Is corporate social responsibility profitable for companies

Post on: 20 Июль, 2015 No Comment

Will businesses continue to invest in development if Wall Street doesn’t reward them? Photo by: Benjamin Dumas / CC BY-NC-SA

This article is produced and published by Devex Impact. a global initiative of Devex and USAID. that focuses on the intersection of business and global development and connects companies, organizations and professionals to the practical information they need to make an impact.

In 2011, Harvard Business School Professor Michael Porter – the king of business gurus – put forward a radical proposition to global corporations.

“Businesses must reconnect company success with social progress,” he wrote in the Harvard Business Review. “Shared value is not social responsibility, philanthropy, or even sustainability, but a new way to achieve economic success. It is not on the margin of what companies do but at the center.”

“We believe that it can give rise to the next major transformation of business thinking,” he boldly pronounced.

Though Porter’s idea of “shared value” was warmly embraced by the heads of some of the world’s largest corporations – all of which have active corporate social responsibility and sustainability programs – not everyone was convinced.

Larry Summers, the former U.S. treasury secretary, and a colleague of Porter’s at Harvard, was overheard at the World Economic Forum meeting in Davos, not longer after the announcement of the idea, asking incredulously: “Do you believe this [expletive]?”

Summer’s offhand comment captured the core argument at the root of corporate global governance efforts. There is a wide chasm between those who believe that corporate social responsibility and sustainability are integral to company profits and growth, and those who believe such efforts are public relations at best and a distraction from core activities at worst.

“These conversations about corporate social responsibility and profits are held in silos,” said Nigel Cameron, president of the Center for Policy on Emerging Technologies (C- PET ), a Washington D.C.-based think tank that analyzes emerging trends in business and government. “The CSR people talk to the CSR people and the corporate people talk to corporate people.”

“There isn’t a connected discussion going on at a high level,” he said.

The question of whether corporate social responsibility is profitable and adds value to a company is important to the development community because the private sector has far greater resources than government aid programs. If the game-changing resources of the world’s largest corporations are put toward the tasks of poverty, climate change and other global challenges, the results could be dramatic.

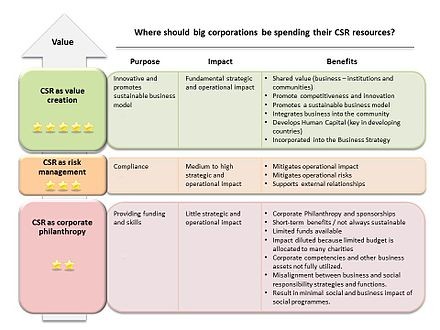

Corporate social responsibility over the years has developed from a simple form of check-writing by companies to a complex set of principles that encompass nearly every interaction a company has with society.

“Corporate social responsibility encompasses not only what companies do with their profits, but also how they make them,” according to a definition from the Corporate Social Responsibility Initiative at Harvard’s Kennedy School of Government. “It goes beyond philanthropy and compliance and addresses how companies manage their economic, social, and environmental impacts, as well as their relationships in all key spheres of influence: the workplace, the marketplace, the supply chain, the community, and the public policy realm.”

Porter’s theory of “shared value” takes the concept of corporate social responsibility further. He argues that companies should use their interactions with society – and more importantly address society’s problems – to drive new business opportunities and create a source of significant untapped profits.

“The ability to address societal issues is integral to profit maximization instead of treated as outside the profit model,” Porter wrote in the Harvard Business Review article, which he co-authored with Mark Kramer, founder of the nonprofit consultancy FSG .

In the debate over the role that profits should play within the realm of corporate citizenship, the views on both sides of the issue can be stark.

Alice Korngold, a New York-based corporate social responsibility consultant to global corporations, echoes many of Porter’s basic concepts.

“There is no question that companies that are the most effective in integrating sustainability in their values and strategy will be the most successful in increasing shareholder wealth,” she said in an email interview. “Businesses that are the most innovative in finding solutions to global challenges – such as climate change and energy, economic development, education, healthcare, human rights, and protecting ecosystems – will be the most profitable.”

