Is Dividend Investing Just A Fad

Post on: 14 Июнь, 2015 No Comment

Is Dividend Investing Just A Fad?

Last update on Aug. 7, 2013.

Shenanigans. Companies are taking advantage of the popularity with dividends to ‘trick’ investors into buying stock

In the last installment of the series, I explained what dividends are, and why dividends have no bearing on the short term price of stocks.

I think I’m going to offend some people today, because I’m going to explain why I think dividends are just a fad.

Why dividends are popular today

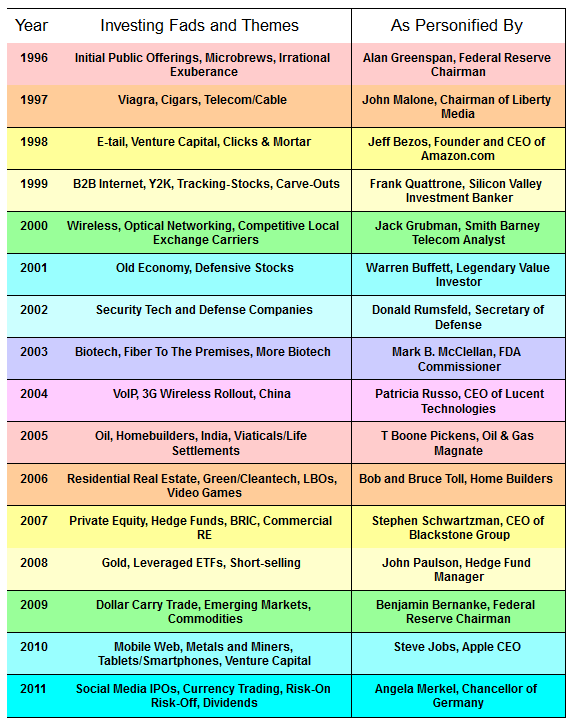

Dividends werent always this popular. Throughout history, there were periods in time when it was more popular than others. We live in one such period today.

Dividends recently became popular in the aftermath of the financial crisis in 2008. In order to keep the economy from free-falling, central banks around the world cut short term interest rates to rock bottom. Then, they engaged in money printing (sort of) to drive long term interest rates down to ridiculously low levels as well.

For decades, people with savings had invested part of their money in long term bonds that paid decent interest rates. In the year 2000, 30-year US bonds paid over 5%/year. In eary 2013 though, you were lucky to get 3%/year, which is about the rate of inflation for the past 100 years.

Those bond investors weren’t happy with the 3% of course, so they started looking for alternatives. They realized that some stocks paid regular dividends of 5%/year or more. So instead of buying bonds, they bought dividend paying stocks. The demand for such stocks rose, which pushed up their values.

The minority of investors who picked stocks based on dividends saw their portfolios gain in value. This made them feel good, which made them more vocal about investing in dividend stocks. This led to the current popularity with dividends.

The Shenanigans Begin

Before long, dividend paying stocks became much more highly valued than their non-dividend paying peers. This wasn’t lost on corporate executives, of course, nor wall street bankers for that matter. Companies that didn’t pay dividends started paying dividends, and those who already paid dividends upped their dividends. Everytime they did, investors rewarded them by buying more stock, which increased their stock prices.

Pretty soon, companies that couldn’t afford to pay dividends were paying dividends. How? Four letters: DRIP.

DRIP stands for ‘Dividend Reinvestment Plan’. This is how it works. When you own stocks that pay dividends, you have the option of signing up for the DRIP. If you do, you automatically reinvest your dividends to buy more stock. As a result, it’s as if you received stock dividends, rather than cash dividends.

This is great for a company wanting to pay dividends without really paying dividends. Let’s say the company can only pay out $50 million in dividends every year, but it wants to pay out $100 million. They declare $100 million in dividends, but they also institute a DRIP, which half of their investors sign up for. They therefore only have to pay out $50 million in cash, and they hand out $50 million in shares.

Why Cutting Dividends Are Better Than DRIP

To understand why DRIP is a waste of money, let’s imagine for a minute that everyone signs up for the DRIP. Then, the corporation doesn’t have pay out any cash for their dividends; only shares. Let’s say it pays out 1 share for every 10 shares you own, and let’s say there’s a total of 10 million shares.

When the company pays out the ‘dividend’, everybody gets 1 share for each 10. The guy who had a million shares get 100,000 shares. The guy who had 10 shares get 1. Everyone’s share count increases by 10%, so everyone retains the same percentage of the company. In other words, if you owned 5% of a company, you’ll still own 5% after.

For the corporation, there is no change in their value. They had just as much cash, and they’re earning just as much as before. I suppose there’s a small difference though — they had to file all the paperwork to administer the DRIP.

Since you still own the same percentage of the company which is worth pretty much the same amount, you’re no richer than if the company didn’t pay dividends at all. But for you, there is a difference. You now have to pay taxes on your ‘dividends’.

What a stupid way to waste money.

What the future holds

As stupid as it is, increasing dividends has worked. The companies which increased their dividends saw their values go up. (As an aside, it’s stuff like this that really makes me wonder how anyone can believe the markets are efficient .)

However, I believe the dividend love-in is coming to an end.

Some day, the world economy will get back on its feet. When this happens, the central banks around the world will stop trying to lower long term interest rates. This has already started to some degree, but in the future, I can see long term bonds yielding 4%/year again.

At that point, a lot of people who bought dividend stocks will question why theyre holding them, instead of the much safer bonds. Sure enough, theyll sell their dividend stocks to buy bonds. Having a large amount of sellers will put downward pressure on dividend stocks, lowering their prices.

At the same time, high growth stocks will thrive in a good economy. As I will explain in the next installment, high growth stocks tend to pay little if any at all, in dividends. This will lift their stock prices far faster than it will for dividend stocks.

People will start saying that you should buy stocks for their growth, not for their dividends. As this becomes the new mantra, people will buy high growth stocks and dump dividend stocks. Again, youll have more sellers than buyers of dividend stocks, lowering their prices.

Im not predicting anything special here — all this has happened in the past, and all this will happen again.

In the next installment, I will explain why paying dividends actually hurts great companies. If you have any questions, please leave a comment. Thanks for reading, and have a great day.