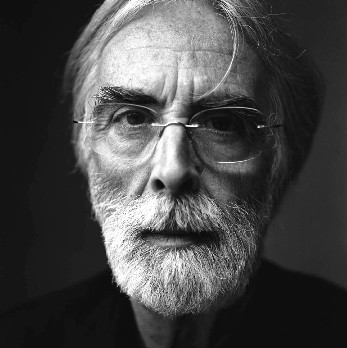

Jason Kelly

Post on: 24 Апрель, 2015 No Comment

This page shows the performance of investing strategies I recommend in The 3% Signal. The Neatest Little Guide to Stock Market Investing. and The Kelly Letter .

The 3% Signal

Congratulations! You just found the stock markets new best practice.

The 3% Signal plan (3Sig), explained briefly on page 119 of the 2013 edition of The Neatest Little Guide to Stock Market Investing . and thoroughly in my 2015 book The 3% Signal . achieves steady 3-percent quarterly growth in a small-company stock fund by skimming off excess quarterly profit into a safe fund thats later used to make up shortfalls in weak quarters. This action, using the unperturbed clarity of prices alone, automates the investment masterstroke of buying low and selling high — with no z-val interference of any kind.

In Chapter 7 of The 3% Signal. readers follow three 401(k) investors at the same company, all earning the same salary and making the same monthly contributions to their plans. The only difference is what they do with their contributions. One of them, Mark, runs the signal plan and greatly outpaces his peers. Below are the annual returns of his plan, 3Sig, compared with dollar-cost averaging (DCA) his same contributions into three other investing plans.

Note that one of 3Sigs primary benefits is the quarterly guidance it provides, which makes an investor more likely to stick with the plan through rough patches. DCA plans do not offer this, so most investors bail at the bottom. Also, because of high volatility that results from focusing an entire DCA plan on a single stock index fund as shown in the two versions below, almost all investors in the real world diversify their DCA plans across several different types of funds, most of which underperform the raw stock indexes represented here by SPY and IJR. Therefore, in the real world, 3Sigs outperformance will be much higher than shown in the table below against perfectly executed DCA plans using raw stock indexes.

Finally, in Marks 3Sig, Mark skipped the call to add more cash in Q109, which crimped his performance. (See March 2009 on page 263 of The 3% Signal for the story.) Therefore, this plan does not show 3Sigs maximum performance potential. which is realized only when all calls for new cash are met. I use it here nonetheless because I believe few people run any investment plan perfectly and that Marks decisions closely match what other people would have done in those extreme times. Even so, you can see his plan beating other plans which themselves achieve better performance than most portfolios assembled and managed by supposed pros.

In sum: The table below pits an imperfect 3Sig implementation against perfectly executed DCA plans of the highest performance allocation, and 3Sig still comes out ahead. It will do the same for you.

Here are the four plans explained:

- Marks 3Sig: Marks plan run with IJR and VFIIX as shown in the book, beginning at the end of the fourth quarter of 2000 with $10,000 and the salary history shown in the book, then his salary increasing 3 percent annually in the years after 2013 (where tracking ends in the book). His quarterly contribution to VFIIX in 2013 was $1,815. In 2014, it was $1,871. This year, its $1,927. Mark also contributed $13,860 in new cash during the subprime mortgage crash, per the signals guidance. Expense Ratios: IJR 0.12%, VFIIX 0.21%

- DCA SPY: The same $10,000 invested at the end of 2000 and Marks same salary history shown in the book, with the same quarterly contributions after 2013. The only difference is that all capital goes into the S&P 500 as represented by the SPY ETF. This is dollar-cost averaging (DCA) into SPY with Marks quarterly contributions. Marks $13,860 in new cash is distributed evenly across the first 50 quarterly contributions (Q101-Q213). Expense Ratio: SPY 0.09%

- DCA IJR: Same as DCA SPY above, but using the S&P SmallCap 600 (IJR) small-company ETF instead of the S&P 500. This is dollar-cost averaging into IJR with Marks quarterly contributions and new cash. Expense Ratio: IJR 0.12%

- DCA Medalists: Same as DCA SPY, but using a portfolio of Morningstar medalist actively-managed funds, initially allocated as follows: 30% Longleaf Partners (LLPFX) large-company stock fund, 20% Wasatch Small-Cap Growth (WAAEX) small-company stock fund, 20% Artisan International (ARTIX) international stock fund, and 30% PIMCO Total Return (PTTDX) bond fund. All are featured in the book, and all are still highly-rated. Contributions are divided by the initial allocation percentages; holdings are not rebalanced back to target allocations. Expense Ratios: LLPFX 0.92%, WAAEX 1.21%, ARTIX 1.17%, PTTDX 0.75%

Heres how the four plans have performed, with all dividends reinvested:

Table in progress. Last column coming soon.