The opposite case has been made by Aneel Karnani, a professor of strategy at the University of Michigan’s Ross School of Business. He argues that by seeking profits and growth, companies generate employment and other benefits to society. They should focus on that task.

“The idea that companies can ‘do well by doing good’ has caught the attention of executives, business academics, and public officials,” Karnani wrote in his 2010 study “Doing Well by Doing Good: The Grand Illusion.” “This appealing proposition has convinced many people. It is also a fundamentally wrong proposition.”

“If markets are working well, there is no need to appeal to companies to fulfill some vague social responsibility,” he wrote.

As a practical matter, for those who make decisions associated with large scale investments in companies, the issue is more nuanced, according to Bharat Joshi, an investment manager at Aberdeen Asset Management in Malaysia who works with a team to oversee $1.7 billion in assets.

“If you ask us strictly as an investor, the key is that the company is being responsible on the social side but at the same time they have sustainable earnings, and it does not jeopardize the operations of the business,” he said in a telephone interview.

“Companies should do CSR in a measured way, not funnel cash to a founder’s social business or charity,” he said. “It is okay to take from the bottom line if it is being done in a sustainable way. It’s healthy and investors look at it quite highly.”

Joshi noted that the relationship between profit and social responsibility is a more pressing issue in the United States, where companies place a premium on corporate social responsibility. Many large companies in other parts of the world, including Asia, need to focus on running their operations with more transparency before they try to improve the world around them.

“They must get corporate governance right, get their house in order first, before they address sustainability and social issues,” he said.

Peter Gampel, the director of business valuation at the accounting firm Fiske & Company in Florida, in the United States, noted that a company’s value is based on its tangible assets – such as it cash holdings, property and buildings – as well as its intangible assets.

“If there is a merger, we are brought into put a value on intangibles,” he said. “There are dollar amounts for patents, licenses, customer relationships, trademarks, but we don’t usually try to assess the value of a company’s social responsibility. This is not quantifiable from a numbers point of view.”

But, Gampel said, social responsibility does clearly have an impact on a company’s value and profitability. Companies that are socially responsible make their brands more attractive to consumers and are more appealing to high quality potential employees. The impact on the profits of companies that behave poorly is less clear.

The situation of Foxconn, the Taiwan-based electronics manufacturer best known for making Apple products in China, is one of the clearest examples of the conflict between social responsibility and profit. Foxconn has been implicated in using underage workers and poor conditions at its factories have been linked to a series of employee suicides.

Despite the scandal, however, the sales of Iphone, Ipads and other Apple products produced in China have soared.

“If conditions were very dire and deplorable for the workers, consumers at some point would say maybe we shouldn’t buy this product, but I think it will take a lot to get that point,” said Gampel. “It will take a lot to get consumers to switch brand loyalty over social issues.”

The situation is similar for investors, he said. They might be concerned about social issues, but it will not easily stop them from making a profitable investment.

“I don’t think the social responsibility issues override the importance of profitability from the investors’ perspective,” he said.

The research on the relationship between profits and social responsibility is inconclusive. It indicates that large scale investors and the stock market do not clearly reward or punish a company based solely on its global corporate citizenship or sustainability efforts, though there are indicators of a slight profit benefit to doing social good.

The one thing that proponents and opponents of linking corporate social responsibility to profits agree upon is that more definitive data is needed. A key problem is how to gauge corporate global citizenship. Companies often have an inflated view of their efforts on the issue, and public relations is often inter-twined with social responsibility activities.

A 2009 working paper by the Bank of Finland looked at companies that were included or excluded in a key social responsibility ranking between 1990 and 2004, and the impact that it had on the value of their stock. The study found that stocks dropped an average 3 percent when a company was removed from a list of socially responsible companies. When a company was added to the list, its stock enjoyed a market value boost of about 2 percent.

