Iron Mountain Board Approves Plan to Pursue Conversion to REIT Iron Mountain

Post on: 30 Май, 2015 No Comment

Proposed Conversion Aligns With Operating Strategy and Provides Significant Benefits to Stockholders

Company to Distribute Accumulated Earnings and Profits (E&P) of Approximately $1.0 Billion to $1.5 Billion in Conjunction with Conversion

Company Announces 8% Increase in Quarterly Dividend Rate

Long-Term Capital Strategy Will Naturally Shift Toward Increased Use of Equity to Support Lower Leverage and Real Estate Investment

BOSTON June 5, 2012 Iron Mountain Incorporated (NYSE: IRM) today announced that its Board of Directors has unanimously approved a plan for the company to pursue conversion to a Real Estate Investment Trust (REIT). This decision follows a thorough analysis and careful consideration of ways to maximize value through alternative financing, capital and tax strategies. Should the company be successful in the conversion process, it would plan to elect REIT status no sooner than its taxable year beginning January 1, 2014.

Our Board and management team believe that electing REIT status will maximize value as we advance our operating strategy, said Richard Reese, Iron Mountains Chairman and Chief Executive Officer. A key element of our strategic plan is a disciplined capital allocation strategy to increase stockholder payouts and the REIT structure supports this plan. Additionally, a REIT conversion will have virtually no impact on our customers. They will experience no change in the people, procedures or industry-leading chain-of-custody they have come to trust with Iron Mountain.

REIT Structure Supports Higher Returns and New Value-Creating Opportunities

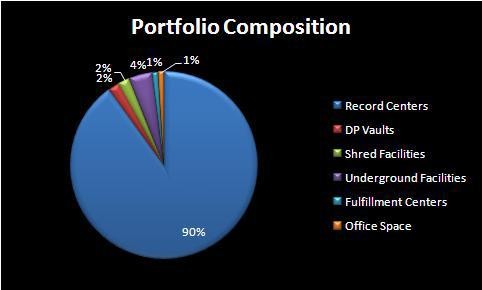

The REIT structure provides stockholders with dividends from U.S. tax savings and other increases in distributable income that will enhance stockholder returns, said Reese. Over time the new structure will facilitate distribution of profits covering approximately 90% of our global storage operations and will also create new opportunities for value creation through increased ownership of real estate and expansion of our stockholder base.

Given that the largest portion of our income is from renting storage space to customers in our more than 64 million square feet of real estate around the globe, we believe conversion to a REIT is the best structure under which to execute our strategy, added Reese. The quality and diversity of our customers are at the center of this opportunity supporting a very durable rental income stream, with stable, high occupancy levels, strong retention and low tenant turnover costs. These characteristics of our business are strikingly similar to those of many real estate and related service companies, and by some measures, even more attractive.

Company Announces Plan to Support Conversion and Stockholder Payouts

In accordance with tax rules applicable to REIT conversions, Iron Mountain expects to distribute accumulated earnings and profits (E&P) of approximately $1.0 billion to $1.5 billion to stockholders, to be paid out in a combination of at least 20% in cash and up to 80% in Iron Mountain common stock. The company expects it will distribute a significant portion of this E&P distribution in the fourth quarter of 2012. The company expects to distribute the balance over several years beginning in 2013 based, in part, on U.S. Internal Revenue Service (IRS) rules and the timing of the conversions of additional international operations into the REIT structure.

Separately, the company announced an 8% increase in its next six regular quarterly dividend payments, accelerating distributions to stockholders with total cash dividends over that period of approximately $280 million, based on the companys currently outstanding shares of common stock. The next quarterly dividend of $0.27 per share is payable on July 13, 2012 to stockholders of record on June 22, 2012.

In addition to payments to stockholders, Iron Mountain expects to incur approximately $325 million to $425 million in one-time costs to support the conversion process, including related income tax liabilities. The company plans to seek a Private Letter Ruling (PLR) from the IRS on a number of technical tax issues, including the characterization of its racking assets as real estate, which would result in a tax liability for the recapture of depreciation expenses. The total recapture of depreciation and amortization expenses across all relevant assets is expected to result in U.S. federal and state tax liabilities of approximately $225 million to $275 million to be paid out over up to five years beginning in 2012, a significant portion of which may be paid in 2012. Additionally, the company currently estimates additional conversion costs over that period to be approximately $100 million to $150 million with approximately $20 million to $30 million of that amount in 2012 (including approximately $10 million in capital expenditures). If the conversion is successful, the company expects to incur an additional $5 million to $10 million in annual compliance costs in future years and may also incur costs and record non-cash charges to realign its employee equity compensation plans with the REIT strategy.

The company will consider the issuance of debt and/or equity to support projected conversion-related cash requirements, including stockholder distributions, tax payments and other conversion costs noted above.

Long-Term Capital Strategy Moving Toward Lower Leverage and Increased Use of Equity

As a REIT, we will evaluate opportunities to increase our capital allocation toward ownership of currently leased real estate, said Brian McKeon, Iron Mountains Chief Financial Officer. Increased ownership of real estate can provide high return investment opportunities. Owning more of our facilities supports our valuation, helps ensure we meet the REIT asset test requirements going forward and can reduce our costs as we substitute more efficient capital funding for higher-cost lease financing.

