IShares Trust Vanguard High Dividend Yield ETF Retirement Dividend Yield v Growth

Post on: 16 Март, 2015 No Comment

Have you ever wondered how billionaires continue to get RICHER, while the rest of the world is struggling?

I study billionaires for a living. To be more specific, I study how these investors generate such huge and consistent profits in the stock markets — year-in and year-out.

CLICK HERE to get your Free E-Book, “The Little Black Book Of Billionaires Secrets”

Another great feature is that they typically have great coverage ratios, and still retain a good amount of earnings to invest in new revenue streams to grow the bottom line. In turn, dividend growth indexes should stand a better chance to keep pace with broad market indexes for investors that are still in their accumulation phase. Those that are able to make these key investments in the earlier stages of their life cycle and then reinvest over time will stand to benefit from a significant yield on cost. This could ultimately make for a more robust income stream when the time comes to draw form the investment in retirement.

For late stage planners or new retirees that are just beginning to draw from their nest egg, I recommend a slightly larger allocation to dividend growth than dividend yield to keep pace with inflation and the markets over the next several decades. These allocations should then strategically taper off into high dividend yield if more stability or income is desired.

Balancing your individual income needs with your desire for capital appreciation should be the single largest factor when sizing an allocation to each strategy. Finally, identifying where you are at in your life cycle and how much volatility you feel comfortable assuming should be a secondary consideration when determining the amount of dividend growth versus dividend yield.

A hypothetical mix within a diversified equity sleeve for someone nearing retirement or just entering retirement could be 60% dividend growth versus 40% dividend yield. Conversely, an investor in retirement currently drawing from their portfolio could allocate just 20% dividend growth, while reserving the remaining 80% for dividend yield.

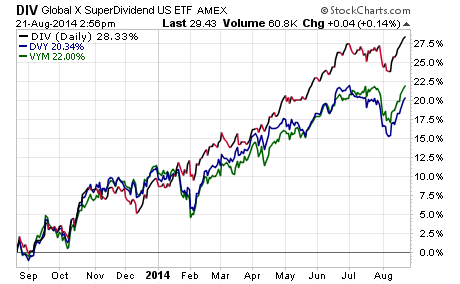

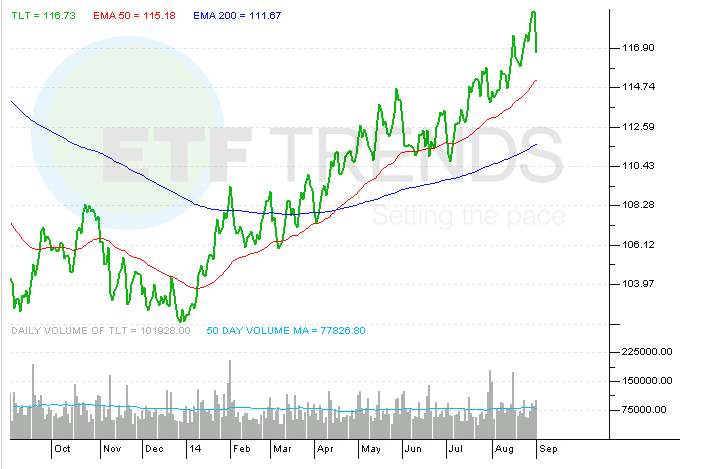

From a strategy perspective, for clients in our Strategic Income portfolio, we are waiting to add additional positions in high-dividend-yield and dividend-growth ETFs during the next pullback greater than the 1%-2% dips we’ve witnessed over the last several months.

Two of our favorite funds for high income include the iShares High Dividend ETF (NYSEARCA:HDV) and the Vanguard High Dividend Yield ETF (NYSEARCA:VYM). For dividend growth, we favor the WisdomTree U.S. Dividend Growth (DGRW) and the Vanguard Dividend Appreciation (NYSEARCA:VIG).

This article is brought to you courtesy of Michael Fabian from FMD Capital Management.