Is Vanguard a Good Company for Investing in Mutual Funds

Post on: 21 Июнь, 2015 No Comment

There are dozens of mutual fund issuers and aggregators that currently operate in the United States. Across the globe, there are hundreds of brand-name fund managers that strive to earn market-beating returns while minimizing the inherent risks of the equities markets. Some of these firms have enjoyed consistent success and earned the respect and admiration of international financial experts. Others are regarded as mediocre, overpriced or inexpertly-managed. Still others are poorly-regarded. Although mutual fund issuers rarely go bankrupt or become defunct, many poorly-performing funds are plagued by declining client rosters. Those that can't attract new inflows of cash may be forced to sell their assets to a larger fund or divest completely from the market.

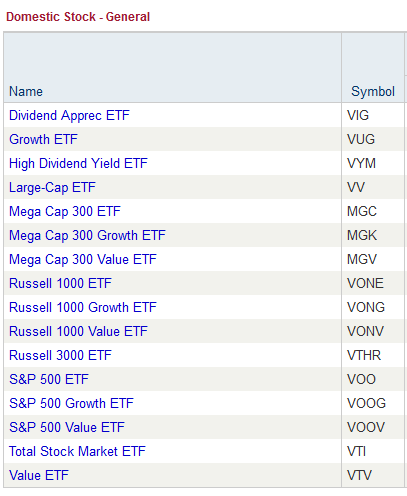

Fortunately, Vanguard is not one of these poorly-performing mutual fund managers. In fact, Vanguard is regarded as one of the country's most innovative and consistent financial institutions. If you're thinking about putting large sums of your hard-earned money in a basket of relatively safe mutual funds, this institution may be able to provide you with solid returns.

There are several ways in which Vanguard distinguishes itself from its competitors. First, it is widely regarded as the least expensive major mutual fund manager. Although all mutual fund managers charge a combination of load, management and other fees, there is a tremendous amount of variation between different fund management companies.

Fund managers that incorporate lots of foreign equities, esoteric commodities or other unusual financial products into their mutual funds may charge higher management fees than fund managers that stick to well-known baskets of dividend-producing American stocks. Likewise, fund managers that eschew high-risk investment vehicles often don't charge expensive load fees. Assessed at the initial point of a fund's purchase, load fees reach 5 percent or more of the total amount invested in the fund. During down markets, these fees can substantially reduce the returns that loaded funds produce.

Vanguard is one of the only fund managers that doesn't charge load fees. This is a significant point of distinction with many of its closest competitors. In fact, its decision to eschew load fees may have contributed to the rapid increase in inflows that the company has experienced since the end of the financial crisis. In 2012, Vanguard accounted for nearly 40 percent of all mutual fund inflows and looks poised to repeat this performance in the coming years. If you're looking for a relatively safe retirement investment, you should consider putting some of your money in Vanguard's mutual funds.