Investment Valuation A Little Theory

Post on: 29 Апрель, 2015 No Comment

Investment Valuation: A Little Theory

We’ll start with a little theory before we get to the calculators.

A company is valuable to stockholders for the same reason that a bond is valuable to bondholders: both are expected to generate cash for years into the future. Company profits are more volatile than bond coupons, but as an investor your task is the same in both cases: make a reasonable prediction about future earnings, and then discount them by calculating how much they are worth today. (And then you don’t buy unless you can get a purchase price that’s less than the sum of these present values, to make sure ownership will be worth the headache.)

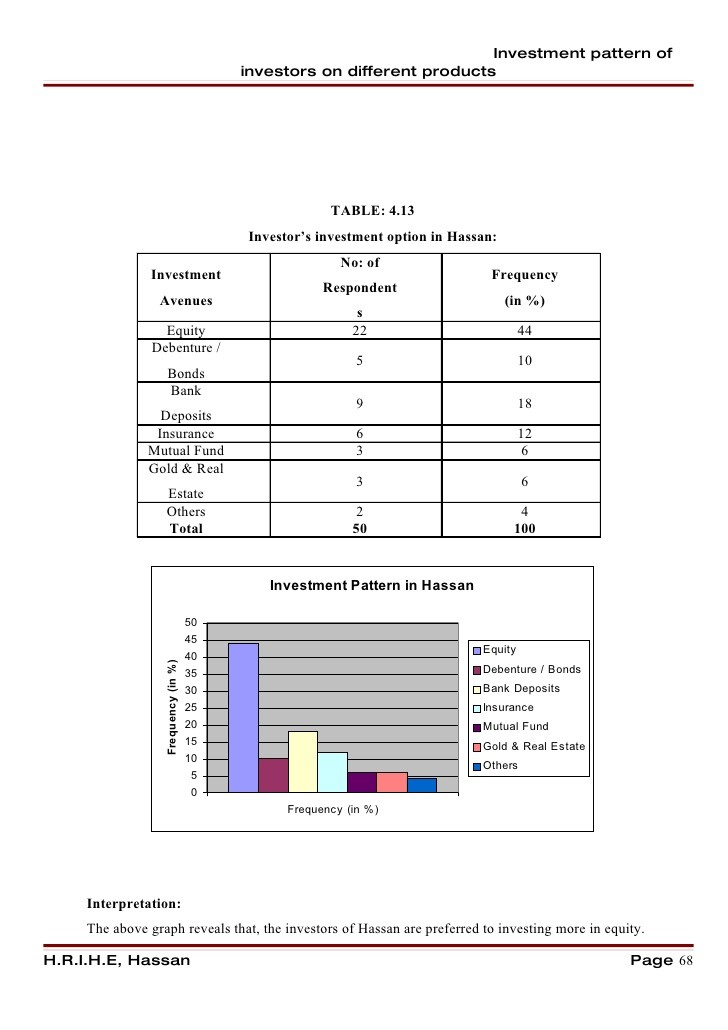

Let’s take an example. Suppose you are interested in a company that earned $10 per share over the last twelve months. Assume you expect the company to grow over the foreseeable future, so that its earnings will grow at a rate of 8% annually for the next 10 years; then, to play it safe, you make no assumptions about earnings after that, but just expect the company to stay at the same size from then on. Your earnings expectations look like this:

Here the height of each blue bar is the earnings per share that you expect for a particular year in the future. (The first bar is earnings over the next twelve months: that is, it’s what you expect the company’s reported annual earnings to be one year from now.)

Now for the discounting, finding how much each blue bar of the future is worth to you in the present. We’ll be using a discount rate of 11%, which is about the average annual return rate of the stock market over the past many decades. The idea is that earnings of $1.11 next year is only worth $1.00 to you right now, since you could invest the $1.00 in the S&P 500 and expect it to grow to $1.11 in one year’s time. Finding the present value of all of the blue bars gives a new graph:

Here each green bar is the value to you, today, of each corresponding blue bar in the first graph.

If you want to check into this in a little more detail, use the popup calculator in future value mode to find that $10 per share growing at 8% annually will grow to $21.59 in 10 years (that’s the height of the blue bar at year 10); and then in present value mode to find that $21.59 10 years from now is worth $7.60 today assuming a discount rate of 11% (that’s the height of the green bar at year 10).

We’ve drawn both graphs with forty bars, but the valuation formulas we’ll use in the calculators assume the company will keep going forever: an infinite number of bars. But the key is that the green bars are shrinking so rapidly that, even though there are an infinite number of them, if you stacked them up they would only reach a finite height: in this example, the height would be $155.40. That total — the sum of the present values of all future earnings — is the theoretical value of the investment right now. (See detail. )

How Long is Forever?

The last paragraph said we’d assume earnings would be going on forever into the future — not exactly a realistic assumption. But it turns out that assumption isn’t really important: the rapid shrinkage of the green bars means that any contribution from the distant future is negligible. In this example, all earnings after year 50 contribute only about one dollar — less than 1% — to the stock’s value today: