of the model, such as the number of assets and the number of realizations of the benchmark portfolio, which makes the method applicable to truly large-scale problems.

Keywords:

asset liability management; stochastic dominance; underfunding; stochastic programming

INTRODUCTION

The Asset Liability Management (ALM) problem has crucial importance for pension funds, insurance companies and banks whose business involves a large amount of liquidity. Indeed, these financial institutions apply ALM to guarantee meeting their liabilities while pursuing profit. The liabilities may take different forms: pensions paid to the members of the scheme in a pension fund, savers’ deposits paid back in a bank or benefits paid to insurers in an insurance company. A common feature of these problems is the uncertainty of liabilities and asset returns and the resulting risk of underfunding. This constitutes a non-trivial difficulty in managing risk in any model applied by the financial institution. The need for multi-period planning additionally complicates the problem.

The paradigm of stochastic programming ( Kall and Wallace, 1994 ; Birge and Louveaux, 1997 ) is well suited to tackle these problems and has already been applied in this context as shown in ( Ziemba and Mulvey, 1998 ) and in the many references therein. One of the first industrially applied models of this type was the stochastic linear program with simple recourse developed in Kusy and Ziemba (1986). This model captured certain characteristics of ALM problems: it maximized revenues for the bank in the objective under legal, policy, liquidity, cash flow and budget constraints to make sure that deposit liabilities were met as closely as possible. Under the computational limits at the time when it was developed, this model took advantage of stochastic linear programming so as to be practical even for the large problems faced in banks. It was shown to be superior to a sequential decision theoretical model in terms of maximizing both the initial profit and the mean profit. However, risk management was not considered in this work: only expected penalties of constraint violation were taken into account.

A major difficulty in ALM models consists in risk management. One may follow the Markowitz risk-averse paradigm ( Markowitz, 1959 ) and trade off multiple contradictory objectives: maximize the return and minimize the associated risk (for example Pyle, 1971 ). A successful example of optimization-based ALM modelling, which took risk management issues into account, was the Russell–Yasuda Kasai model, for a Japanese insurance company by the Frank Russell consulting company, which used multi-stage stochastic programming ( Cari ň o et al. 1994 ; Cari ň o and Ziemba, 1998 ). This dynamic stochastic model took into account multiple accounts, regulatory rules and liabilities to enable the managing of complex issues arising in the Yasuda Fire and Marine Insurance company. Expected shortfall, that is the expected amount by which the goals were not achieved, was applied to measure risk more accurately than the calculation of expected penalties and it was easy to handle in the solution process. Moreover, the model proved to be easy to understand for decision makers. The implementation results showed the advantages of the Russell–Yasuda model over the mean-variance model in multi-period and multi-account problems.

There are various ways to control risk in addition to those mentioned above, such as variance and value at risk. Stochastic dominance leads to an alternative tool and it has recently gained substantial interest from the research community. It has several attractive features, of which two are particularly important: stochastic dominance is consistent with utility functions and it considers the whole probability distribution. We will discuss these issues in detail in the section ‘Stochastic Dominance’. The stochastic dominance concept dates from the work of Karamata in 1932 (see ( Levy, 1992 ) for a survey). Subsequently, stochastic dominance has been applied in statistics ( Blackwell, 1951 ), economics ( Hadar and Russell, 1969 ; Hanoch and Levy, 1969 ) and finance. However, stochastic dominance involves the comparison of (nonlinear) probability distribution functions, which makes its straightforward application difficult.

The inclusion of first-order stochastic dominance (FSD), within the stochastic programming framework, leads to a non-convex mixed integer programming formulation. By contrast, second-order stochastic dominance (SSD) can be incorporated in the form of linearized constraints ( Dentcheva and Ruszczy ń ski, 2003 ) that makes it a more attractive option. In a series of papers, Dentcheva and Ruszczy ń ski analysed several aspects of the use of stochastic dominance, such as its optimality and duality ( Dentcheva and Ruszczy ń ski, 2003 ), applications to nonlinear dominance constraints ( Dentcheva and Ruszczy ń ski, 2004 ) and an application to static portfolio selection ( Dentcheva and Ruszczy ń ski, 2006 ). The introduction of non-convex constraints by the use of FSD introduces serious complications into optimization models and makes their solution difficult. Relaxations of these problems were analysed in Noyan et al (2006) ; stability and sensitivity of FSD with respect to general perturbation of the underlying probability measures were studied in Dentcheva et al (2007). Noyan et al (2006) also introduced interval SSD, which is equivalent to FSD, and generated a mixed integer problem based on this dominance relation. Roman et al (2006) proposed a multi-objective portfolio selection model with SSD constraints and Fábián et al (2009) developed an efficient method to solve this model based on a cutting-plane scheme. The application of stochastic dominance in dispersed energy planning and decision problems has been illustrated in ( Gollmer et al. 2007. 2008. 2009 ), including both first-order and SSD. The use of multivariate stochastic dominance to measure multiple random variables jointly was discussed in Dentcheva and Ruszczy ń ski (2009) .

