Investment Risk And Diversification

Post on: 16 Март, 2015 No Comment

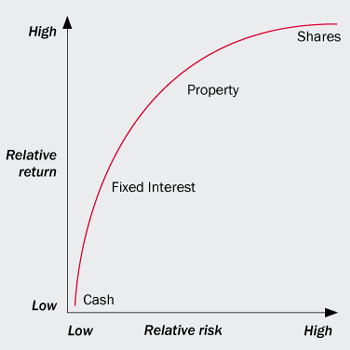

Risk is inherent in the environment (social, political, economic and natural) in which we live. Holding cash entails some risk, but diversification can temper it and make it hurt less when one of our investments fails.

Using funds to produce income or increase their monetary value also entails risk. How much risk he is likely to run, the investor must learn to assess (it is presumed that he knows how much risk he is willing to run). And in spite of all that is known and has been written, the degree of risk cannot be precisely or scientifically measured.

The investment company has an economic reason for existence largely because it tends to reduce risk for the investor. To discuss risk in the modern economic world would require assessment of social and political tendencies, international problems, monetary management, business cycles, technological changes, labor-management relations, fiscal policies, and even the winds of fashion. Besides this general context of risk, there are the risks inherent in change within industries and within the affairs of single companies. Even superficial treatment of any one of these risks would require a book as long as this. So far as we can tell at mid-century, the only trend worth predicting is a trend toward bewilderingly rapid social change.

Rapid change means greater risk. Good investment management should lessen risk, however, and sound investment management is one of the two reasons for investment companies. How can investment companies reduce risk and increase return? Most managements rely upon diversification and timing as their principal instruments.

To spread risk by diversification is the very essence of investment company theory and operation. Stripped of qualifications, diversification means avoiding putting too many eggs in one basket. As applied to investment company practice, diversification is an effort to distribute risk somewhat in accordance with insurance principles.

Classic treatments of diversification also reveal some of its limitations. When Britain was the world’s greatest investor, a British financial writer formulated a geographic distribution of investment as a means of protecting capital. He stated three tests for maintaining a sound investment position:

1. Ability to realize some considerable portion of the invested capital at any time without loss

2. Maintenance of the total realizable value of all the securities held at a fairly permanent level

3. Regularity of income

The absence of reference to capital gain indicates the date of publicationbefore World War I, when it was assumed that the sound currencies of the civilized world, pound sterling, franc, dollar, or mark, would always have more or less the same purchasing power.

Today, common stocks are more likely to predominate, and the object of investment is more often likely to be capital gains than income. Underlying this revolution is the belief that fixed-income securities (bonds and high-grade preferred stocks) tend to shrink in value as commodity prices and the cost of living rise. The income from such securities cannot grow and make up for declines in purchasing power at the grocer’s or the department store.

The value of geographical diversification is easily overrated. The Great Depression of the thirties swept away values in the United States, France, Brazil, Peru, and Germany alike. The armor of protection offered by purely regional diversification was pierced. Only since the recovery of Western Europe in the late 1950s have investors returned in a limited way to geographic distribution of investment.

Diversification, for both the investment company and the individual investor, can take the form of putting money into different industries. Such diversification is most valuable, of course, when applied to common stocks. Experience shows that profits fluctuate more violently in some types of industry than in others.

Therefore, diversification not only among companies but among industries is absolutely essential to the healthy portfolio. Investors who put all of their money into one stock more often than not find themselves holding the proverbial bag (and it’s not a bag full of cash.)

This article is a small snippet from www.investmentpioneer.com

At Last! Discover How YOU Can Become An Investment Pioneer By Investing Your Money Easily And Safely With Using A Long Lost Formula