Investment strategies topdown vs bottomup

Post on: 7 Апрель, 2015 No Comment

Melanie Timbrell

There are many different strategies you can pursue when choosing shares to invest in. Two approaches commonly used by professional investors are ‘top-down’ and ‘bottom-up’. Here, MyWealth explains the differences between the two and how they can work for you.

The main aim of any investment strategy is to generate enough returns to help you achieve your goals in an appropriate time frame. The question is, how and where do you start in order to get you to this end?

Top-down investing

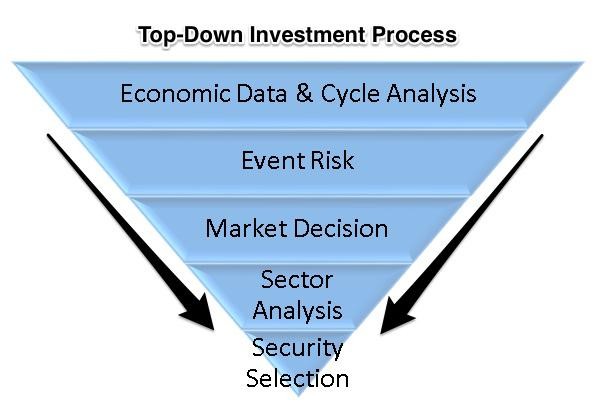

A top-down approach starts by looking at the big picture, which in practical terms means thinking about what the political and economic conditions are like in a variety of different regions and countries around the world.

Closer to home, the top-down investor would be looking at what is happening with Australia’s major trading partners like China and Japan, as well as keeping a close eye on economic indicators, such as domestic employment figures, inflation and interest rates.

The top-down investor would start by identifying a theme at this macro-level and work their way through to a conclusion about what this might mean for a particular sector.

An example of a theme might be a falling currency. For instance, if, back in April this year, a top-down investor saw the US economy powering ahead while the RBA cut interest rates, they might have come to the conclusion the Australian dollar was ripe for a sustained fall. Those who thought that may then have looked at certain sectors within the Australian economy that would be most likely to benefit from a drop in the Australian dollar .

This might apply to sectors such as materials or energy producers, because exports from Australia become more affordable when the currency is cheaper, prompting a rise in demand.

Another example is healthcare, where most of the revenue is earned offshore in a different currency, which means a more favourable conversion to Australian dollars when profits are brought home.

Once the investor decided on a sector they thought might be likely to do well, then they may have looked at specific companies within that sector to determine which were performing best and could add value to their portfolio.

Bottom-up investing

The bottom-up investor on the other hand is very focused on specific stocks, believing that the right company will make you money over time, regardless of what the rest of its sector or industry is doing.

Bottom-up investors will often be attracted to a specific company through reading some news or becoming acquainted with its products or services.

They will then study the company and might look at things like its competitive position within its market, its level of debt, the amount of cash it has, what sort of dividend it pays and how its profits and share price have been growing. Through this detailed research and analysis, the bottom-up investor will then make an assessment on whether the company meets its investment criteria and therefore, whether it looks like a good buy.

Warren Buffett is probably one of the world’s most famous bottom-up investors. He has a track record of buying companies based on an assessment of their fundamental value, and then holding onto these companies regardless of what is happening in the broader economic climate.

In 2009, around the time that markets were bottoming out in the middle of the GFC, Buffett told a Columbia Business School forum that “the world’s not going to tell you about great deals – you have to find them yourself and that takes a fair amount of time”.

An example of a successful bottom-up investment choice would be someone that bought shares in Apple 10 years ago, based on the company’s market share and new suite of products even as the broader sector was in the midst of the so-called ‘tech wreck.’

Which is better?

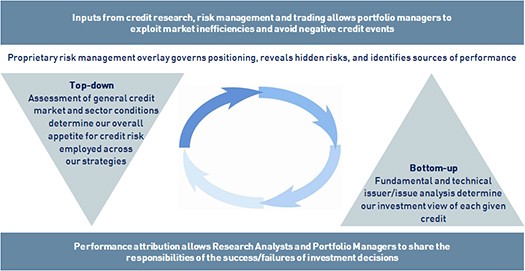

There are advantages and disadvantages associated with both strategies. While many fund managers may advocate one approach or the other, in reality many investors end up using a combination of the two. For example, you might use the top-down approach to arrive at a particular sector you think has the potential to do well, and then use the bottom-up approach to determine which company within that sector is likely to deliver the best value for money.

Alternatively, you could start with some bottom-up analysis to assess the financial health of a number of companies you are interested in.

Once you narrow your list down to companies that look like they are ‘healthy’ and in a position to achieve strong growth in the coming years, you could then apply the top-down approach to determine which of these companies appears to be at an advantage given the macro-economic outlook.

Supporters of the top-down approach will say that it can give investors perspective across a variety of different asset classes, reducing the chance of ending up in a situation where you need to sell when the market is at the bottom. The GFC is a recent example of this.

Proponents of top-down investing argue that there were a number of economic warning signs that the global financial system was fragile, including high levels of credit growth, which can overheat economies, and abnormal growth in asset prices, which should have been an indicator for investors to re-think their portfolios.

The negative to top-down investing, of course, is that although the indicators might be there for all to see, it is not necessarily easy to read the situation correctly, meaning you could miss out on good opportunities to generate the returns you desire.

On the other hand, bottom-up investing requires both time and patience to do your research properly and, depending on how technical you want your analysis to be, a level of understanding and confidence around what criteria you want to use as indicators of good value and how you will calculate this.

“There is no real ‘right or wrong’ answer when it comes to the method of analysis chosen,” says Janine Cox, senior analyst at Wealth Within.

“Investors should choose a method they are comfortable with and, importantly, can prove works over the long term for them.”

This article is intended to provide general information of an educational nature only. It does not have regard to the financial situation or needs of any reader and must not be relied upon as financial product advice.