To the best of our knowledge, stochastic dominance has not yet been applied in the ALM context; and, in this article, we demonstrate how this can be done. Further, we introduce relaxed interval SSD, which is a dominance constraint intermediate between first-order and second-order, in a problem with discrete probability distributions, and demonstrate how it can be used to model chance constraints. By combining SSD and relaxed interval SSD, the model can help generate portfolio strategies with better management of risk and better control of underfunding. We illustrate this issue with a small example and an out-of-sample backtest analysed in the sections ‘Model Example’ and ‘Backtesting’, respectively.

Owing to the uncertainties of asset returns and liabilities, the resulting stochastic programming formulation involves many scenarios corresponding to the Monte Carlo simulation of realizations of the random factors. As a result, the problem grows to a large size, especially when the problem has multiple stages, and this leads to difficulties in the solution process. Consigli and Dempster (1998) proposed the Computer-aided Asset / Liability Management model as a multi-stage model and solution. Of the simplex method including the interior point method and nested Benders decomposition, the latter is shown to be the most efficient with regard to both solution time and memory requirements.

Stochastic dominance constraints link variables that are associated with different nodes at the same stage in the event tree. Adding such constraints to the linear stochastic programming problem destroys the usual tree structure of the problem and prevents the effective use of direct Benders decomposition or the progressive hedging algorithm ( Rockafellar and Wets, 1991 ). See Fábián and Veszpremi (2008) for a solution based on dual decomposition. We discuss this issue further in the section ‘Numerical Efficiency’. Instead, we apply the specialized structure-exploiting parallel interior point solver, object-oriented parallel solver (OOPS), to the structure of our ALM model with stochastic dominance constraints, to take advantage of such information in the solution process. OOPS is an interior point solver, which uses object-oriented programming techniques and treats each sub-structure of the problem as an object carrying its own dedicated linear algebra routines ( Gondzio and Grothey, 2009 ). This design allows OOPS to deal with complicated ALM problems that contain stochastic dominance constraints. The computational results confirm that, by exploiting the structure, OOPS outperforms the commercial optimization solver CPLEX 10.0 on these problems.

The basic multi-stage stochastic programming model used for ALM is discussed in the next section. The theoretical issues of stochastic dominance are discussed in the section after that, with an emphasis on SSD and relaxed interval SSD. The practical aspects of the application of different stochastic dominance constraints in the ALM model (second-order and relaxed interval SSD) are covered in the subsequent section. These are followed, in the penultimate section, by an analysis of a small example of the model proposed and a backtest and discussion of computational results for a selection of realistic medium scale problems. The final section concludes the article.

ASSET LIABILITY MANAGEMENT

ALM models assist financial institutions in decision making on asset allocations, considering full use of the fund and resources available. The model aims to maximize the overall revenue, sometimes as well as revenue at intermediate stages, while controlling risk. Risk in ALM problems is present in two aspects: a possible loss of investment value and the inability to meet liabilities. The returns of assets and the liabilities are both uncertain. It is essential in ALM modelling to deal with these uncertainties as well as with the resulting risks. The stochastic programming approach is naturally applicable to problems that involve basic uncertainties; an approach to deal with risk management is discussed in the next section.

Multi-stage ALM modelling

Suppose a financial institution plans to invest in assets from a set I = { 1, …, m }. with x i denoting the investment in asset i. The return r of assets is uncertain, but we assume that it has a known probability distribution, which can be deduced from historical data, and the total return of the portfolio is R = r T x. Then, we can calculate the expected return of the portfolio:

Considering a risk function φ (x ), measuring the risk incurred by decision x ∈ ℝ m. a general portfolio selection problem, without taking the liabilities into account, can be formulated in one of the following three ways:

Suppose that constraints E [ r T x ] α. φ (x )β have strictly feasible points. It can be proven ( Krokhmal et al. 2001 ) that these three problems are equivalent in the sense that they can generate the same efficient frontier, given a convex set X and a convex risk measure function φ (x ). The best-known example of formulation (2) is the Markowitz mean-variance multi-objective model ( Markowitz, 1959 ), which considers both return and risk in the objective. In formulation (3), risk is minimized with acceptable returns, whereas in formulation (4), the return is maximized subject to risk being kept at an acceptable level. The constraint in (4) defines the feasible set with feasible risk, so that, in the objective, the decision maker can focus on maximizing the return. In this article, we will use formulation (4).

