Japanese Retail Investors Play It Safe

Post on: 13 Апрель, 2015 No Comment

Whatever happened to Mrs Watanabe?

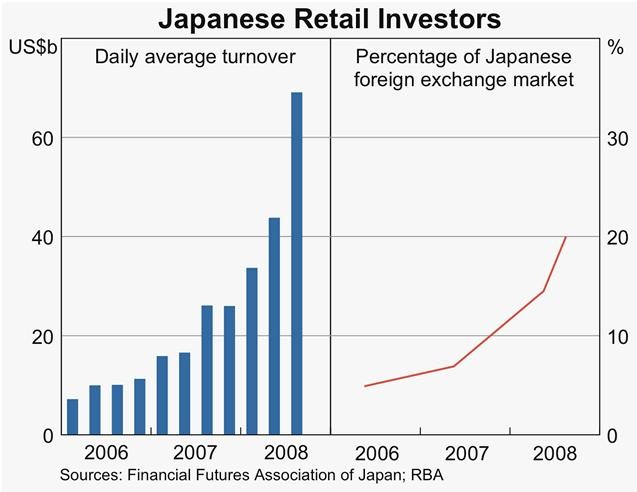

For most of the past decade the proverbial keeper of Japan’s household savings has poured money outside Japan at almost every opportunity. Since last September, however, Japanese retail investors have each month pulled cash out of investment trusts, or “Toshin”, which account for most of their exposure to overseas assets. That net outflow, totalling Y839bn ($10.4 billion) according to fund tracker Lipper, is easily the longest sequence of redemptions since February 2001.

Two forces have been at work, say analysts. On the demand side, investors have been clinging to domestic assets amid fears over the eurozone crisis, partly from a belief that the Japanese yen would only strengthen. And on the supply side, distributors of Toshin have pulled in their horns, awaiting the outcome of a regulatory inquiry into high-risk, complicated products.

The Financial Services Agency’s chief concern is sales of so-called “currency-overlay” Toshin, which promise investors big monthly returns by bundling assets such as junk bonds, and high-yielding currencies, such as the Brazilian real. Sometimes derivatives are used to magnify those bets.

In recent weeks, aggressive Toshin marketing has resumed under new guidelines, while a falling yen and rising stocks have stoked appetite for risk. But Mrs Watanabe’s return to overseas investment is cautious. For now, only the most familiar, “quality” assets – Australian dollars and so-called “uridashi” bonds – will do.

“We’re seeing a structural shift from exotic Toshins to more straightforward financial products,” says Yunosuke Ikeda, head of forex strategy at Nomura in Tokyo.

Retail flows into plain US Treasury Toshin, for example, may have helped drive the yen significantly lower against the dollar in the days after the Bank of Japan’s unexpected monetary easing last month.

Nomura has also enjoyed success with a new Toshin that buys Australian government bonds while boosting income by selling call options on Aussie dollar/yen. The fund, launched three days after the BoJ’s easing, attracted Y90bn of inflows in a week, making it the most successful Toshin launch in almost two years. A derivative-focused fund that stops short of promising a fixed payment every month, it looks likely to attract imitators from Daiwa and Mizuho among others.

The fund’s popularity is a reflection of Japanese investors’ enduring affinity towards the Aussie dollar: liquid, high-yielding, and backed by one of the world’s few remaining triple-A sovereigns, say analysts. Last month the Aussie dollar was ranked the “most appealing currency” in a survey by Nomura of 3000 individual investors – just as it has every month since the question was first asked in January 2010.

Meanwhile, brokers report strong interest in uridashi, which are bonds issued outside Japan and denominated in foreign currencies.

Turkish-lira uridashi have been particularly popular, offering high yields, a solid structural growth story and a fair chance of appreciation against the yen. The lira has become the new “hot currency” among retail investors, supplanting Brazil’s real, says Masafumi Yamamoto, chief forex strategist at Barclays Capital. The same rationale has supported strong flows into the South African rand and the Indonesian rupiah, apparently at the expense of the real. Many clients “say they have enough Brazil exposure,” says Akira Takahashi, head of third-party sales at Royal Bank of Scotland in Tokyo.

Importantly, these uridashi issues are from highly-rated borrowers with long track records in the Japanese market. On Tuesday, for example, Mizuho Securities was due to sell a 10-year, 4 per cent Aussie-dollar uridashi on behalf of the World Bank, rated triple-A, which has been issuing uridashi for decades. Next week double-A Korea Eximbank will sell a 3-year rupiah deal yielding 6.1 percent through SBI Securities, the online brokerage of Softbank, the media and telecoms group.

Within Japan, investors are turning to exchange-traded funds and other passive index products, as well as real-estate investment trusts, which tend to pay high monthly dividends, says Shoko Shinoda, fund analyst at Lipper.

The FSA’s investigation “has damped retail purchases of some types of [Toshin] funds,” says Junya Tanase, chief forex strategist at JPMorgan in Tokyo.

The renewed activity may not be enough to tip Toshin flows for February into positive territory, say analysts, but points to a resumption of net inflows in March. After all, retail investors’ quest for income goes on. Toshin holders, about 70 percent of them retirees, face tiny yields from bank savings and meagre returns from Japanese government bonds, as they try to fund their costs of living.

“Appetites for yield and asset diversification are still intact,” says Mr Yamamoto of Barcap.

Additional reporting by Nobuko Juji