We also expect our long-term capital strategy will naturally shift toward lower leverage, reflecting the loss of tax advantages associated with deductibility of interest expense, added McKeon. We will consider a variety of approaches to shift our debt/equity mix toward more equity. This will support our goals of increasing our investment in currently leased real estate and of lowering our leverage over time.

Successful Conversion Requires Approvals; Significant Hurdles Remain

The company has completed an extensive analysis of the REIT requirements and believes it can meet the operational and technical thresholds following the sale of its digital business in June 2011, and by structuring a portion of its international operations as Qualified REIT Subsidiaries (QRS) over time. The companys planned timeframe for REIT election is driven by a number of factors, including: (1) the requirement to separate the U.S. business into Taxable REIT Subsidiaries (TRS) and QRS; (2) the extent of the companys global operations and the need to separate certain of its international subsidiaries into the QRS/TRS structure; (3) the complexity of required modifications to information and accounting systems; (4) further review and development of optimal domestic and international structures; and (5) refinement of the REIT testing process.

We have done the work necessary to feel comfortable that we can operate as a REIT; however, there are a number of hurdles yet to be cleared that are out of our control and there can be no assurances we will be successful in our planned conversion, said Reese. Our team charged with providing support to the Board throughout this process has done an outstanding job getting us to this point.

As noted, Iron Mountain will file a PLR request seeking rulings on several technical tax issues. Should the company be unsuccessful in obtaining favorable IRS rulings, it will not be able to successfully convert to the REIT structure but may still be required to pay up to $225 million to $275 million related to the tax on the depreciation and amortization recapture. In addition, stockholder approval will be required to effect the necessary corporate reorganization, including a provision to establish REIT-related ownership restrictions in Iron Mountains charter. Should the company fail to complete the conversion process it will have incurred substantial costs in this effort.

Principal advisors to the company related to the REIT conversion are EA Markets LLC, J.P. Morgan Securities LLC, Latham & Watkins LLP, Morgan Stanley & Co. LLC, PricewaterhouseCoopers LLC and Sullivan & Worcester LLP.

Conference Call and Investor Presentation

Iron Mountain will discuss the details of its announcement to pursue a potential conversion to a REIT on a conference call for investors on Wednesday, June 6 at 8:30 AM ET. The public may access the conference call through a live audio webcast available on the investor relations section of its website, www.ironmountain.com. The conference call can also be accessed in listen-only mode by dialing (888) 263-0282 for domestic callers or (706) 902-0708 for international callers, conference ID 88486519. The company suggests participants dial in approximately 10 minutes before the call. In addition, a replay of the call may be accessed online at the investor relations section of its website, www.ironmountain.com. or by phone in the U.S. at (855) 859-2056 for domestic callers or (404) 537-3406 for international callers, conference ID 88486519. Telephone replays will be available from 12:00 PM ET on June 6, 2012 until 11:59 PM ET on June 13, 2012.

Iron Mountain will also post an investor presentation on the investor relations section of its website, www.ironmountain.com. by 6:00 PM ET on Tuesday, June 5, 2012. The presentation will be furnished to the Securities and Exchange Commission (SEC) and will be available on the SECs website www.sec.gov .

About Iron Mountain

Iron Mountain Incorporated (NYSE: IRM) provides information management, storage and services that help organizations lower the costs, risks and inefficiencies of managing their physical and digital data. The companys solutions enable customers to protect and better use their informationregardless of its format, location or lifecycle stageso they can optimize their business and ensure proper recovery, compliance and discovery. Founded in 1951, Iron Mountain manages billions of information assets, including business records, electronic files, medical data, emails and more, for organizations around the world. Visit www.ironmountain.com for more information.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

This press release contains forward looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws. The forward looking statements are subject to various known and unknown risks, uncertainties and other factors. When the company uses words such as believes, expects, anticipates, estimates, plans or similar expressions, the company is making forward looking statements. Although the company believes that its forward looking statements are based on reasonable assumptions, its expected results may not be achieved, and actual results may differ materially from its expectations. For example:

This press release states that the company plans to pursue conversion to a REIT and that the company believes it can meet the operational and technical thresholds of becoming a REIT. In fact, there are significant implementation and operational complexities to address before the company can convert to a REIT, including obtaining a favorable PLR from the IRS, completing internal reorganizations and modifying accounting, information technology and real estate systems, receiving stockholder approvals and making required stockholder payouts. The company can provide no assurance when conversion to a REIT will be successful, if at all. In addition, REIT qualification involves the application of highly technical and complex provisions of the Internal Revenue Code of 1986, as amended (the Code), to the companys operations as well as various factual determinations concerning matters and circumstances not entirely within the companys control. Although, if it converts to a REIT, the company plans to operate in a manner consistent with the REIT qualification rules, the company cannot give assurance that it will so qualify or remain so qualified.