Besides return and risk control, the ALM model considered has also the following features:

- Transaction costs; each transaction will be charged a certain percentage of total transaction value, and different transaction costs may apply to purchases and sales.

- Cash balance; liabilities should be paid to clients, meanwhile there is an inflow in terms of deposits or premiums; the model should make sure there is outflow and inflow match.

- Inventories of assets and cash, which are essential in a dynamical system of 2- or even a multiple-stage problem.

- Legal and policy constraints should be aligned with the financial sector’s requirements.

This work considers the first three points.

It is important for the decision makers to rebalance the portfolio during the investment period as they may wish to adjust the asset allocations according to updated information on the market. The strategy that is currently optimal may not be optimal any more as the situation changes. Taking this into account, the problem is a multi-period problem and at the beginning of each period in the model, new decisions are made.

We denote the time horizon by T. and decision stages by t = 0, …, T. At each time stage t, a decision is made on the units of each asset to be invested in and amount of cash held, based on the state of the total wealth and the forecast of prospective performance of the assets at that particular time. When the random factors follow discrete distributions, the resulting decision process can be captured by an event tree, as shown in Figure 1. Each node is labelled with (i. j ) denoting node j at stage i. Each node represents a possible future event. Asset returns, liabilities and cash deposits are subject to uncertain future evolution. Meanwhile, asset rebalancing is done after knowing the values that the asset returns and liabilities take at each node.

An example of event tree describing different return states of nature.

Full figure and legend (10K )

The notation of the model is given first:

Parameters.

W i price of asset i G total initial wealth λ the penalty coefficient of underfunding γ the transaction fee, which is proportional to trading volume (assumed to be equal for purchases and sales) β upper bound on acceptable risk ψ funding ratio, showing the percentage of liabilities to be satisfied

Random data.

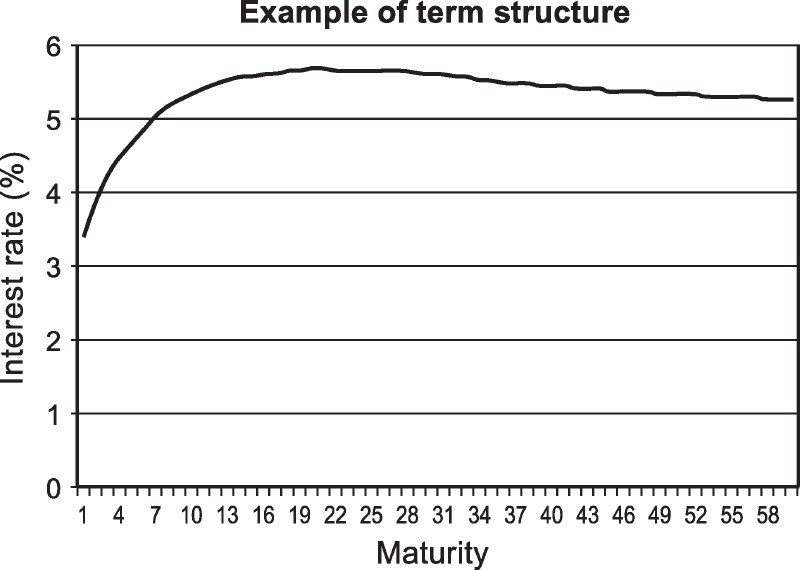

R i,j t the return of asset i in node j at stage t R c,j t the interest rate in node j at stage t A j t the outflow of resources, for example liabilities D j t the inflow of resources, for example. contributions π the joint probability distribution of above uncertain factors

Decision variables.

xh i,j t units of asset i held in node j at stage t xs i,j t units of asset i sold in node j at stage t xb i,j t units of asset i bought in node j at stage t c j t units of cash held in node j at stage t b j T the amount of underfunding in node j at the terminal stage that cannot be satisfied

Indexes and sets.

t the stage index, with t = { 1, …, T } i the asset index, with i ∈ I = { 1, …, m } n t the number of nodes at stage t j the node index, with j ∈ N t = { 1, …, n t }. t = { 1, …, T } a (j ) the ancestor of node j

Then the multi-stage ALM problem concerning the investment strategy can be represented as: