Is Life Insurance a Good Investment_2

Post on: 26 Май, 2015 No Comment

You can opt-out at any time.

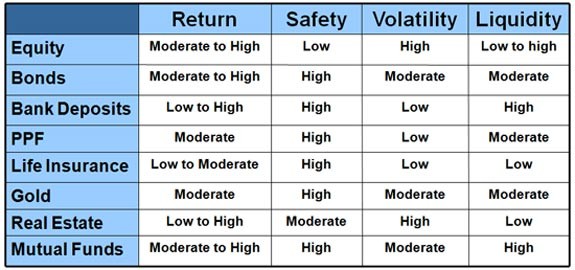

I should write this article anonymously because I am afraid of the hate mail I am likely to receive. This opening line should give you some indication as to my position on buying life insurance solely for investment purposes. That being said, there are situations in which life insurance has its purpose in the investment arena, but that application is usually earmarked for wealthy individuals and sophisticated investors. Suffice it to say since if you are reading this article, which is in the investing for beginner’s site, life insurance is probably not the investment choice for you.

This is not to suggest that insurance is not an important part of a sound financial plan. In fact, if people rely on you for financial support, it is in my opinion an essential piece of the financial puzzle.

This being said, a hammer is generally best used as a hammer. I could use it to pry open a can of tuna but that is not its primary function. I would encourage you to think of insurance in a similar fashion. Here are some insurance terms you may hear.

A whole life insurance policy covers the insured for their whole life while simultaneously building cash value. The cash value grows tax deferred. This is considered permanent insurance.

Term Insurance

Term insurance covers the insured for a specific period of time. The premiums are a fixed rate.

Variable Life

Variable life is similar to whole life insurance in its features but has the added feature of allowing the policy holder to allocate a portion of the premium payments to a separate account which may consist of different investment funds.

Universal life is similar to whole life insurance but offers more flexibility with respect to making adjustments to premiums or the face amount of insurance.

These are very basic definitions of some common life insurance products available. My purpose is not to discuss the applications of insurance; I am solely looking at insurance as an investment choice. In my opinion, I believe that you should buy insurance to satisfy your insurance needs and invest on your own. Term insurance offers the lowest cost option, but it is not permanent insurance. If you are buying insurance with the sole purpose if buying it as investment, you are paying a premium to do so and you are likely limiting the investment choices you could otherwise have available to you.