Investment policy statement finiki the Canadian financial wiki

Post on: 9 Июль, 2015 No Comment

An investment policy statement (IPS) forces you to put down on paper your investment goals and timelines and how you will get there. It spells out how you will measure how you are doing and how often you will review how you are doing. For an individual investor the IPS is typically about two or three pages, written in plain English, that will serve to guide all investment decisions.

For investors challenged by the complexity of an IPS or when the investment objectives don’t justify the effort needed to create an IPS, the investor may consider the use of a simple investment plan .

Contents

Benefits of using an IPS

In the following quote, Yogi Berra wasn’t talking about investing but he could have been.

You’ve got to be very careful if you don’t know where you’re going, because you might not get there.

If you don’t know where you are going, you will wind up somewhere else.

— Yogi Berra [1]

Every investor could potentially benefit from having an investment policy statement. It provides the foundation for all future investment decisions to be made by an investor. It serves as a guidepost, identifies goals and creates a systematic review process. The IPS is intended to keep investors focused on their objectives during short-term swings in the market and provides a baseline from which to monitor investment performance of the overall portfolio, as well as the performance of individual fund managers. If you are using some sort of financial advisor, an IPS outlines the ground rules of the relationship between you and that advisor. And you can use the IPS as a reference to see whether or not your portfolio is achieving your stated goals and objectives. Any proposed changes to your investments can also be evaluated and reviewed against your overall objectives using your IPS.

A properly constructed Investment Policy Statement provides support for following a well-conceived, long-term investment discipline, rather than one that is based on false overconfidence or panic in reaction to short-term market fluctuations.

Drawbacks of not using an IPS

Someone who doesn’t have a written policy often bases decisions on day-to-day events, which often leads to chasing short-term performance that may hinder them in reaching long-term goals. Having a policy encourages maintaining focus on the long-term nature of the investment process, especially during turbulent or exuberant times.

Elements of an IPS

When creating an investment policy statement there can be many elements to include. The following list, while not exhaustive, provides some of the major points to consider.

- Current status, including sources of income, information about dependents, where existing financial assets are located (institutions, types of accounts)

- Intented monthly contribution or withdrawal

- Objectives and constraints, including time horizons, income needs and their timing, tax considerations

- Risk tolerance

- Investment philosophy (about risk, diversification, costs, taxes. )

- Asset classes to be used and those to be avoided

- Target asset allocation between equities, fixed income and cash (if any), and split between domestic and foreign assets

- Investment selection criteria

- Expected annualized return

- Rebalancing policy

- Monitoring and review policy, choice of benchmark for portfolio returns

Morningstar [2] provides an excellent summary of what an IPS should include and a downloadable worksheet [3]. Libra Investment provides a sample IPS for a hypothetical retired widow [4] .

Investing plan

In some circumstances, a prospective investor may have a relatively simple or short-term (say, 5 years or less) goal that does not require a full investment policy statement. In those cases, a relatively simple Investing Plan may suffice.

An investing plan can be as easy as following these simple steps:

- Step 1 — Formulate your goals. Be as specific as possible, realizing that you’ll make changes as the years go by.

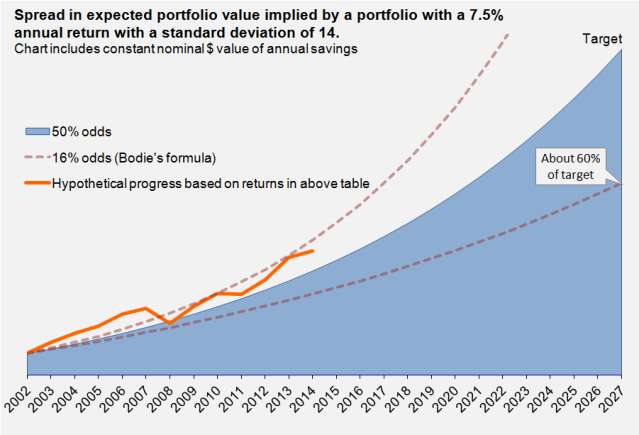

- Step 2 — Set up a plan for each goal. The plan consists of identifying what type of account you will use to save the money, choosing the amount you will put toward the goal each year, working out an asset allocation likely to reach the goal with the minimum risk necessary, and identifying a plan B for the goal in case the returns you’re planning on don’t materialize.

- Step 3 — Select the best (usually lowest cost) investments to fulfill your desired asset allocation.

Considerations

A basic component of the planning process is to create a budget. This can be done with the aid of personal finance software or even a simple spreadsheet. Additional considerations:

- For retirement savings the tax-sheltered accounts available are a Registered Retirement Savings Plan (RRSP) and Tax-Free Savings Account (TFSA). The latter can be used for any savings goal, including emergency funds .

- For educational purposes, a Registered Education Savings Plan (RESP) may be used

- In general, if funds are required in 5 years or less, equities (stocks) should not be used because of the risk of loss.