Is Fed Sowing Seeds Of Next Recession

Post on: 16 Март, 2015 No Comment

Janet Yellen speaks during her first news conference as Federal Reserve Chair in Washington on Wednesday. — AP View Enlarged Image

Monetary Policy: Now that Janet Yellen says the countdown to a Fed interest-rate hike has begun in earnest, maybe we should ask a follow-up question: Is this also a countdown to the next recession?

In her first remarks as new Fed chairwoman, Yellen this week seemed to back off the central bank’s earlier vow to start raising interest rates only when unemployment falls to 6.5% or lower.

Instead, she said, the Fed will rely on a wide range of information, including measures of labor market conditions, indicators of inflation pressures and inflation expectations, and readings on financial developments.

We’re not sure what she means by that, but she did make a prediction of sorts: The Fed will wait a considerable time after its $85 billion-a-month bond-buying program ends before starting to raise interest rates.

And what exactly does a considerable time mean? She implied it would be about six months, give or take. We should note that, as she spoke, the Dow Jones industrial average swooned.

While Yellen’s comments were opaque at best, the Fed’s official forecasts show a fed funds rate of 1% by the end of 2015, up from basically zero now. And by the end of 2016, the forecast sees a 2.25% rate higher than earlier estimates.

The bottom line is, we’ve basically had zero interest rates for almost five and a half years now, so a fairly big rise is on the way.

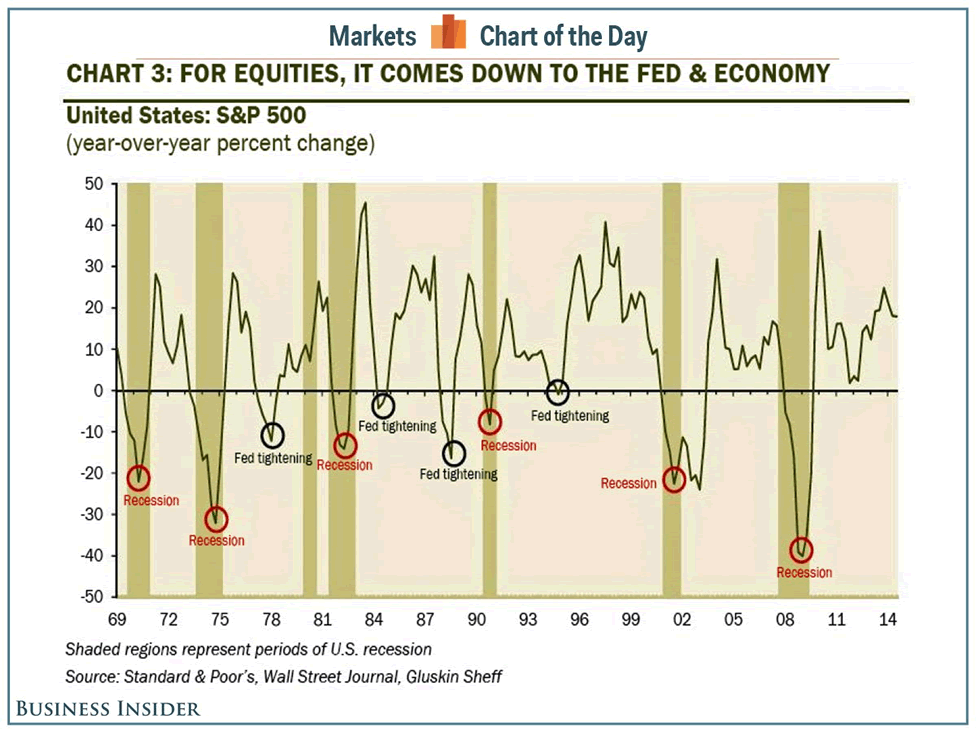

If you go back in history, you can see that substantial rises in interest rates have always preceded recessions. Always. But even after half a decade of interest rates near zero, the economy is still basically just crawling.

GDP growth remains less than half the normal pace for a recovery. We still have 2 million fewer jobs than we did at the peak in late 2007. While unemployment has indeed fallen to almost 6.5%, it’s mainly due to frustrated jobseekers leaving the workforce entirely.

There has never been a recovery worse than this, (and) there is no reason to think doing nothing would have turned out worse, said University of Georgia economist George Selfin, speaking at an American Enterprise Institute conference on the Fed this week.

The Fed, in short, has painted itself into a corner.

Things that are economically possible with interest rates below 1% are no longer possible when rates rise even to 2%. And what happens when interest rates eventually return to normal, around 5% or so?

As the Fed unwinds its stimulus, we’ll face monetary head winds to economic growth for years to come. The Fed put us into this spot; now it can’t get us out.

The economic impact will be severe.

Even if Obama weren’t adding a trillion dollars a year to our debt, just returning to 5% interest rates would raise federal debt payments $600 billion a year.

And with many mortgages and nearly all consumer credit carrying adjustable interest rates, a big hike in rates will hit already struggling families hard.

By keeping rates at abnormally low levels after the financial crisis in 2008 to stimulate growth, the Fed distorted markets and made our economic pain inevitable.

So, yes, the Fed will raise rates. And as it does, it will almost certainly sow the seeds of our next recession.