It s All About Your Asset Allocation

Post on: 7 Апрель, 2015 No Comment

In my first column. I wrote about the importance of a written Investment Policy Statement. In this column we’ll discuss how to select an asset allocation for your IPS.

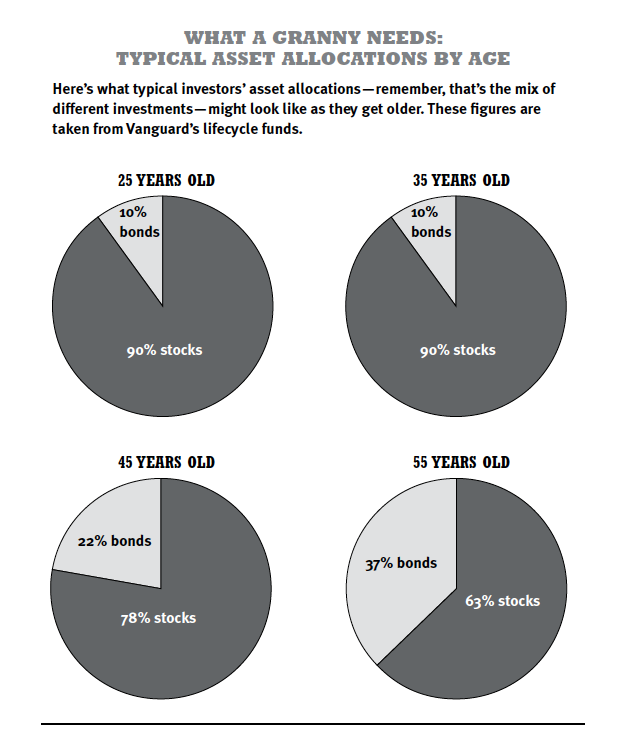

Selecting investments is the fun part of investing; selecting an asset allocation is the tough part. Yet it is the most important part. In his book All About Asset Allocation . my co-columnist Richard Ferri explains that asset allocation is “the amount of money you invest in each of various asset classes, such as stocks, bonds, real estate, and cash.” Research demonstrates that asset allocation will be responsible for more than 90% of portfolio returns, making it far more important than specific fund selection.

Over the last few years investors were reminded once again that higher expected returns always come with higher risk–and that this risk can mean huge declines in portfolio value rather than the gains they had hoped for. Since risk level and portfolio return are directly related, your asset allocation should balance your need to take risk with your ability to withstand the ups and downs of the market.

Need can be determined in many different ways. If you are young, you have the benefit of many years of compounding ahead, so in one respect your need to take risk is low. On the other hand, your portfolio size is probably small, leaving you with a long way to go to reach your retirement goals. As a result, you could argue that your need to take risk is high.

If you are closer to retirement and feel you do not have enough saved and need to catch up, you may feel your need to take risk in order to generate better returns is high. Or, you may have achieved your financial goals and have a low need to take risk in your portfolio.

For people closer to retirement, it may be possible to more closely determine need. First, estimate approximately how much income will be needed annually after retirement. For this example, we’ll assume you need $100,000 per year. Next, look at any pension or social security benefits that will provide a source of income. If a pension provides $30,000 per year and social security provides an additional $20,000 per year, your portfolio would need to provide the remaining $50,000 each year.

Academic research demonstrates that you should probably withdraw no more than 4% of your portfolio value per year in retirement if you wish to have your portfolio last over a projected 30-year retirement. Based on a 4% withdrawal rate, you’ll need $250,000 in savings to provide each $10,000 per year in needed income. How close are you to your goal?

Your ability to take risk relates to your personal tolerance for withstanding a down market without panicking and making changes to your asset allocation that are contrary to your IPS. Selling in the face of a market decline is about the worst thing you can do because it turns what could be a temporary loss into a permanent loss. Unfortunately, many investors did just that in the last few years when their emotions got the best of them. Data from a figure in The Bogleheads’ Guide to Retirement Planning demonstrates the amount of portfolio decline possible for various stock/bond allocations.