Investor Vs Trader Investing It!

Post on: 14 Апрель, 2015 No Comment

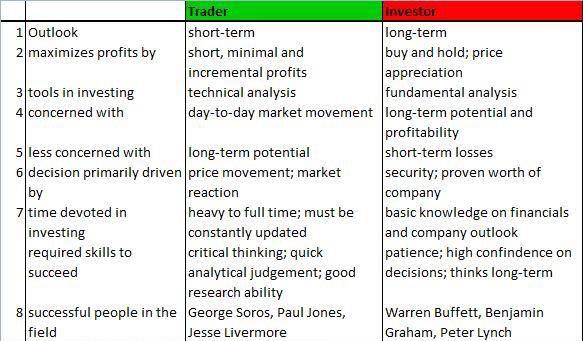

If you are a new entrant in stock market, you will come across some stock market jargons which will confuse you. One of them is related to the identity and behaviour of the stock market participant. Sometimes a participant is referred as stock investor and the next day same guy becomes stock trader. These two terms are used interchangeably resulting in a lot of confusion. We will try to keep this confusion at bay by figuring out the personality and behaviour of stock investor and stock trader through this article.

Stock Investor Vs Stock Trader

We can differentiate between the two on following parameters:

Return Objective and Number of Transactions

Stock investors and stock traders basically approach the stock market with same objective but employ different modus operandi. Both of them want to maximize their return, but stock investor tries to achieve this through a single transaction where as stock trader chooses the route of multiple transactions, but in quick succession. Stock investor just buys and holds the stock while stock trader buys and sells the same stock on a continuous basis.

Time Horizon

Stock investor has a longer time horizon and is ready to hold stocks in multiyear time frame. Stock trader on the other hand has relatively shorter time horizon and is not willing to hold the stock for more than a month or two. There is large proportion of traders who do not even hold the stocks post one day or one week.

Way of selection of stocks for Investment

Stock investors consistently look for undervalued stocks for investment. They are very patient and have the tendency to hold stocks till market realises its actual worth.   Stock traders on the other hand are least worried about the valuation of the stock. They are simply concerned about the price movement. They are ready to buy an overvalued stock, if the price movement suggests so. Similarly, they can short sell undervalued stock if the price movement is in downward direction.

Market segment they are active in

Stock investors are interested in taking delivery where as traders are not interested in taking delivery. This constraint makes derivative market more suitable for traders and cash market for investors.

Trading Tools

Stock investors rely heavily on fundamental analysis for identifying investment avenues. They employ top down and bottoms up approach together with ratio analysis for stock selection. On the contrary, stock traders use technical analysis to maximize their returns. They are only concerned about historical and current price movements. Based on the price movement, a lot of indicators have been defined using which traders place their bet.

Why should you know the difference?

One should use the above parameters to understand his or her psychology before entering the market. Identifying your personality at the very beginning will enable you to employ right tools and techniques to be a winner. It’s difficult to say which technique is better as we have trend setting examples in the form of Mr. Buffet and Mr. Soros from both the fields. Both of them have made a great fortune following two different paths. Hence it’s not recommended to judge the path as both lead to the same destination. It’s only about choosing one based on your psychology. If you are comfortable with speculation, be a trader and if you are conservative, choose to be an investor.

About the Author:

The author Bimlesh Singh is a financial advisor. He holds a Bachelor’s degree from IIT and is a CFA Level 2 candidate. He can be reached at expert@investmentyogi.com

For more details on trading, please click here