Japan s lost decade a lesson in recession

Post on: 12 Сентябрь, 2015 No Comment

Countries around the world can learn a few things from Japan’s decade-long battle to recover from the severe economic slump that hit that country in the 1990s, a Japanese economist says.

Countries around the world can learn a few things from Japan’s decade-long battle to recover from the severe economic slump that hit that country in the 1990s, a Japanese economist says.

I think there is one ray of hope in all of this, and that is that we in Japan experienced it 15 years earlier and even though it took us a long time, we actually did manage to come out the other end, Richard Koo, chief economist at Nomura Research Institute in Tokyo, told a symposium hosted by The Japan Society in Toronto yesterday.

The very aggressive recession that is enveloping much of the globe is not a textbook downturn, Koo said. Like the prolonged slump that became known as Japan’s lost decade, the current crisis is a balance sheet recession, he said – one that happens when asset price bubbles burst, leaving private-sector balance sheets with more liabilities than assets. Companies spend any cash flow they have paying down debt rather than maximizing profit. As a result, few want to borrow money even after central banks lower interest rates sharply, rendering monetary policy largely ineffective, Koo said.

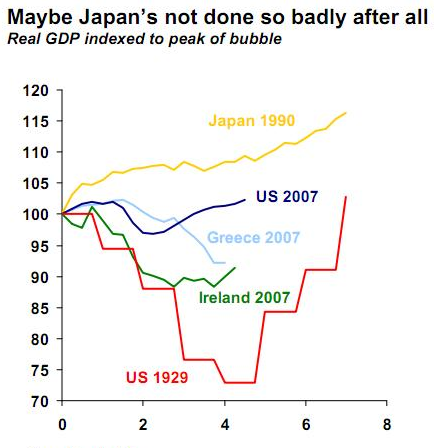

Koo admitted that Japan is often cited as an example of how not to handle an economic crisis. But he argued that the country did a remarkable job, citing the fact that commercial real estate prices in Japan fell 87 per cent from their peak, but gross domestic product never dropped below the peak of the bubble, both in real and nominal terms.

Koo said Japan was able to pull itself out of its protracted slump when the government came in and borrowed (money) and put it back into the income stream.

But Koo cautioned against ratcheting back fiscal stimulus too soon. Twice during Japan’s economic slump, the government tried to cut its budget deficit, a decision that led to a complete meltdown. Because after all, the whole economy was supported by this government maintaining the income stream, so when you pulled the plug, the whole thing just plunged.

After the government injected more stimulus, the economy improved, Koo said. But those zigzags only prolonged Japan’s downturn, he argued.

Also at the symposium, former Bank of Canada governor David Dodge warned that U.S. and Canadian banks are underestimating losses they will incur from defaults on credit card and business loans. So-called conventional loan losses tend to rise late in the business cycle, lagging behind the losses generated by the mortgage defaults that led to the current recession in North America, he said.

Those loan losses are going to mount, Dodge said, and they’re going to be larger than banks have provisioned for.

He said this year is essentially history, and it’s going to be a very dark page in the economic history of the world. So we should all be very careful in urging governments to deal with things now, as opposed to urging them to adopt policies that will deal with a problem that is likely to linger for several years.