Japan s tankan survey offers both hope despair

Post on: 16 Март, 2015 No Comment

TakashiNakamichi

TOKYO—Sentiment among large Japanese manufacturers deteriorated sharply following the recent sales tax increase, the Bank of Japan’s tankan corporate survey showed Tuesday, challenging the notion that the nation’s economy is generally doing well even as consumption weakens.

But the results of the central bank’s quarterly poll of over 10,000 companies don’t necessarily mean that Japan’s economic recovery is stalling either, with large firms saying they plan to ratchet up capital spending.

The survey’s headline index measuring big manufacturers’ views about current economic conditions worsened to plus 12 in the June. That was down from plus 17 in March and missed economists’ forecasts for a plus 16 reading. Business sentiment fell as Japanese households tightened their purse-strings, particularly on big ticket items like autos and homes, after months of rush purchases preceding the consumption tax’s increase to 8% from 5% in April.

With optimistic corporate managers still outnumbering the pessimists, we can say. companies have generally stuck to their bullish economic views even after the sales tax increase, said Yasunari Ueno, chief market economist at Mizuho Securities. But it is unclear whether they will be able to maintain such a bullish stance from here on out. Everything depends on how exports and consumer spending play out.

The sales tax increase has been seen as the biggest test yet of Abenomics, Prime Minister Shinzo Abe’s growth policy centering on aggressive monetary stimulus and government spending.

Until recently, a popular view among Japanese officials has been that the economy was likely to weather the tax increase relatively quickly, helped by government stimulus measures. But a sense of caution among private economists has grown since the release of economic data signaled that the domestic demand sectors that have driven much of the growth since Mr. Abe took office in late 2012 are struggling.

In May, a slump in consumption deepened despite a booming jobs market, as wages adjusted for price changes continued to decrease. Housing construction plummeted, and unsold goods piled up at auto dealers and electronics distributors. Manufacturers signaled that they would boost output only modestly ahead. Meanwhile, the economy is getting little support from exports amid lackluster demand in Asia.

The tankan also showed that big firms have mixed feelings about the coming three-month period.

The survey’s manufacturers’ outlook index registered a plus 15 reading, slightly higher than the index for current conditions.

The combined pretax profit forecasts for large companies for the continuing fiscal year worsened to a 4.6% decline from a 2.3% fall. A BOJ official played down the forecast, saying the change was partly due to upward revisions to corporate earnings in the previous year.

But the tankan has some bright spots. Large companies raised their combined investment plans for the continuing financial year ending in March to a 7.4% increase, higher than their forecast made three months earlier and the best showing since the June 2007 survey. Corporate investment is one of the areas that BOJ officials are counting on to prop up growth until consumption and exports recover.

Big manufacturers are looking to increase investment by 12.7%, above economists’ forecasts and the highest since the June 2006 tankan.

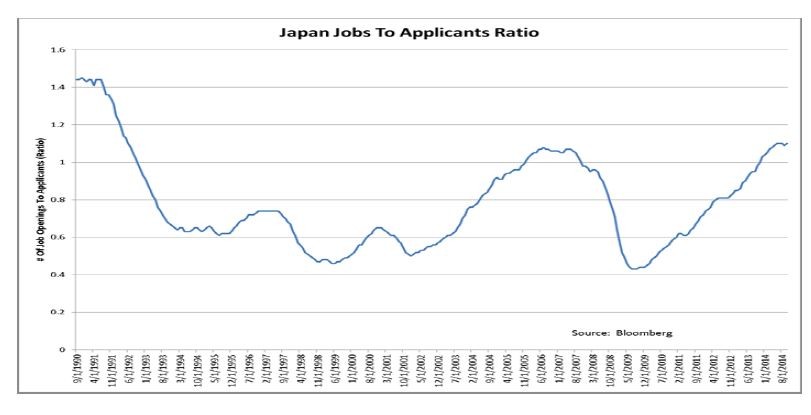

Manufacturers also acknowledged an improvement in overseas demand for their products, boding well for exports, according to the tankan. Japanese companies are also short of workers, which suggests the current hiring boom could continue barring a sharper worsening in economic conditions.

Bank of Japan’s tankan corporate survey signaled a sharp deterioration in business sentiment following the recent sales tax increase, challenging the notion that the economy is generally doing well despite the tax change.

The quarterly poll of over 10,000 companies offered the most comprehensive picture yet of how corporate Japan feels about the headwinds from a rise in the national sales tax rate to 8% from 5% on April 1.

The index measuring how Japan’s big manufacturers think of present economic conditions came to plus 12 in the survey released by the central bank Tuesday, down from a plus 17 in the March poll.