Is Your Portfolio Overweight

Post on: 21 Июнь, 2015 No Comment

Most persons, early each year, are passionate about their new year’s resolutions. Among these decisions are plans to exercise, get fit, lose weight, and ensure greater balance in their lives. With the focus on greater balance in your lives, with diet and exercise, as investors, it is also critical to consider the health of your investment portfolios.

While you can easily step on a scale and compare your weight, relative to your ideal Body Mass Index (BMI) weight range; it is not as simple to ascertain whether or not your portfolio is in perfect shape, or overweight.

GETTING YOUR PORTFOLIO IN SHAPE

It begins with diversification, supported by strategic asset allocation. Simply put, diversification is the process that puts together a variety of investment assets, with the intention of reducing the overall risk exposure of the portfolio. These proposed mix of assets should be invested across the various asset classes and have little or no correlation with each other, in order to achieve the desired results. Strategic Asset Allocation, on the other hand, is an investment strategy that aims to balance risk and reward by apportioning a portfolio’s assets according to an individual’s goals, risk tolerance and investment horizon.

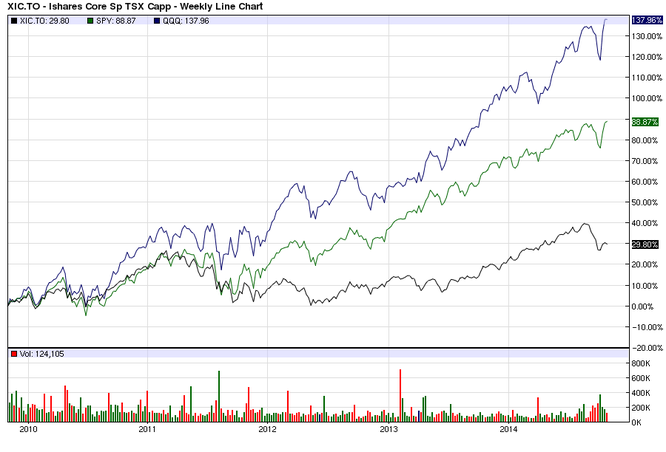

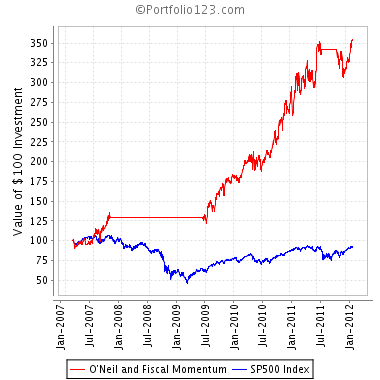

This is important because individual asset classes can be volatile, but in a well-constructed portfolio, there will be other investments that can partially offset that volatility, both on the upside and downside; thus producing a more stable return pattern. Additionally, asset allocation helps investors keep a long-term perspective and avoid knee-jerk reactions. Investors have a tendency to chase the best-performing segments of the market, and shun poor-performing areas. Yet, it is extremely difficult to determine which assets will continue to be top performers.

KEEPING YOUR PORTFOLIO IN SHAPE

While portfolios can become overweight, for example, due to the high performance of one asset class, it is important to remain true to your objectives and return to the original allocation. This will entail the off-loading of some assets, or making additional purchases in another, to maintain that efficient balance of risk and return. This will ensure that at all times the portfolio’s risk is constrained, while still performing with the view to achieve predetermined investment objectives. It is important to ensure your portfolio is at all times appropriately balanced relative to your risk profile, investment objectives and time horizon.

A balanced portfolio is based on your unique circumstances and is kept in ideal shape with the right mix of assets including: US$ global bonds, unit trust investments, as well as local and regional equities investments.

Regardless of portfolio size, investor risk profile, and portfolio objectives, it is important to conduct periodic reviews. An aggressive investor with a growth objective, who begins to experience a loss in value in one asset class, can seek to rebalance his/her portfolio by way of increasing holdings in that asset class, once the long- run value proposition remains strong. This allows for the portfolio to return to its original strategic allocation. While a conservative investor, with an income generation objective with excess cash, must seek to rebalance by reducing cash holdings and increase, for example, holdings in bonds.

For an investor seeking long-term growth, ensure that equities such as: GraceKennedy, Jamaica Teas and Lasco Manufacturing are part of your portfolio holdings, in the appropriate amounts relative to your risk profile. With an objective of income generation, your focus should be on ensuring that your portfolio has the right mix of global bonds, in the appropriate weighting.