Journal Entry for Equity and Debt Securities of Longterm Investment

Post on: 5 Июнь, 2015 No Comment

On my previous post, I have talked about Journal Entry for Temporary Investment[Equity and Debt Securities] , in this post I will discuss Journal Entry for Equity and Debt Securities of Long Investment enriched with case examples for easier understanding. Enjoy!

Advertisement

Journal Entries For Long-Term Investments: Debt Securities

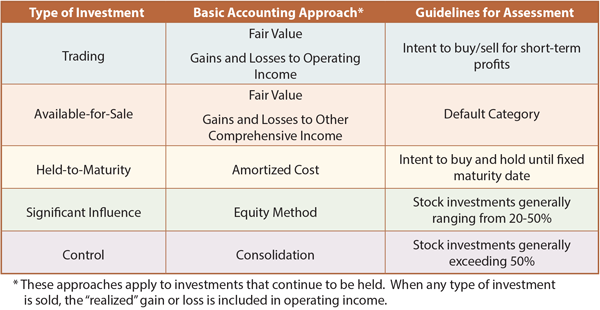

Long-term investments in debt securities consist of bonds or other debt instruments whose principal is payable after 1 year or the operating cycle [whichever is longer], and there is no intention to sell them before the due date. Thus, condition 2 mentioned earlier for marketable securities has not been met. Therefore, these instruments are subject to amortization of premiums and discounts.

A company purchases a 5-year, 10%, $100,000, long-term bond at par, on January 1, 20X9. The journal entry is :

[Debit]. Investment in Long-term Debt Securities = $100,000

[Credit ]. Cash = $100,000

Every December 31, an entry must be made either to accrue interest on the bond, or to record the actual receipt of interest, if this date is an interest payment date .

In the previous example, if December 31 is an interest payment date, and interest is payable annually, the journal entry would be :

[Debit]. Cash = $10,000

If interest is payable annually on June 30, the journal entry on December 31 would be :

[Debit]. Interest Receivable = $5,000

[Credit]. Interest Revenue = $5,000 *

( Note. *To accrue six months of interest: $100,000 × 10% × 6/12 )

When the bond matures, an entry would be made debiting Cash and crediting the investment account. If the bond is purchased at a price above or below the par value, the investment account would be debited at par, and the difference would go to a premium or discount account, which would be amortized over the life of the bond. Amortization can be calculated under either the straight-line method or the effective interest method. In this post we will use the simpler, straight-line method.

If the bond is purchased at a premium, the amortization entry debits the Interest Revenue account, thus reducing the interest earned. Conversely, if the bond was purchased at a discount, Interest Revenue would be increased.

The Lie Dharma Company purchases a $100,000 par, 10% bond at 102 on January 1. The interest is payable annually on December 31 and the bond matures in 10 years. The premium is $2,000, and the annual amortization is $200 ($2,000/10).

The journal entries are :

[Debit]. Investment in Long-term Debt Securities = $100,000