Investment Portfolios The Importance of Diversification Horizon Bank blog

Post on: 5 Сентябрь, 2015 No Comment

This post was authored by Steve Skalka

In light of the recent market turbulence, it seems appropriate to discuss the importance of diversification within one’s investment portfolio.

Simply put, diversification is a technique that reduces risk by allocating investments among a multitude of asset types. When you diversify, you try to ensure that at any given time, the value of some of your holdings might be down, and some might be up, but overall you are doing fine.

Investors confront two primary types of risk when investing. The first type of risk is referred to as undiversifiable risk. This type of risk is not specific to a particular company or industry and it cannot be eliminated through diversification. Causes of undiversifiable risk include factors such as interest rates and inflation rates.

The second type of risk is diversifiable risk. Diversifiable risk is specific to a company, industry, economy or country. Diversifiable risk can be reduced through diversification. Causes of diversifiable risk include business risk and financial risk.

An investor diversifies in order to reduce diversifiable risk. For example, let’s assume Investor A has a portfolio consisting entirely of UPS stock. UPS is a major package delivery company whose main competitor is DHL. Let’s assume that a drivers strike is announced at UPS. Following the news of the strike, UPS’s stock drops and DHL’s stock increases on speculation that UPS’s customers will start utilizing DHL’s services. In this example, if Investor A held DHL stock as well as UPS stock they could have reduced their diversifiable risk.

Let’s take the example one step further. Assume that instead of a drivers strike, gasoline prices rise precipitously. This increase in gasoline prices negatively affects the entire package delivery industry, driving down the stock price of both UPS and DHL. In this situation, Investor A would have had to diversify even further to reduce diversifiable risk. For example, if Investor A held shares in an energy company which benefited from the increase in oil prices they would have been impacted to a lesser degree by the increase in gasoline prices.

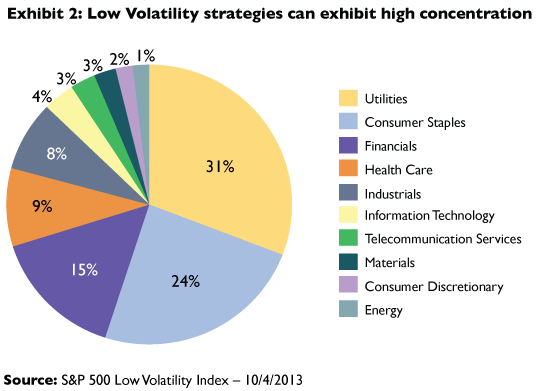

This example illustrates the importance of not only diversifying across companies but also across different types of sectors and industries. However, proper diversification goes beyond that. To reduce diversifiable risk even more, Investor A would have had to diversify across different economies and countries as well as among different asset classes (i.e. equity, fixed, cash). The key to diversifying is variety coupled with structure and discipline.

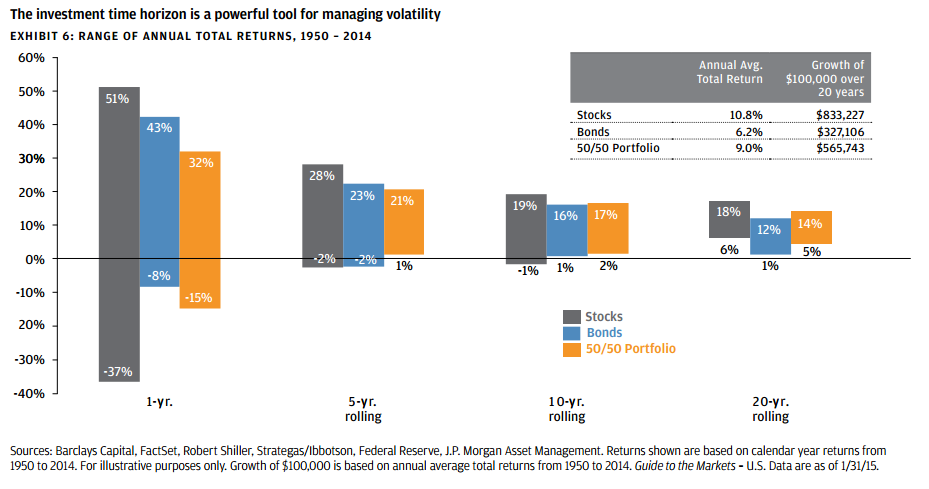

The market is cyclical. The frequency, intensity and duration of market changes are hard to predict. Asset classes, sectors, investment styles and regions come in and out of favor. Often times the big winners of months past turn out to be the big losers of today. By diversifying your portfolio, your investment performance should fluctuate less because losses from some investments are offset by gains in others.