In one of the most definitive studies on the topic, researchers from Harvard Business School, University of California and the University of Michigan reviewed 167 scholarly studies, according to a summary of their work in the report “Measuring the Value Of Corporate Philanthropy: Social Impact, Business Benefits, And Investor Returns,” produced by the Committee Encouraging Corporate Philanthropy.

The study authors concluded that “after thirty-five years of research, the preponderance of scholarly evidence suggests a mildly positive relationship between corporate social performance and corporate financial performance and finds no indication that corporate social investments systematically decrease shareholder value.”

The research indicates that the profit link to social responsibility could be vulnerable to other company activities. For example, global corporate citizenship might indeed be profitable but exploiting workers or destroying natural resources in developing countries might be more profitable.

The relationship between social responsibility and profits has not been demonstrated to the point that it is the primary driving factor in the way large scale, mainstream investments are undertaken. But there are notable efforts to go beyond socially responsible investing and bring in the hedge funds, institutional investors and other major players.

In 2006, then-United Nations Secretary General Kofi Annan launched the UN Principles for Responsible Investment, a set of values and guidelines for sustainable investing. To date, nearly 1,000 asset owners and investment managers – including many mainstream funds – are signatories to the program. Though the effort is worthy of praise, its critics note that the principles are voluntary. Asset managers can enjoy the prestige of becoming a signatory and ignore the principles if they choose.

Another more low-key but influential effort was established by the late actor Paul Newman in 1998. The Committee Encouraging Corporate Philanthropy was created to encourage companies to commit greater resources to philanthropy. Today, its members include the CEOs of some of the top global corporations, and it funds in-depth research into topics such as the links between profitability and corporate responsibility.

Though many are having the conversation about linking core company operations and profit to social responsibility, their clearly remains a large divide in the debate.

To illustrate this point, Cameron, the president of the Washington D.C. think tank Center for Policy on Emerging Technologies (C- PET ), recalled a speaking engagement he had at the Planet Under Pressure conference in March 2012 in London in the run-up to the United Nations Conference on Sustainable Development (Rio+20).

He noted that the event was billed as a premiere gathering of those interested in issues associated with climate change, but there was almost no corporate presence at the meeting. The heads of the world’s energy companies were also not in attendance.

“If the energy companies saw this discussion as part of their core mission, they would have been part of the process,” he said. “It was mostly CSR people.”

According to Cameron, the debate on whether social responsibility is profitable will not be answered by studies and research. It will be answered by the actions of the world’s largest companies those who lead them.

“For most people at the top end of the investment community, the business community, the banks, the people who push the capital markets around, corporate social responsibility is a fringe issue,” he said. “If the people at the top saw this as an issue of building long-term value, there would be a retooling of corporate resources and activities across the board. We aren’t seeing that now.”

Though the debate is far from settled over the profitability of corporate social responsibility, there is near complete agreement that corporate citizenship is no longer an option. It is now a requirement.

Corporate social responsibility is an intangible asset that in some cases is integrally linked to a company’s profits – such as Starbuck’s, which markets its coffee as beneficial to the growers who produce it. Its social responsibility in part justifies the fact that its prices are higher than a generic cup of coffee at the convenience store.

In other cases, social practices are more about risk mitigation. A chemical company might have little public profile or apparent need to address social issues, but if its waste fouls its surrounding community it will likely pay a price in litigation and government sanctions that affects its profits.

Companies around the world, and those who trade their shares and analyze their value, have recognized that corporate social responsibility has inherent value for a company. The exact dollar figure on that value may never be clearly quantified but the general trend toward greater corporate engagement in social issues is one that will have long-term impacts on the development community.

Explore related content

Join the 500,000-strong Devex community to network with peers, discover talent and forge new partnerships – it’s free! Then sign up for the Devex Impact newsletter to receive cutting-edge news and analysis every month on the intersection of business and development.