This press release states that the company plans to elect REIT status no earlier than the taxable year beginning January 1, 2014. In fact, the company does not know when, if at all, it will elect REIT status, and it may not do so. Further, as described in this press release, many conditions must be met in order to complete the conversion to a REIT, and the timing and outcome of many of these are beyond the companys control.

This press release states that the company believes electing REIT status will provide significant benefits to stockholders, maximize value, provide increases in distributable income to enhance stockholder returns over time, increase the ownership of real estate and expand the companys stockholder base. The companys Board of Directors considered a variety of strategies, and there can be no assurance that conversion to a REIT will be the most beneficial of the alternatives considered. Further, conversion to a REIT may not result in increases in distributable income, and the company can provide no assurance that its stockholder base will be expanded.

This press release provides an estimated range of the companys E&P distribution. The company is in the process of conducting a study of its pre-REIT accumulated earnings and profits as of the close of the companys 2010 taxable year using the companys historic tax returns and other available information. This is a very involved and complex study, which is not yet complete, and the actual result of the study relating to the companys pre-REIT accumulated earnings and profits as of the close of the companys 2010 taxable year may be materially different from the companys current estimates. In addition, the estimated range of the companys E&P distribution is also based on its projected taxable income for its 2011, 2012 and 2013 taxable years and its current business plans and performance, but the companys actual earnings and profits (and the actual E&P distribution) will vary depending on, among other items, the timing of certain transactions, the companys actual taxable income and performance for 2012 and 2013 and possible changes in legislation or tax rules and IRS revenue procedures relating to distributions of earnings and profits. For these reasons and others, the companys actual E&P distribution may be materially different from the companys estimated range.

This press release states that the company expects to pay up to 80% of the E&P distribution in the form of company common stock. The company may, in fact, decide, based on its cash flows, strategic plans, IRS revenue procedures relating to distributions of earnings and profits, leverage and other factors, to pay some or all of these amounts in all cash or a mix of cash and common stock that pays stockholders up to 80% in Iron Mountain common stock.

This press release states that the company anticipates distributing a significant portion of the E&P distribution in the fourth quarter of 2012 and expects to distribute the balance over several years beginning in 2013. The timing of the planned E&P distributions, which may or may not occur, may be affected by potential tax law changes, including an extension of the current tax law regime for taxation of dividends, the completion of various phases of the REIT conversion process and other factors beyond the companys control.

This press release states that the company plans to increase its regular quarterly dividends to stockholders over the next six quarters. The company can provide no assurance that it will increase or even maintain its current level of dividend payouts. In addition, future dividends will be dependent on the companys cash flows, as well as the impact of alternative, more attractive investments to dividends.

This press release provides an estimated range of the companys tax and other costs to convert to a REIT, including estimated tax liabilities associated with a change in the companys method of depreciating and amortizing various assets and annual compliance costs. The companys estimate of these taxes and other costs may not be accurate, and such costs may turn out to be higher than the companys estimates due to unanticipated outcomes in the PLR, changes in the companys business support functions and support costs, the unsuccessful execution of internal planning, including restructurings and cost reduction initiatives, or other factors.

This press release states that the company expects to seek a PLR from the IRS and that the company requires favorable rulings from the IRS before converting to a REIT. The company can provide no assurance that the IRS will ultimately provide the company with a favorable PLR or that any favorable PLR will be received in a timely manner for the company to convert successfully to a REIT as of January 1, 2014. Further, changes in legislation or the federal tax rules can adversely impact the companys ability to convert to a REIT or the benefits of being a REIT.

This press release states that the company may issue a portion of the E&P distribution in shares of its common stock and that it expects to shift its debt/equity mix toward more equity. Whether the company issues equity, at what price and amount and other terms of any such issuances, will depend on many factors, including alternative sources of capital, the companys then existing leverage, the companys need for additional capital, market conditions and other factors beyond the companys control. If the company raises additional funds through the issuance of equity securities or debt convertible into equity securities, the percentage of stock ownership by the companys existing stockholders may be reduced. In addition, new equity securities or convertible debt securities could have rights, preferences, and privileges senior to those of the companys current stockholders, which could substantially decrease the value of the companys securities owned by them. Depending on the share price the company is able to obtain, the company may have to sell a significant number of shares in order to raise the capital it deems necessary to execute its long-term strategy. The companys stockholders may experience dilution in the value of their shares as a result.

This press release states that the company intends to shift its long-term capital strategy toward lower leverage. The company can provide no assurance that it will lower its leverage. The cost of the companys debt will depend on numerous factors, many of which are outside the companys control, including interest rates.

The companys forward looking statements should not be relied upon except as statements of the companys present intentions and of the companys present expectations, which may or may not occur. Cautionary statements should be read as being applicable to all forward looking statements wherever they appear. Except as required by law, the company undertakes no obligation to release publicly the result of any revision to these forward looking statements that may be made to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events. Readers are also urged to carefully review and consider the various disclosures the company has made in the companys filings with the SEC, including the sections Risk Factors and Cautionary Note Regarding Forward Looking Statements in the companys Annual Report on Form 10-K for the year ended December 31, 2011 filed with the SEC on February 28, 2012.

Investor Relations Contact:

Stephen P. Golden

Vice President, Investor Relations